UK house prices rise 0.7% in January

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

UK house prices rose 0.7% in January, Nationwide said this morning, That pares the annual decline to -0.2%, up from -1.8% last month, which is the best reading since January 2023.

Falling mortgage rates has transformed sentiment. Two-year fixed-rate mortgages at about 4.5% are higher than most people are used to, but appear manageable. While it might take some time for the annual rate of inflation to fall from 4% to the 2% target, the fact that conditions are trending better is enabling people to make decisions they had been putting off.

"Inflation has fallen faster than predicted, which means financial markets believe rates will drop by a full percentage point in 2024," says Knight Frank's Tom Bill. "Whatever the Bank of England decides to do, mortgage lenders set their rates based on these lower expectations, which is increasing demand...we expect UK house prices to rise by 3% this year."

Mortgage rates

The effective interest rate on mortgages drawn in December fell by 6 basis points to 5.28%, the first drop since November 2021, the Bank of England said yesterday.

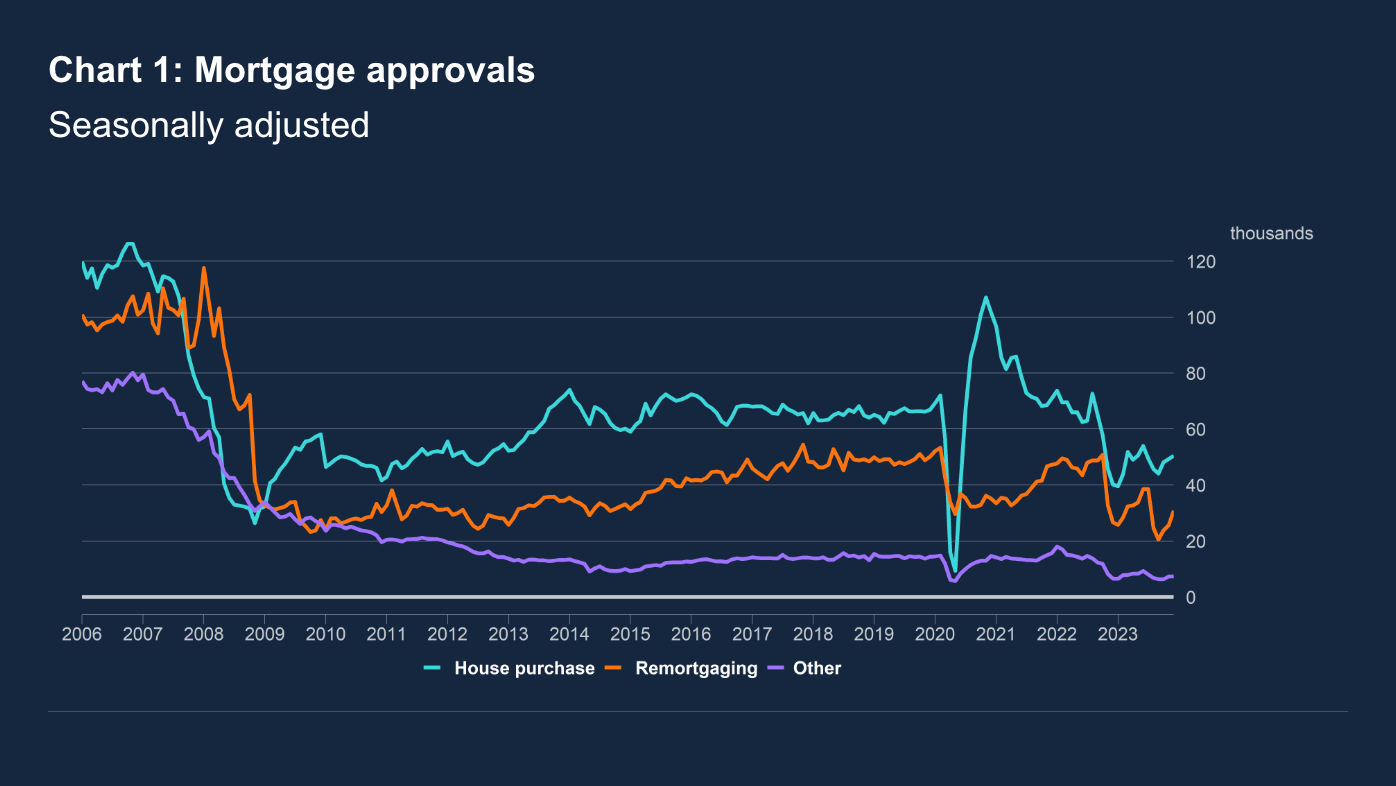

Mortgage approvals for house purchase, a good indication of future borrowing, ticked up to 50,500, from 49,300 (see chart). That's up about a quarter compared to December 2022 but still a quarter below the five-year average. The value of new lending was outstripped by mortgage debt repayments - borrowers repaid a net £0.8 billion over the course of the month.

