Rural Update: Enabling a resilient food chain

Your weekly dose of news, views and insight from Knight Frank on the world of farming, food and landownership

9 minutes to read

Viewpoint

The impact of Rachel Reeves’ recent Budget is being felt from the bottom of the UK’s food supply chain right to the top. Following farmers' anger at cuts to inheritance tax reliefs and support payments, supermarkets are now claiming they will be hit by billions of pounds of extra staffing costs due to the hike in employers’ national insurance contributions.

To avoid further hammering farmers who, as we reveal below, are also set to face additional fertiliser bills, it is crucial that retailers do not try to pass their extra costs back down the supply chain.

Once the fallout from the Budget has eventually settled, the government may want to ponder a more fundamental question: how resilient is the UK’s food supply chain if neither farmers nor retailers can cope with the current tax burdens being applied to them?

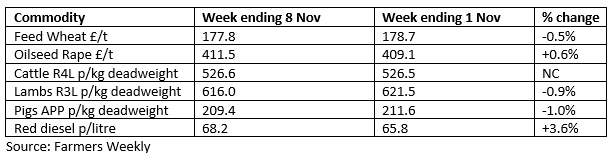

Commodity markets

Trump’s oil impact

Wall Street remains split on what a Trump presidency will mean for oil prices. Some analysts are suggesting a sharp drop based on the president-elect’s promise that he will “drill, baby, drill” and open up access to reserves lying under federal lands. Others, however, are more circumspect. They point to changes in the US’s shale gas industry since Trump’s previous term that make a huge surge in output unlikely. Schemes involving federal land are also unlikely to come onstream within the next four years. A more robust approach to Iran, for example allowing Israel to strike the country’s refineries, could even push up prices. Much will depend on Trump’s tariff plans and how they impact global economic growth and trade. Hits to the US and Chinese economies could push down demand and prices.

Wheat upside limited

Trader Frontier says it is hard to see where the next significant wheat price rally will come from. Global markets have been drifting downwards since the beginning of the month. Argentina and Australia have made good harvest progress so far and their wheat markets have followed the bearish trend of Europe and North America. Argentina's futures are trading at seven-month lows while Australian futures have hit seven-week lows.

Fertiliser carbon hike

As mentioned in our recent Budget coverage, one of Chancellor Rachel Reeves’ announcements concerned the introduction of a border tax from the beginning of 2027 on the import of carbon-intensive products such as fertiliser and steel. The potential impact on farmers’ fertiliser bills is likely to be a minimum of £50/t, according to Farmers Weekly.

The headline

Trump and farming

Trying to predict what President-elect Donald Trump might do over his four years in office following last week’s US election victory is akin to forecasting what the weather will be doing in 12 months’ time. But based on what we know, the following could be some of the implications for agriculture.

As discussed above, oil prices could go down, but there is also a risk they might go up. Trump’s plans to impose huge tariffs on imports, especially from China, and the risk of a resulting trade war could put pressure on farmgate commodity prices. For example, Chinese retaliatory tariffs on US soya beans could see more of that crop diverted to European markets.

In terms of a potential free trade agreement, commentators and former diplomats seem to reckon that even if the US offers the UK a deal, the terms would be so one-sided they would not be considered acceptable.

Given his hostility to environmental and green energy subsidies, it might be expected that Donald Trump’s administration will have little time to support nature-friendly farming. However, it is widely rumoured that Robert Kennedy Junior, who stepped back from his own presidential campaign to support Mr Trump, is in line for some kind of health-related post.

Mr Kennedy is extremely hostile to the agrochemical industry, so he could be an advocate for more regenerative farming practices in the US. However, his controversial views on other things like children’s vaccines may mean the Senate is unwilling to approve any position that will give him real power.

News in brief

Supermarkets lambast Budget

Tesco, the UK’s largest retailer, says its national insurance bill will rise by £1 billion over the course of the current parliament following the hike in employers’ contributions announced in the recent Budget. Supermarket bosses say that food prices may have to rise to cover the cost. Analyst Morgan Stanley predicts food price inflation could top 2% next year.

Nature finance hopes

Despite slow progress towards establishing a private nature finance market in the UK, plenty of positive news emerged from last week’s Nature Finance UK Conference, which was sponsored by Knight Frank. Our Natural Capital Lead James Shepherd says the speech by Nature Minister Mary Creagh was particularly encouraging.

Read James’ full review of the conference.

Scottish nat cap framework launched

Speaking at the conference, Tom Arthur, Scotland’s Minister for Employment and Investments, announced the launch of a new communities-focused Natural Capital Market Framework. The framework provides guidance for investors, land managers and communities on attracting responsible private investment into peatlands, woodlands and nature restoration. Scotland’s natural assets contribute an estimated £40 billion to the economy each year and support around 260,000 jobs.

