The Alpine property market: where to invest

Here we round-up the key trends influencing the French and Swiss Alpine property markets.

2 minutes to read

This article forms part of the Ski Property Report 2024 series giving insight into the latest market trends, property data and investment volumes across key ski locations.

The pandemic-induced Alpine mini boom is fortunately ending with a fizzle, rather than a bang, as limited supply keeps a floor under prices in most markets.

French Alps resort listings down

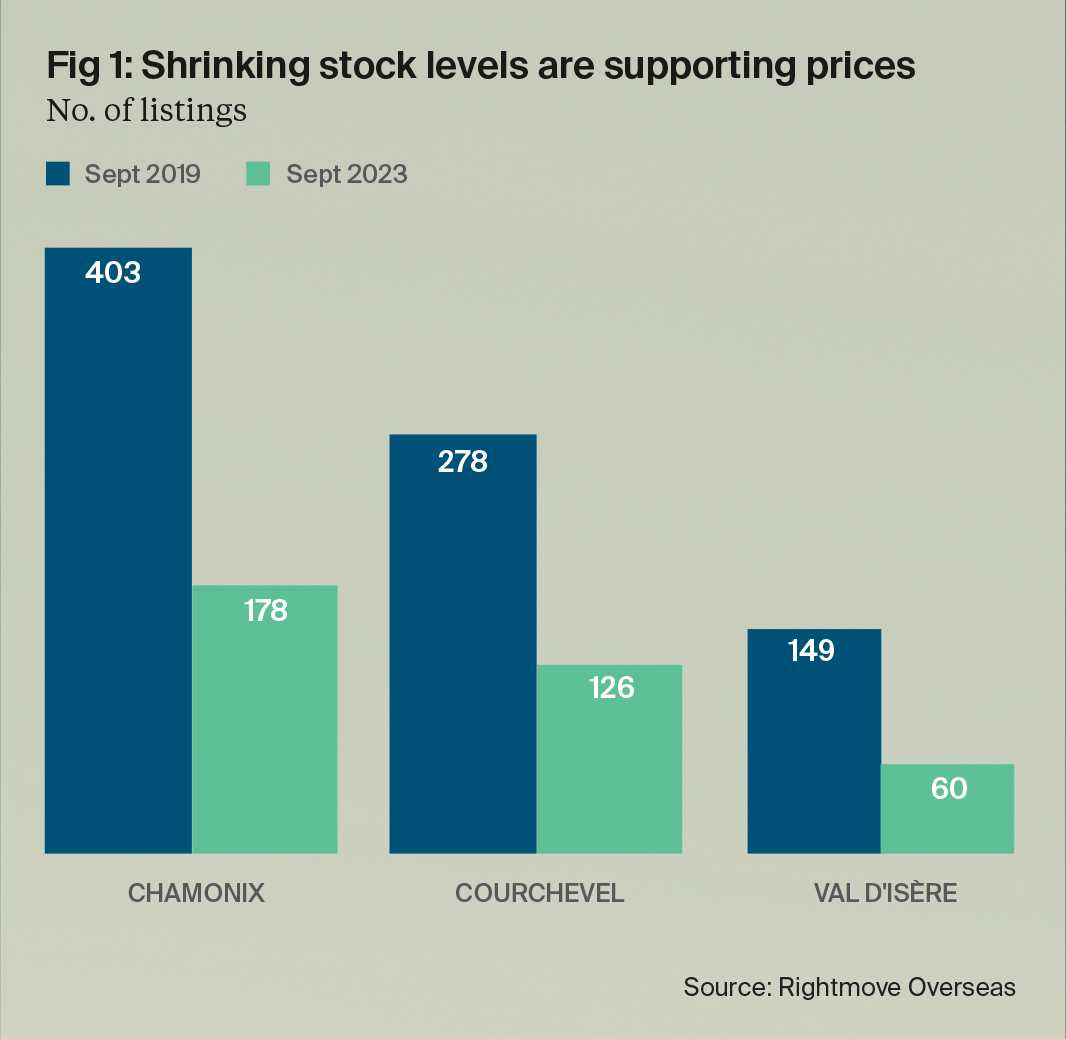

Across three key French resorts listings are down 56% on average compared to before the pandemic (see Fig 1) and this is set against a backdrop of robust demand. It’s a similar story across St. Moritz, Verbier and Crans-Montana.

Here, enquiries are strong, off-market sales are on the rise and buyers are having to prepare finance and paperwork in advance to be in a position to move quickly when a suitable ski property comes to the market.

