Key Highlights in Asia-Pacific Property Landscape

Delve into the key highlights of The Wealth Report pertaining to the Asia-Pacific landscape

3 minutes to read

The Wealth Report is the ultimate guide to prime property markets, global wealth distribution, the threats and opportunities for wealth, commercial property investment opportunities, philanthropy and luxury spending trends. This article breaks down key highlights of The Wealth Report pertaining to the Asia-Pacific landscape outlined by Christine Li, Head of Research, Knight Frank Asia-Pacific.

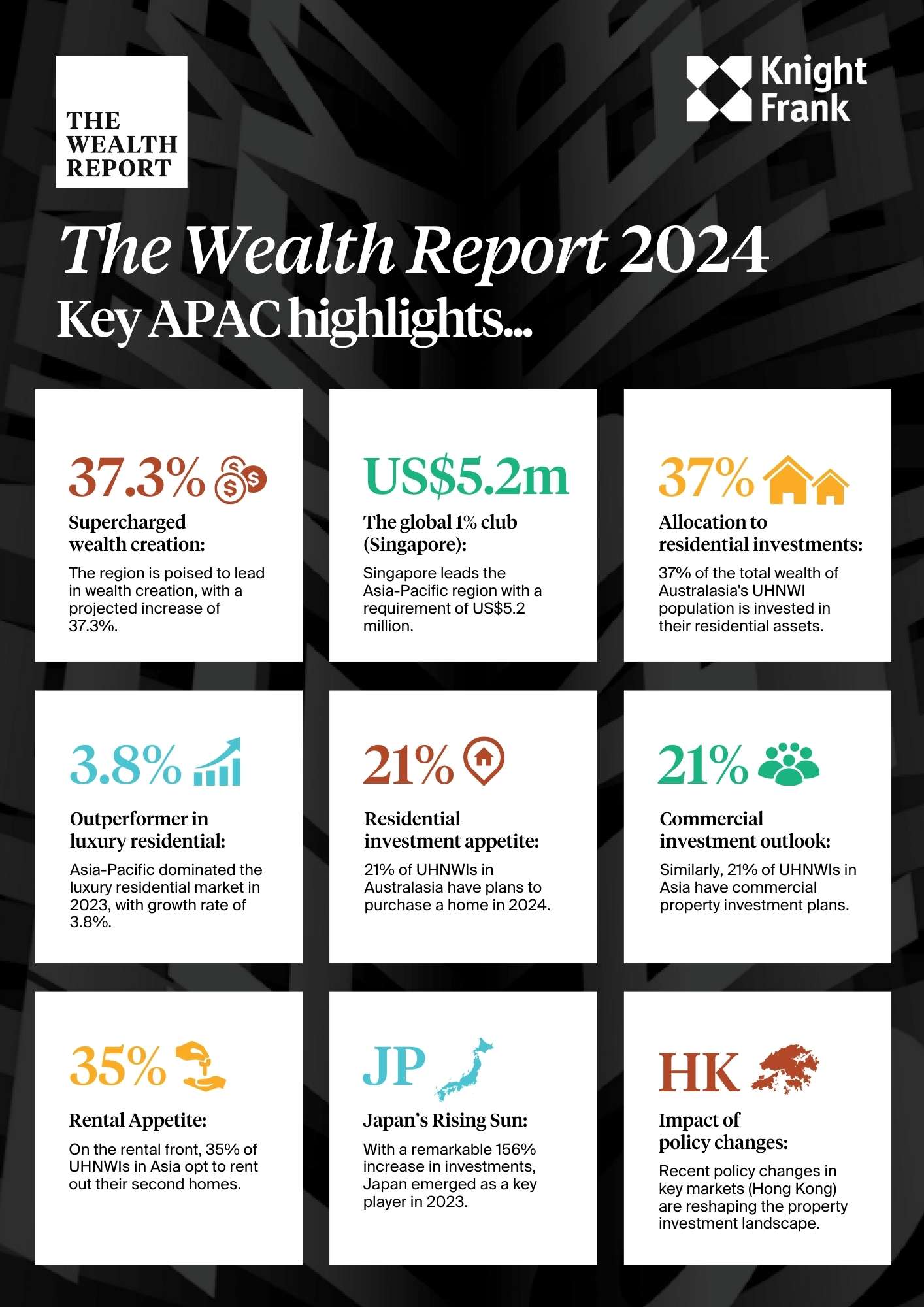

- Supercharged wealth creation: The number of Ultra High Net Worth Individuals (UHNWIs) in Asia-Pacific surged by 3.0% in 2023, reaching over 181,000, reversing the decline seen in 2022. Looking ahead to 2028, the region is poised to lead in wealth creation, with a projected increase of 37.3% driven by India, the Chinese Mainland, Malaysia, and Indonesia.

- The global 1% club: In terms of the level of individual net wealth required to join the top 1% of their respective countries, Singapore leads the Asia-Pacific region with a requirement of US$ 5.2 million, followed by Australia, New Zealand, Hong Kong, Japan and Chinese mainland (US$ 1.07 million) highlighting the concentration of wealth in these areas.

- Wealth allocation to residential investments: A significant portion of the wealth of UHNWIs in Australasia (37%) and Asia (30%) is allocated to their principal and second homes. This distribution exceeds the global average (29%), highlighting the strong preference for residential real estate among wealthy in these regions.

- Outperformer in luxury residential in 2023: Asia-Pacific dominated the luxury residential market in 2023, with the fastest growth rate of 3.8% compared to other regions as noted by Knight Frank’s Prime International Residential Index (PIRI). Manila emerged as the top-performing city, boasting an impressive 26.3% growth rate.

- Residential investment appetite for 2024: A notable percentage of UHNWIs in Australasia (21%) and Asia (18%) have plans to purchase another home in 2024, showcasing continued interest and confidence in the property market.

- Commercial investment outlook: A substantial proportion of UHNWIs in Asia (21%) and Australasia (17%) are planning to invest in commercial properties in 2024, surpassing the global average. Notably, investors from Singapore, Hong Kong SAR, and Chinese mainland contributed more than 80% of all cross-border global commercial real estate investments in 2023.

- Rental Appetite: On the rental front, a considerable portion of UHNWIs in Australasia (32%) and Asia (35%) opt to rent out their second homes. While prime rents are stabilising from post-pandemic highs, a shortage of available properties in key cities is expected to maintain positive annual growth in most advanced economies.

- Japan’s rising sun: Japan emerged as a key player in global cross-border commercial real estate investment in 2023, with a remarkable 156% increase in investments compared to 2022. The total transaction volume exceeded JPY5 trillion (US$34 billion) in 2023, down by about 9% but still elevated compared with pre-pandemic levels. For more information on the thriving private investment landscape in Japan, click here.

- Impact of policy changes: Recent policy changes in key markets are reshaping the landscape of residential property investment. Hong Kong's decision to reduce stamp duty rates in February 2024 is expected to stimulate demand for residential properties in the region. Meanwhile, the Chinese mainland is implementing new housing policies in its first-tier cities. In New Zealand, reinstated mortgage interest deductions and reduced capital gains tax exemptions aim to incentivise property investment. Conversely, Australia has implemented measures such as tripling fees for foreigners buying existing houses and doubling taxes on vacant dwellings owned by non-residents to address housing affordability concerns and curb speculative purchases.

For more insights on our latest edition of The Wealth Report, please click here: https://www.knightfrank.com/wealthreport.