Decoding innovation-led real estate demand in Oxford and Cambridge

3 minutes to read

As take-up from the science and innovation sectors accelerates in the global innovation powerhouses of Cambridge and Oxford, we analyse the specific real estate needs of rapidly growing sub-sectors such as AI, engineering biology and quantum computing.

In today’s knowledge-driven economy, Oxford and Cambridge stand out as undisputed powerhouses thanks to their unparalleled strengths in science and broader innovation.

Cambridge’s position as the world’s foremost cluster for patent applications and research citations based on population, coupled with Oxford ranking third globally on the same measure, underscores the remarkable intellectual prowess in these cities. Furthermore, the University of Oxford and the University of Cambridge consistently rank as the top UK institutions regarding the number of equity deals secured by spinouts and their respective spinout populations, cementing their status as incubators of cutting-edge ideas and entrepreneurial ventures.

Take-up and active demand

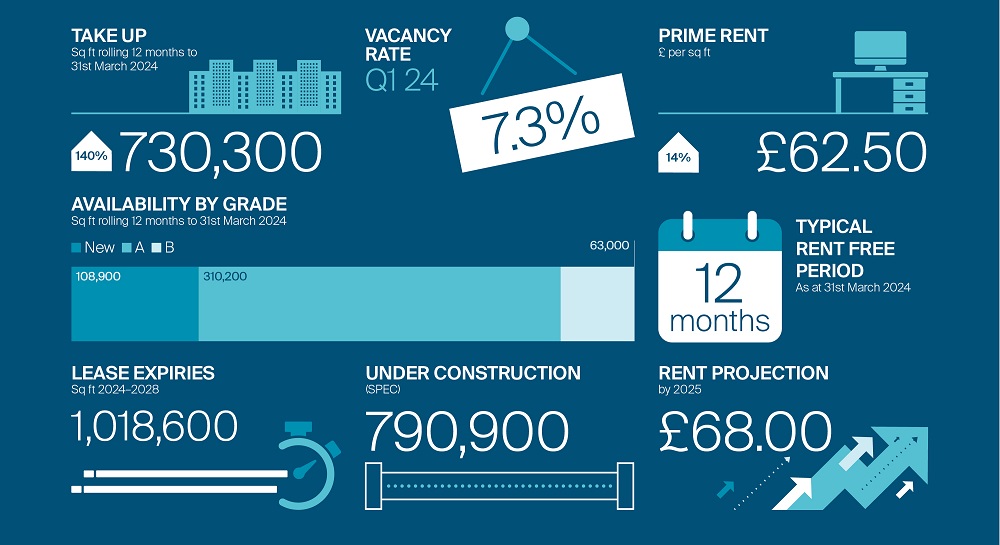

This critical mass of scientific and innovative capabilities has fuelled demand for appropriate real estate across both cities. Over the past five years, take-up from the science and technology sectors has grown by 3.4m sq ft, constituting 72% of the total take-up. Recent large-scale corporate investments, together with the opening of new research institutions, further amplify the real estate requirements emanating from the science and innovation sectors and the maturation of the supporting ecosystems.

Examples include, BioNTech expanding their global R&D activities with a new lab in Cambridge and plans to open an Oxford branch of the Ellison Institute of Technology, designed to tackle the world’s most pressing challenges. Looking ahead, the science and technology sectors account for 88% of named demand across both markets. These sectors also have 1.6m sq ft of lease expiries, impacting over 106 occupiers, occurring between now and the end of 2027.

Where next for innovation-led demand

Of course, science and innovation sectors are characterised by a vast array of companies and stakeholders, both interlinked and independent. This complexity means that the origination of demand and its real estate requirements are more nuanced than initially thought and are influenced by both local, national, and international opportunity and investment.

The biotech sector in Oxford and Cambridge saw a decline in venture capital funding during 2023 compared to the 2020-2022 boom. This downturn is impacting real estate decisions, but early signs of recovery are evident. In Q1 2024, biotech venture capital funding across both cities reached £311m, the highest since Q2 2022.

Considering the Life Sciences sector as a whole, it is undergoing a significant transformation. Notable examples include the convergence of Technology and Life Sciences, heightened mergers and acquisitions activity and R&D investment driven by big pharmaceutical companies’ urgent need to replenish their product pipelines. This will generate fresh real estate demand as well as potential consolidation activity.

The cities of Oxford and Cambridge are also witnessing increasing interest in cutting-edge sectors such as artificial intelligence, softwareas-a-service, quantum computing, and clean technology. These fields demand advanced real estate facilities and the same level of academic excellence that has fuelled the growth of the biotech sector. As these emerging sectors gain traction, they are poised to drive demand for specialised real estate solutions to support their unique requirements.

Using several key variables, overlaid with our market insight and expertise, we can decode the intricate nature of science and innovationled real estate demand in both markets. This enables supply-side actors to further understand current requirements and also anticipate and accommodate the potential for exponential growth within the most burgeoning segments of the innovation economy.