Mortgage costs impacting price brackets

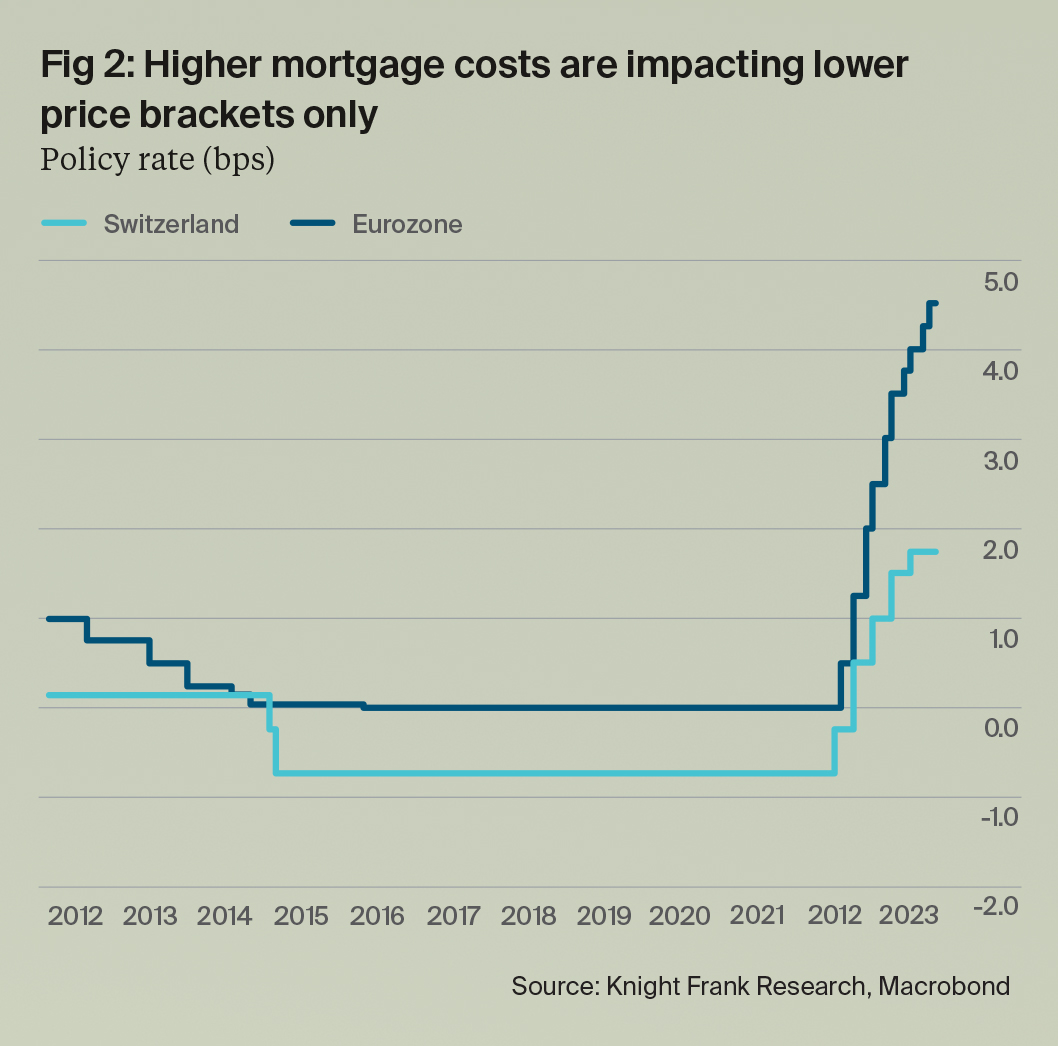

Lower price brackets are stymied by the higher interest rate environment, prompting owners to stay put rather than incur a hike in mortgage costs.

Owners of higher value homes are reluctant to surrender their Alpine home given the limited alternatives and, for many, the lifestyle benefits of their mountain abode have never been more apparent.

There are clear challenges ahead for ski resorts, not least climate change, the need to upgrade infrastructure and strict planning rules.

But the market is evolving, attracting buyers from further afield (Asia and Middle East) and from southern Europe, as recent heatwaves prompt some second homeowners to pivot northwards.

The appeal buying a ski property in the French and Swiss Alps, however, goes beyond the lifestyle. Prospective buyers cite the low purchase and ownership costs, the opportunity for currency diversification, and the potential for any rental income to provide a hedge against inflation in the current climate.

Key Findings:

1. Tight supply

Supply remains tight. Listings are down 56% on average across three key Alpine resorts compared to pre-pandemic levels.

2. Prime prices rising

Prime prices continue to rise, averaging 4.4% annual growth across the 24 resorts tracked, with Swiss resorts on top this year.

3. Variety of resorts

Purchaser motives are diverging. The split between clients targeting ski and year-round resorts is becoming more pronounced putting different resorts in the spotlight.

4. Resilient resorts

Some 72% of buyers say the resilience of a ski resort influences where they buy.

5. Cash buyers

With cash buyers accounting for 70% of Alpine purchases above €1.5 million, the impact of higher mortgage costs is limited to lower price brackets.

Ski property opportunities

As we move further into the 2023/24 ski season, investors looking for worthwhile opportunities in the ski property market should take note of these trends.

With supply remaining tight, prime prices continuing to rise, and the split of purchaser incentives becoming more pronounced, savvy investors may find ample opportunities in year-round resorts.

Discover more

For more market insights from leading experts, the latest price trends, buyer sentiment and more, download below or visit the Ski Property Report hub.