What do latest changes for net zero policy mean for property industry?

As an industry, there has been a call for consistency and clarity in our approach to net zero goals and regulation, yet recent announcements have had the opposite effect. We consider the potential impact for the real estate sector.

7 minutes to read

Rishi Sunak has announced a number of changes to the UK's net zero related policies including:

- Delaying the sales ban on petrol and diesel cars from 2030 to 2035.

- Confirmation that the minimum energy efficiency standards in the residential private rented sector will not be tightened.

- Increased subsidies for heat pumps.

- Relaxation of the phaseout of new gas boilers.

- Imminent changes to the grid connections process.

We take a look at the various measures and the implications for different property sectors.

Residential rollback

A scrapping of anticipated tighter minimum energy efficiency standards measures for residential private rental properties (beyond the current minimum EPC E) which had been trailed over the summer was confirmed by Rishi Sunak last week. Broadly, this will be welcomed by many residential landlords for alleviating some of the growing pressures they face, which has squeezed rental supply in recent years. Data from Rightmove indicates that average monthly rental listings are more than 50% lower than the 2017-19 average.

We had written about the potential bill for Landlords of up to £18 billion should these measures have been implemented. London landlords faced the prospect of a particularly hefty outlay, at £3.2 billion, where more than half of privately rented homes have an EPC of D or below. This is driven by the prevalence on Private Rented Sector (PRS) households in the capital (a fifth of the total), rather than a reflection of the quality of existing PRS stock.

However, the UK has some of oldest and most energy inefficient housing in Europe. Improving standards in the rental sector is a good thing for tenants, as are energy efficient homes more broadly; all which still need to be addressed in a measured, holistic way and done collaboratively with the sector.

The increase in the subsidy for households that install heat pumps from £5,000 to £7,500 will be welcome news for homeowners. The latest Climate Change Committee progress report highlighted that progress on heat pumps was ‘significantly off track’ with current rates around one-ninth of the target level. The UK lags behind other European nations in installations with 88 per 100,000 people in 2022 compared to more than 4,000 per 100,000 in Finland.

The relaxation of the 2035 phaseout for installing new gas boilers and delayed ban on new oil or LPG boilers for those off-grid from 2026 to 2035 will be of greater interest to developers. However, many had already shifted towards different heating systems in preparation for the phase-out and therefore will have little impact on the sector. Developers and home-builders say they are most affected by planning delays and mortgage costs. However, the delaying may mean a lack of credibility in any future consulted policies.

Commercial path set

For commercial property owners, investors and tenants, there was no mention of minimum energy efficiency standards (MEES) for non-residential buildings, which have been mooted to rise to a minimum EPC C by 2027 and EPC B by 2030, from the current EPC E. Due to the scrapping of the proposals for the private residential sector, this could mean greater uncertainty for the timelines and standards yet to be announced.

However, this uncertainty won't stop the industry from making progress towards more efficient buildings. The increase in disclosure requirements remain (around 40% of respondents to our ESG Property Investor Survey require EU Taxonomy compliance or SFDR alignment with acquisitions), as are the financial pressures from lenders, as well as companies' own net zero targets. Our latest (Y)OUR SPACE research confirms that almost all global occupiers believe their own ESG commitments and strategies will influence real estate decisions to some extent over the next three years.

Most importantly, demand from occupiers for more sustainable, wellbeing-supportive buildings is rising. Part of this is a reaction to the recent high energy prices, which has resulted in a greater focus on efficiency to avoid any future fluctuations. But, the other more pertinent component is that occupiers are looking to amenity-rich buildings to attract and retain staff. According to the (Y)OUR SPACE research, real estate supports the business strategy in this regard.

Jonathan Hale, head of ESG consulting at Knight Frank said, “Preparing for decarbonisation capex is essential in helping to transform our existing buildings into desirable stock, whilst protecting occupiers from the rapid increases that have been witnessed in service charges. Concurrently, certainty from government is definitely needed on MEES to support the investor resilience of the commercial asset classes. Future-proofing real estate is essential and there are clear advantages for both landlord and occupier to gain from this transition.”

Welcome news for renewables

Sunak also announced that a lifting of the ban on onshore wind and changes to the grid are imminent. He noted that the current grid infrastructure is insufficient and a barrier to our renewable goals.

The government “will shortly bring forward comprehensive new reforms to energy infrastructure,” to achieve this aim. This will include a spatial plan for that infrastructure, speeding up planning for the most nationally significant projects and an ending to the “first-come-first-served approach to grid connections by raising the bar to enter the queue and make sure those ready first, will connect first”.

David Goatman, Knight Frank’s global head of energy & sustainability said, “The changes to grid connection process sound positive and will be welcomed by the industry as it’s been the biggest constraint on bringing projects forward, however the devil will be in the detail.”

He continues, “What is meant by raising the bar will be pivotal. What will the criteria be to apply? Will it be a multistage approach whereby developers can apply and then once receive connection approval they have to show progress or lose it? These details will determine how much could be unlocked. The spatial plan could provide transparency to where there is capacity but invariably has the potential to pushing up costs for developers to acquire sites and ultimately squeeze viability.”

The UK’s onshore wind capacity is currently around 15GW, with many calling for this to double to 30GW by 2030. Any progress in unlocking this potential should be seen as a positive, particularly with a high level of public support for renewable energy generation projects.

