4 minutes to read

A strong education foundation services established and emerging knowledge-intensive clusters. Reading was ranked 6th in terms of the percentage of the working-age population with high-level qualifications, according to the Centre for Cities. Along with existing talent, the researchintensive University of Reading is recognised for its expertise in climate and food science, business, and agriculture, providing occupiers with a consistent stream of future talent. Significantly, affordability means that students are choosing to stay in Reading after graduation.

Alongside an established Technology cluster, interest from Pharmaceutical, Healthcare and MedTech companies in 2023 has reinforced Reading’s position as an important cluster for these sectors.

What is the shape of the office market?

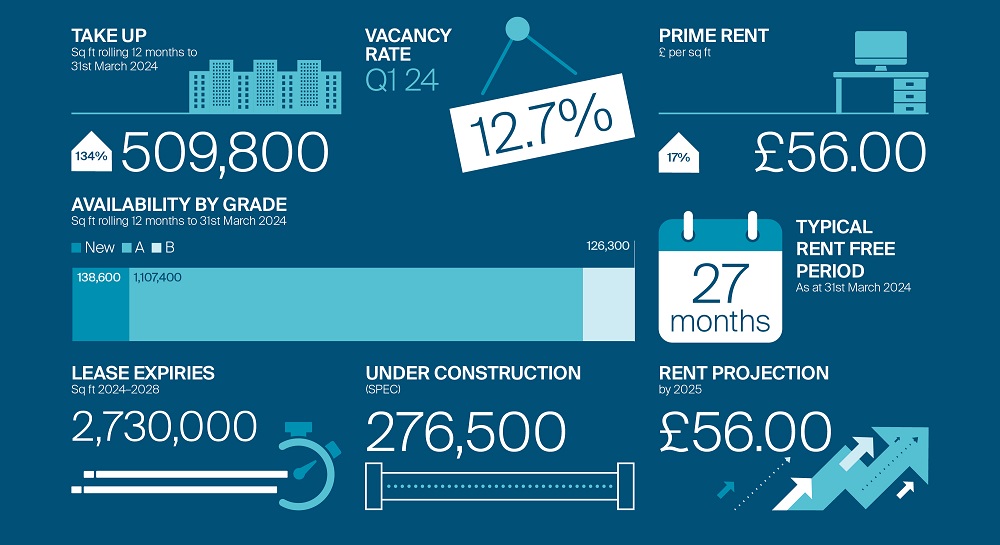

2023 represented the highest level of annual take-up in Reading since 2018, finalising at 445,199 sq ft. This reflected a 64% year-on-year increase and is 42% above the 5 year annual average. In the first quarter of 2024, momentum has continued, with take-up reaching 73,746 sq ft, 8% above the 5-year Q1 average.

Activity in the out-of-town market has dominated in recent years at nearly double the amount of take-up in the town centre. However, the first quarter of 2024 has bucked this trend, with town centre activity representing 75% of takeup and recording the two largest lettings of the year so far. Further larger transactions in the town centre are expected, with four deals between 15,000 – 40,000 sq ft currently under offer, restoring the historical balance of circa 50:50 between the sub-markets.

A flight to quality is notable in Reading, with 93% of occupier take-up being for new or grade A space over the past 5 years. In Q1 2024, this increased to 100%, reflecting the flight to quality and also the high quality of office stock in the Reading market.

Who is taking space?

The TMT and Pharmaceutical, Medical and Healthcare sectors underpin demand for office space in Reading. TMT occupiers have accounted for 40% of total take-up in Reading over the past 5 years. However, in 2023, the Pharmaceutical, Medical and Healthcare sectors dominated market activity, accounting for 43% of take-up. This was supported by the largest transaction across all the South East markets, with the acquisition at Thames Valley Park by pharmaceutical manufacturing firm Lonza, the former British Gas HQ site.

In Q1 2024, Financial and Business Services companies dominated take-up, with the proportion of office space leased by the sector nearly 2.5 times above the 5-year average. The sector accounted for almost half of the office space leased in Q1 2024, with EY and Crowe Clark Whitehill now known as Crowe UK. Whitehill securing space in Reading’s town centre.

What does future demand look like?

The Technology sector dominates the forecast of business growth in Reading and, as such, potential real estate activity. At the time of writing, 426,000 sq ft of space requirements are active in the city, with 70% derived from TMT firms.

What factors will challenge growth?

Hindering the Reading office market is the uncertainty around the delivery of the next wave of office development that will provide the quality of space to align with occupier preference for the best accommodation. Although new and grade A availability is 16% above the 10-year average, the weight of demand targetting this market area means that supply is tight.

Is office supply to grow?

There is a minimal development pipeline, with just one building currently under construction. Building One, part of the Station Hill development will provide 276,470 sq ft of much-needed office space in Reading’s town centre and is expected to be completed by the end of this year. Of this, 110,000 sq ft is currently under offer, intensifying the supply squeeze on the best-quality office stock, which will support rental growth in the town centre market.

What will underpin longer-term growth?

The £750m Station Hill development and other mixed-used developments, such as the £250m regeneration of Minster Quarter demonstrate investor confidence in Reading as a location. Mixed-use projects like these will attract occupiers who are increasingly focused on amenities outside the office building, not just within.

Occupier demand is strong with 73% being expansion-led and 55% involving TMT or Pharmaceutical, Healthcare and MedTech occupiers. Several large corporates are already based in Reading, demonstrating confidence in the market and attracting companies to cluster around them. They include Oracle, PepsiCo, HP, Cisco, Thales, Hutchinson 3G and Microsoft.

Reading offers highly connected, amenity-rich office space and a highly qualified talent pool for occupiers. For investors and developers, it provides an opportunity for attractive returns via rental growth and the demand for additional office stock.