Mortgage rates will continue to drive a moderate recovery, provided they remain relatively stable. Swap rates ticked up after data published earlier this month revealed a few, continuing inflationary pain points. The price war among high street lenders appears to be running out of steam a little:

"High street lenders appear to have called a temporary truce in their price war after economic indicators published in January pushed back the likely date of the Bank of England's first rate cut," says Simon Gammon of Knight Frank Finance. "A lot will depend on the language used by the Bank when it publishes its next decision on Thursday. A hold is overwhelmingly likely, but any dovish overtones could prompt lenders to issue another round of cuts to their fixed rate products."

Bond vigilantes

Everything appears to be moving broadly in the right direction. Businesses started 2024 with confidence at the highest level in nearly two years, according to a Lloyds survey published this morning. Half of all companies say that they are planning to increase headcount this year. Consumers, too, are the most confident they've been in two years.

Politics now poses the biggest risk to progress, particularly any promises of lavish spending as election campaigning gathers pace. The so-called 'bond vigilantes' that brought down Liz Truss stand ready to punish politicians that overreach, Vivek Paul, BlackRock’s UK chief investment strategist suggested earlier this month. César Pérez Ruiz, chief investment officer of Swiss bank Pictet issued a similar warning on Monday. The IMF also opted to point out Britain's sizeable spending demands to fund health and social care, plus the transition to net zero, all while keeping debt contained:

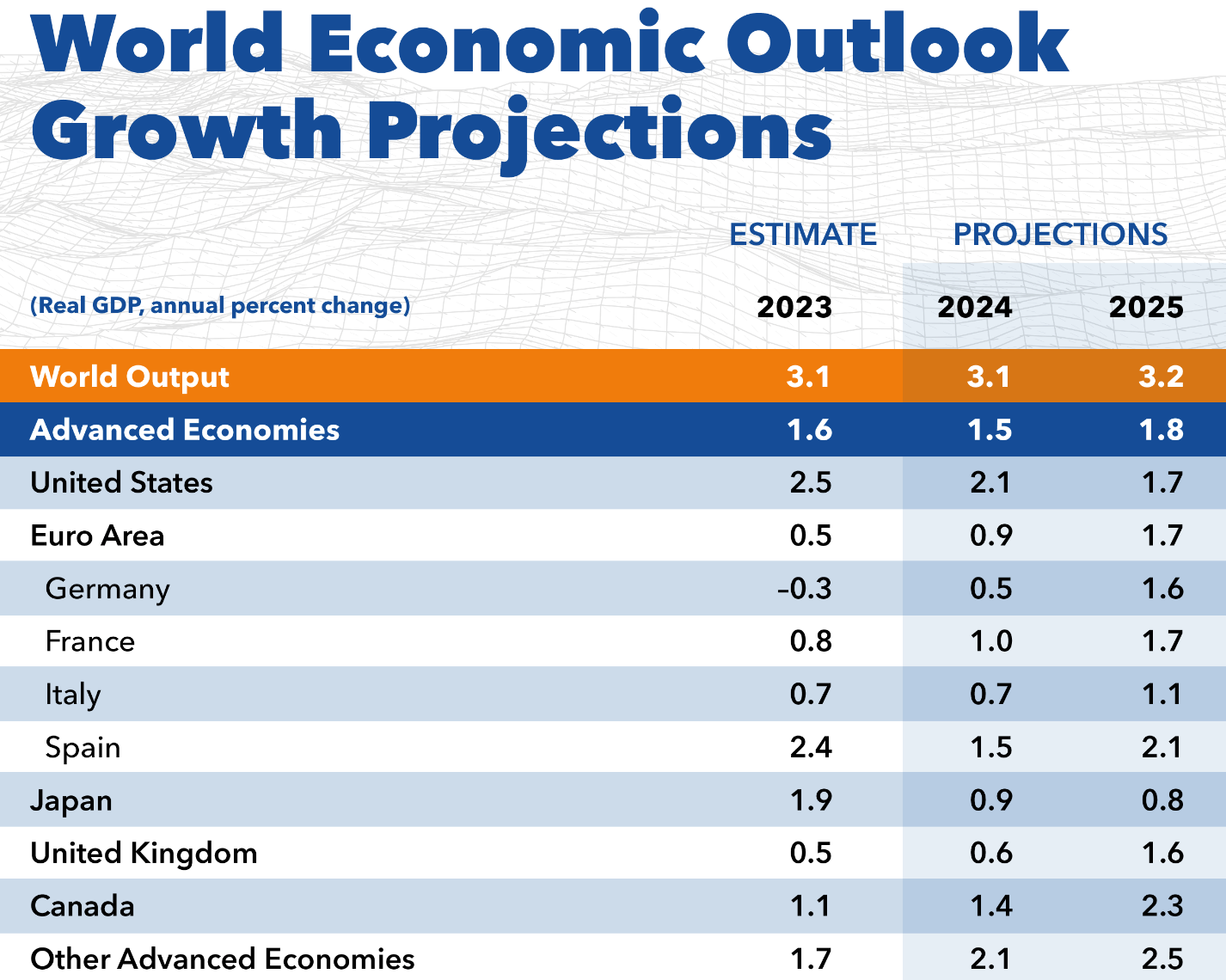

"In that context, we would advise against further discretionary tax cuts," the IMF's chief economist Pierre-Olivier Gourinchas, told reporters yesterday. The group published new forecasts yesterday - it expects UK GDP to expand 0.6% in 2024 and another 1.6% in 2025 (see table).

