European residential update

Making sense of the latest property and economic indicators from across Europe

3 minutes to read

1. The first cut

The European Central Bank (ECB) cuts its base rate on 6th June for the first time in five years, reducing rates by 25 basis points to 3.75%. The move was welcomed by mortgaged households and indebted businesses across the Eurozone.

While the ECB was the first among the major central banks to cut rates, it followed earlier reductions by Sweden and Switzerland.

The ECB’s pivot may be enough to motivate some buyers in the Eurozone’s 19 member states , and it may encourage more vendors to bring their property to the market, anticipating a shift in market sentiment and improved conditions.

Financial markets are currently anticipating a further reduction of 50 basis points in the ECB’s base rate by the end of the year, with the next cut projected for September.

The ECB’s divergence from the Federal Reserve and the Bank of England has seen the Euro weaken but few expect the ECB to move far and fast given a weaker euro will carry risks in a US election year when protectionist policies are likely to be ramped up.

Decisions from the Bank of England and the Swiss National Bank are due today, economists expect a further cut in Switzerland but in the UK rates are likely to remain unchanged ahead of the general election on 4th July.

2. House prices

Less than a fortnight after the ECB’s rate cut announcement, The Economist this week has an article entitled, Are house prices surging again?

Using Knight Frank’s Global House Price Index I’ve taken a deeper dive into Europe’s stats. The results? Well, the Economist may be on to something.

House prices across the 34 European countries tracked in the index are up 2.3% on average year-on-year.

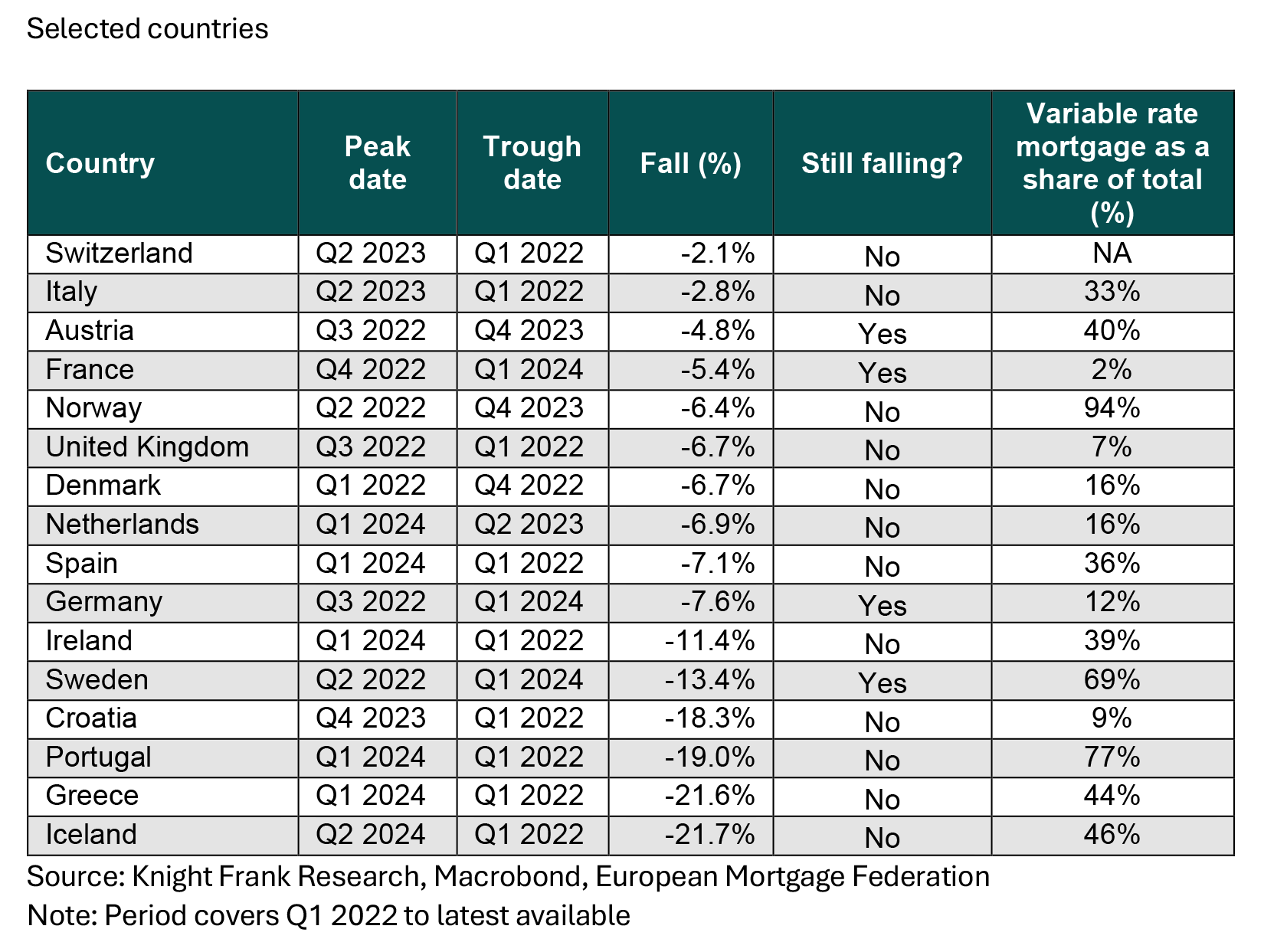

But this follows a challenging period when prices fell by as much as 20% from peak-to-trough terms in markets such as Iceland and Greece.

Analysis shows 24 of the 34 countries are now seeing prices increase again on an annual basis.