Electric Vehicle momentum not to be derailed

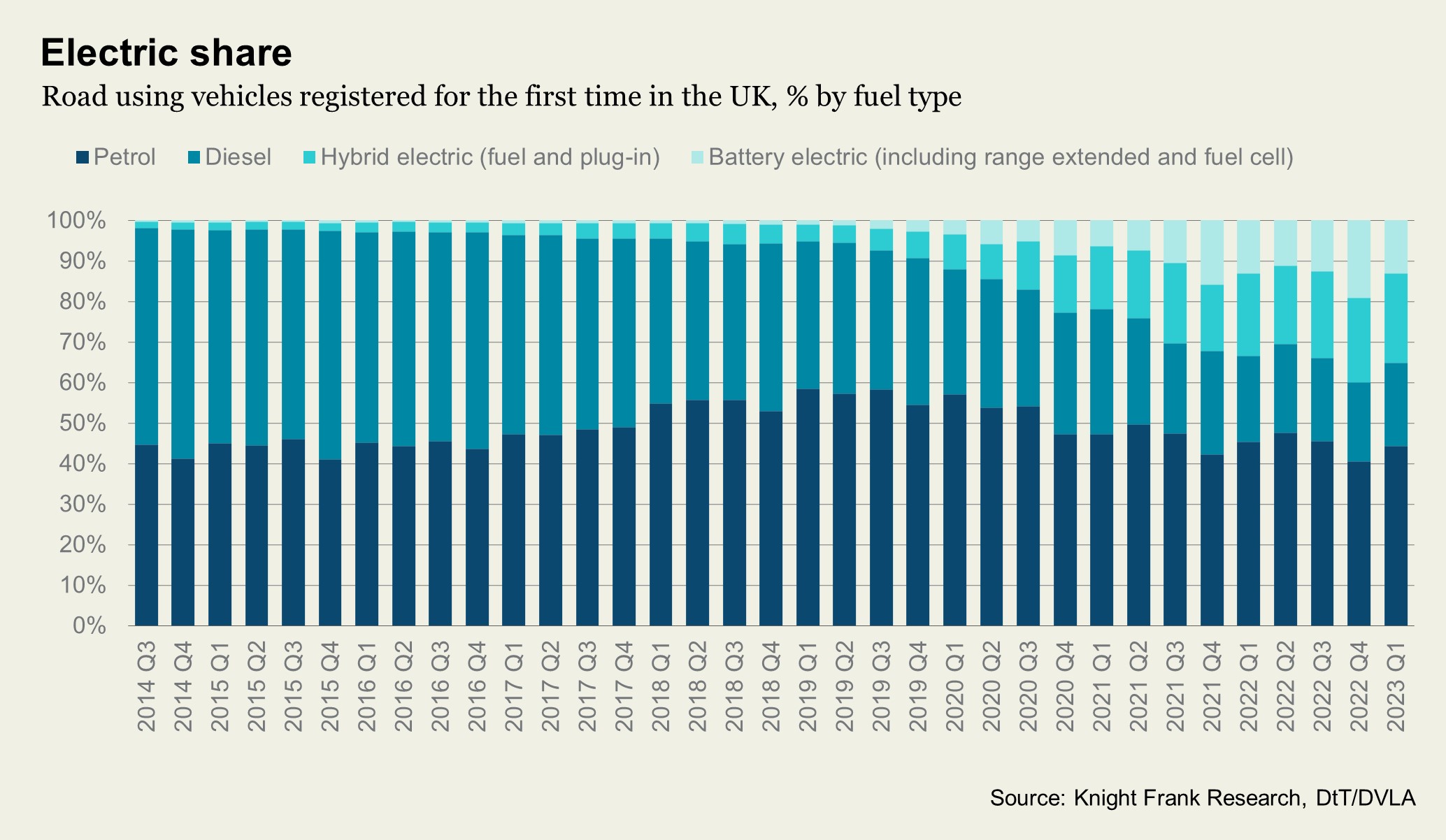

The final announcement was to delay the ban on new petrol or diesel cars by five years to 2035, bringing the UK in line with the EU and some US states. Electric vehicles (EVs), as a proportion of the total newly registered vehicles have been growing since 2019, see chart below, accounting for 40% in the final quarter of 2022 and around 35% in Q1 2023.

Consumers are increasingly opting for EVs, shown by new car registrations. Consequently, the demand for charging points from property owners will only continue to increase. The confirmation from Nissan that it will only sell EVs in Europe from 2030 highlights the transition underway.

The recognition of the need to incorporate EV charging infrastructure across the country and in new developments has seen the number of points almost double in the last year. According to Zapmap there were 48,450 electric vehicle charging points across the UK, across 29,062 charging locations, a 42% increase in since August 2022. Despite the delaying of the ban by five years, the delivery of a charging network is something property owners and occupiers need to consider.

Goatman adds, “Until now, grid capacity has been a constraint, particularly for larger-scale charging hubs and changes to the grid connection process will hopefully go some way to address this. For property owners with suitable sites, its important to think about incorporating EV charging points because demand isn’t going to slow with the delay, and it can be an important differentiator and required to fully futureproof assets. In addition, there are potential revenue generation opportunities with the installation of rapid charge points. We have seen the rental values for these grow by three or even four times in recent years for the most in-demand locations.”

Net zero target implications

Overall, the UK has a legally binding commitment to be net zero by 2050 and the latest Climate Change Committee progress report set our very clearly that the current trajectory means we are way off track.

These announcements do not materially move the dial but ultimately raise the risk of missing this target and could potentially make the transition more costly both in terms of urgency later and the missed opportunity.

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here