When it comes to housebuilding, Labour has little time to waste

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

"The agony goes on", reads the Telegraph's main headline this morning. The paper leads on the England football team's wait for a major trophy, but the theme of waiting pervades the business sections, too.

For starters, the housing market is stuck in first gear as buyers wait for borrowing costs to fall, according to Rightmove figures out this morning. Will their wait span weeks or months? Meanwhile, we have a new government with a manifesto packed with pledges that will impact real estate. When do they plan to get started?

The answers to those questions will take shape over the course of this week. New inflation and figures will be released Wednesday, the same day the new Parliamentary year begins. Wage data will arrive the following day. The government is preparing 35 bills for the opening, so a busy autumn beckons. Or does it?

A pick up in three months?

Sellers trimmed asking prices by 0.4% during July, according to Rightmove. That's the first time sellers have opted to cut asking prices so far this year.

Housing data has for months pointed to a market trading sideways. Mortgages at prevailing rates won't support a more sustained recovery, but the data hints that it's coming. The number of sales agreed was 15% higher compared with the same period last year despite the general election on July 4th.

Surveyors that responded to the latest RICS survey, out last week, are bullish over a time horizon of just three months. A net balance of +20% foresee sales volumes recovering by September, which is the most upbeat figure since January 2022.

A cut to the base rate will be the game-changer, Rightmove says, and we agree. Traders put the chances of an August base rate cut at about 45%. Services inflation will be the key figure. Economists tallied by Bloomberg expect that figure to ease to 5.6%, down from 5.7% the previous month.

A closing window

The robust economic outlook has prompted the chance of an August cut to dwindle since the beginning of the month. The economy expanded 0.4% in May, according to figures published last week. That's double what economists had expected and is the sixth consecutive month that growth has exceeded consensus.

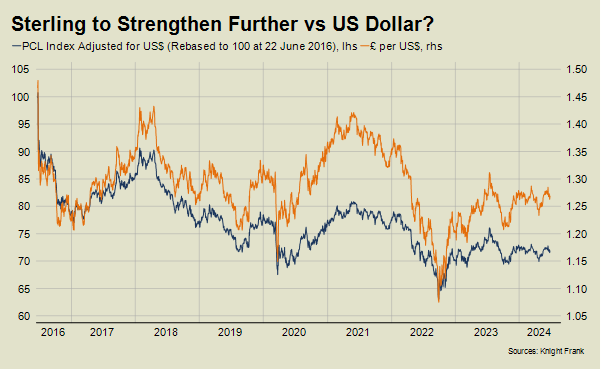

Goldman Sachs, Barclays and Deutsche Bank all upgraded their growth forecasts as a result. Barclays said the economy would expand 1.1% this year, up from an initial estimate of 0.8%. Goldman reckons growth will reach 1.2%. The pound hit its highest level against the dollar in a year following publication of the growth figures, according to Bloomberg.

This will be particularly important for buyers in prime London markets. Tom Bill covered this steadily closing window of opportunity in his note earlier this month: when you combine the impact of a weaker pound and price declines in PCL over recent years, an effective discount of 28% is available compared to the pre-referendum level for dollar-denominated buyers or those purchasing in currencies pegged to the US dollar, such as the Hong Kong dollar or UAE dirham.

In simple terms, the same house in PCL that cost US$100 in May 2016 would now cost US$72. The more sterling strengthens, the smaller this effective discount for PCL property will become.

Speed and stability

The new government faces all sorts of trade offs, but many can be placed into the competing categories of speed or stability.

If you haven't already, I recommend our team's updates on Labour's priorities. See Tom Bill on the residential market here, Anna Ward on development here, Will Matthews on commercial here, or Flora Harley on ESG here. Our experts emphasise the degree to which the leadership will seek to handle the prevailing economic momentum with kid gloves given the long shadow of the mini-budget.

But equally, progress takes time, particularly when it comes to housebuilding, which is perhaps Labour's number one priority. In her first speech as chancellor, Rachel Reeves cantered through policies, from restoring mandatory house-building targets for local authorities, to funding the hiring of more planning officers, speeding up planning approval for infrastructure projects and prioritising unresolved planning decisions.

On this front, Labour has little time to waste. Houses aren't a resource that can be delivered quickly, as Barratt's results showed last week. The company said it expected to build between 13,250 and 14,250 units in the year ending June 30, 2024, down from 17,206 homes the year before. Delivering at the mid point of the range would mark a 20% drop - the same cut to forecasts as flagged by Berkeley - see more from Reuters here.

In other news...

China’s economic growth slows in second quarter (FT), and finally, European IPO market surges in first half of year (Times).