Ordinarily, weak economic growth - the IMF forecasts average GDP growth of just 0.8% in 2024 across the Eurozone - coupled with a cost-of-living crisis would usually result in a protracted downturn. However, data shows that where prices have fallen since July 2022, the date of the ECB’s first rate hike, European house prices declined for an average of just 16 months.

Countries with a higher proportion of fixed-rate mortgaged households have weathered the storm better, but there is resilience even in nations where variable or tracker deals predominate, such as Norway and Austria. One explanation is tight supply, but data suggests households are also tapping into savings to service higher debt costs and extending their mortgage terms. Additionally, wages are rising, up by an average of 5.8% across the European Union in the year to Q1 2024.

With debt costs now decreasing, not only is sentiment among owner-occupiers likely to improve, but lower property values, cheaper finance, and ongoing affordability concerns may also entice more investors back into the market.

Timing and size of house price falls

3. Elections

I opted to take the first two weeks of June off, little did I know how eventful a fortnight it would be in European politics.

As I boarded my flight at Stansted Airport, Rishi Sunak had already made his move. However, the unexpected outcomes of the European parliamentary elections, followed by President Macron's sudden election call, caught many off guard.

Macron’s decision has been met with scepticism in financial markets. For a detailed analysis, Bloomberg’s John Stepek provides insights into the potential implications.

What does this mean for Europe’s housing markets? In short, it remains uncertain. Swings to the centre-right in key European markets could result in lower property taxes, fewer rental restrictions, and potentially more private investment. However, it is too early to make definitive predictions.

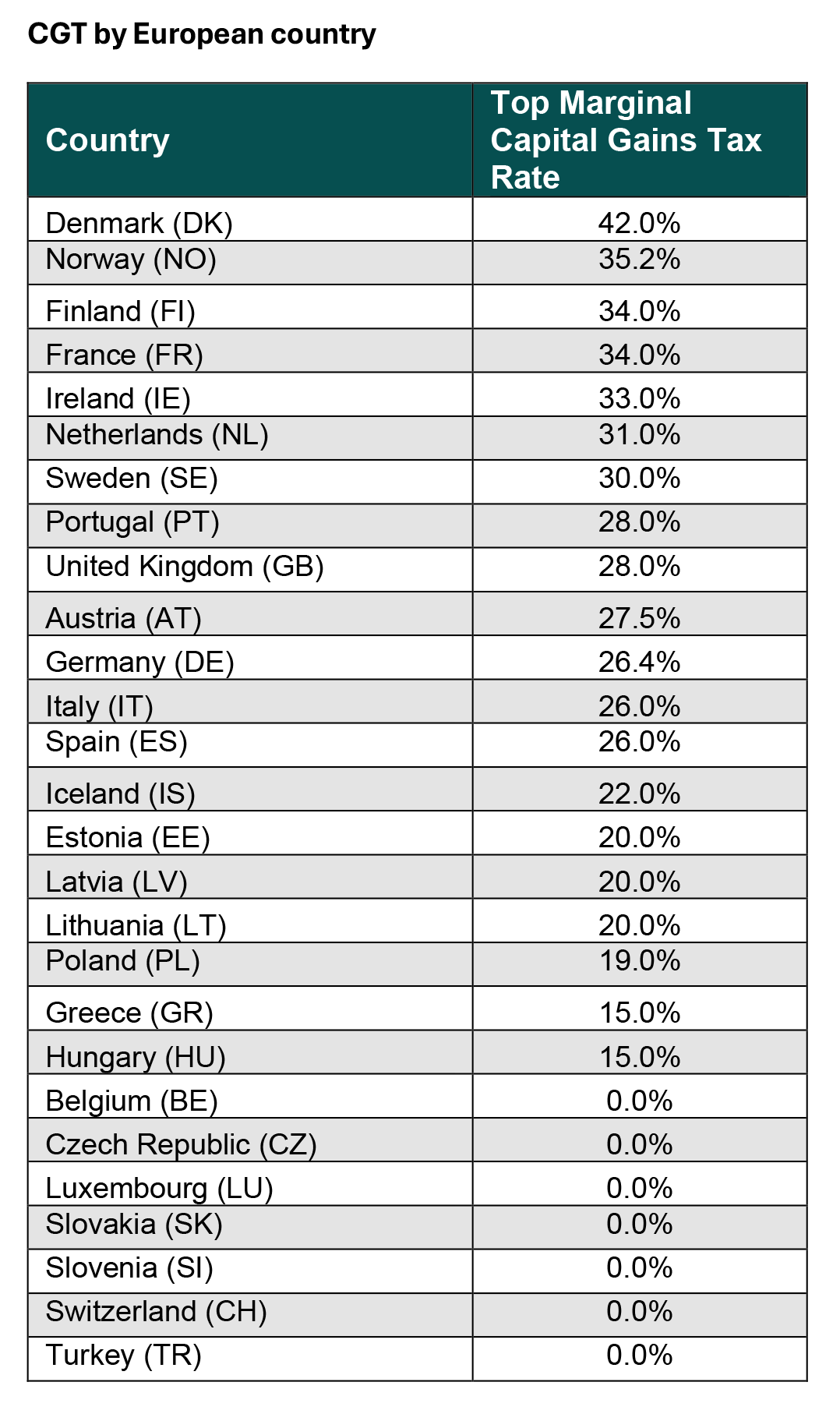

In the UK, Labour’s reluctance to rule out an increase in capital gains tax (CGT) may cast Europe in a more positive light. Entrepreneurs and second homeowners (principal private residences are exempt from CGT in the UK) could seek opportunities overseas if the current 28% CGT rate rises significantly.

Source: Tax Foundation