Land values

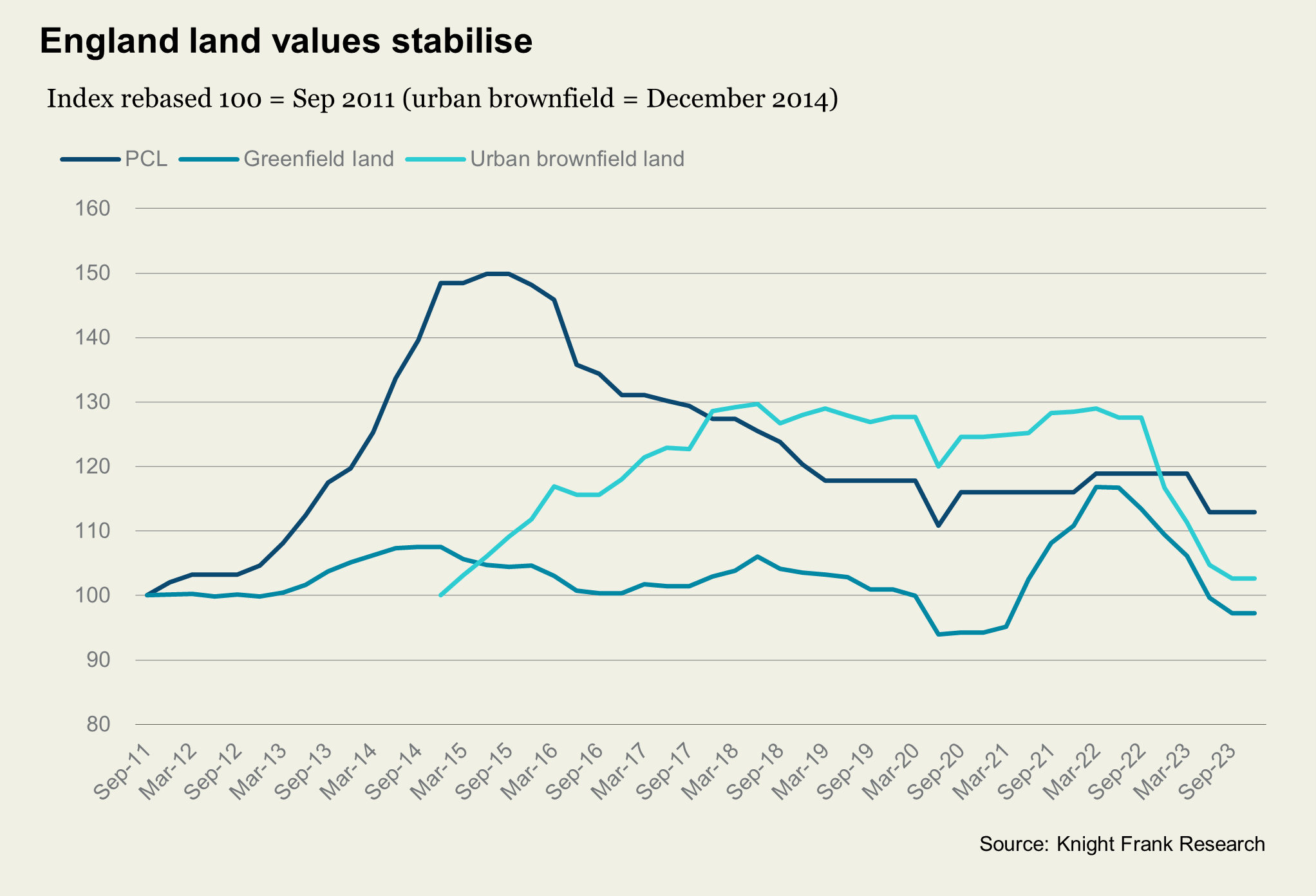

The double digit falls in our Knight Frank land index have bottomed out as the UK’s economic outlook has improved, the pace of build cost growth has slowed considerably, and new home site visits and reservations have picked up. Block sales to build-to-rent (BTR) housing operators and investors are also helping housebuilders to de-risk sites.

England greenfield and urban brownfield values were flat in Q4 2023 compared to the previous quarter. Previously, urban brownfield values had fallen by 20% since the most recent peak of the market in the first quarter of 2022 up to Q3 last year, with greenfield down 17% during this period (see chart).

In prime central London, land prices were also flat. The PCL land market has proven more resilient over the past couple of years, given its lack of available sites, bigger pool of cash buyers and robust overseas demand.

The majority of housebuilders (70%) said they thought that land prices would be stable in the first quarter of the year, unchanged from Q4 2023, with a fifth predicting a fall and 10% an increase. Previously, half had anticipated a fall in land values when surveyed in Q3.

In other news...

From our team - Christine Li on the residential recovery in Asia-Pacific

Chinese investors buy gold as property and stock markets fall (FT), and finally, Labour pledges to “unashamedly champion” the UK’s financial services sector (Bloomberg).