Base rate cut

The Bank of England’s Monetary Policy Committee cut the base rate from 5% to 4.75% last week. Bradley Smith, a rural property specialist at Knight Frank Finance, said: “Despite the cut, the inflationary pressures from the extra borrowing announced in the Budget and the result of the US election means swap prices are higher than we would like. But, as agricultural mortgages are generally on a margin above base, it is still a welcome reduction. However, rates may now drop at a slower pace than forecast because of the inflationary pressures mentioned above.” Contact Bradley if you need help with your borrowing requirements.

Tenant farming commissioner

Defra has committed to appointing England’s first Commissioner for the tenant farming sector, a key recommendation of the independent Rock Review. The role “will help ensure fairness in the sector, investigating and facilitating solutions to complaints”. The commissioner will be appointed through an open competition process with “the aim of making an appointment by spring next year”. Defra has also just published its terms of reference for the new Farm Tenancy Forum.

Welsh transition fund

The Welsh government is making £14 million of funding available to help support farmers before the country’s new Sustainable Farming Scheme is launched in 2026. The cash will boost five existing schemes, including the Agriculture Diversification and Horticulture Scheme. For help with grant funding please contact Henry Clemons.

Hemp rules relaxed

It will now be easier for farmers to grow hemp following newly announced changes to the licencing regime for the cannabinoid-containing crop. From 2025, licence holders will now be able to grow hemp anywhere on their farms, rather than having to specify an exact field.

From 2026, there will be an extension of the maximum period for a licence from three to six years, subject to compliance with the licence terms.

Bluetongue and bird flu update

Following the identification of further cases, the bluetongue restricted zone was extended on 8 November and now covers Bedfordshire, Berkshire (part), Buckinghamshire, Cambridgeshire, City of Kingston upon Hull, City of York, East Riding of Yorkshire, East Sussex, Essex, Greater London, Hampshire (part), Hertfordshire, Isle of Wight, Kent, Leicestershire (part), Lincolnshire, Norfolk, North Yorkshire, Northamptonshire, Nottinghamshire, Oxfordshire (part), Suffolk, Surrey, Warwickshire (part) and West Sussex.

Read the latest updates and advice from Defra.

The first case of avian flu since the declaration of zonal freedom in February has also just been announced following an outbreak at premises in the East Riding of Yorkshire.

The Rural Report – Out now

The latest edition of The Rural Report, our flagship publication for farm and estate owners, looks at the numerous opportunities and challenges arising in the countryside following the election of the new government.

Find out more or request a copy

Property markets

Country houses Q3 – Market waits

Discretionary buyers held back from a new country house purchase pending Labour’s first budget on 30 October. Offers from potential buyers were down 10% in the three months to August, according to the latest results from the Knight Frank Prime Country House Index. However, the slide in average values has slowed with prices dropping by just 1.2% in the 12 months to the end of September - the lowest annual fall since Q1 2023 - points out Head of UK Residential Research Tom Bill. He predicts a total average price slide of 2% this year, dependent on the outcome of the Budget.

Farmland Q3 – Prices flatline

The farmland market in England and Wales was also on budget alert, judging by the latest results from the Knight Frank Farmland Index. Average values for bare land nudged up by just 0.2% in the third quarter of the year to £9,351/acre. This was the smallest increase for several years. For more insight and data please download the full report.

Development land Q3 – Greenfield sites up

The average value of greenfield land values in England rose 3% in the third quarter of 2024, according to the latest instalment of our Residential Development Land Index. However, brownfield and prime central London prices stayed flat due to thin activity, with some market participants taking a “wait-and-see” approach ahead of the Budget, says the report’s author, Anna Ward. Housebuilders are also sceptical that it will be possible to deliver the 1.5 million new homes pledged by Labour over the next five years. Download the full report for more insight and data.

Property of the week

Kiwi Alpine playground

This week’s update from Georgie Veale, who is currently working with our New Zealand real-estate partner Bayleys, comes from the South Island, where she has been spending some time with the firm’s rural agents in Canterbury. “My property of the week has to be Manuka Point, a 3,142-acre station nestled at the foot of the Southern Alps. The location is undoubtedly New Zealand's most private position, ideal for someone looking for seclusion and unspoilt landscapes. It’s an outdoor playground - perfect for heli-skiing, hunting, fly fishing, manuka honey production, jet boating and the opportunity to graze a total of 30,664 acres across a further block of leased land. There is also an award-winning retreat homestead with views of the stunning Rakai Gorge. This is truly something very special.” For further details, please contact Bayleys’ Ben Turner.

Read more from Georgie on the opportunities available for UK buyers in New Zealand.