Madrid leads professionalised rental housing market

Nearly 30,000 professionally managed units delivered with a growing pipeline in the capital and other provinces.

2 minutes to read

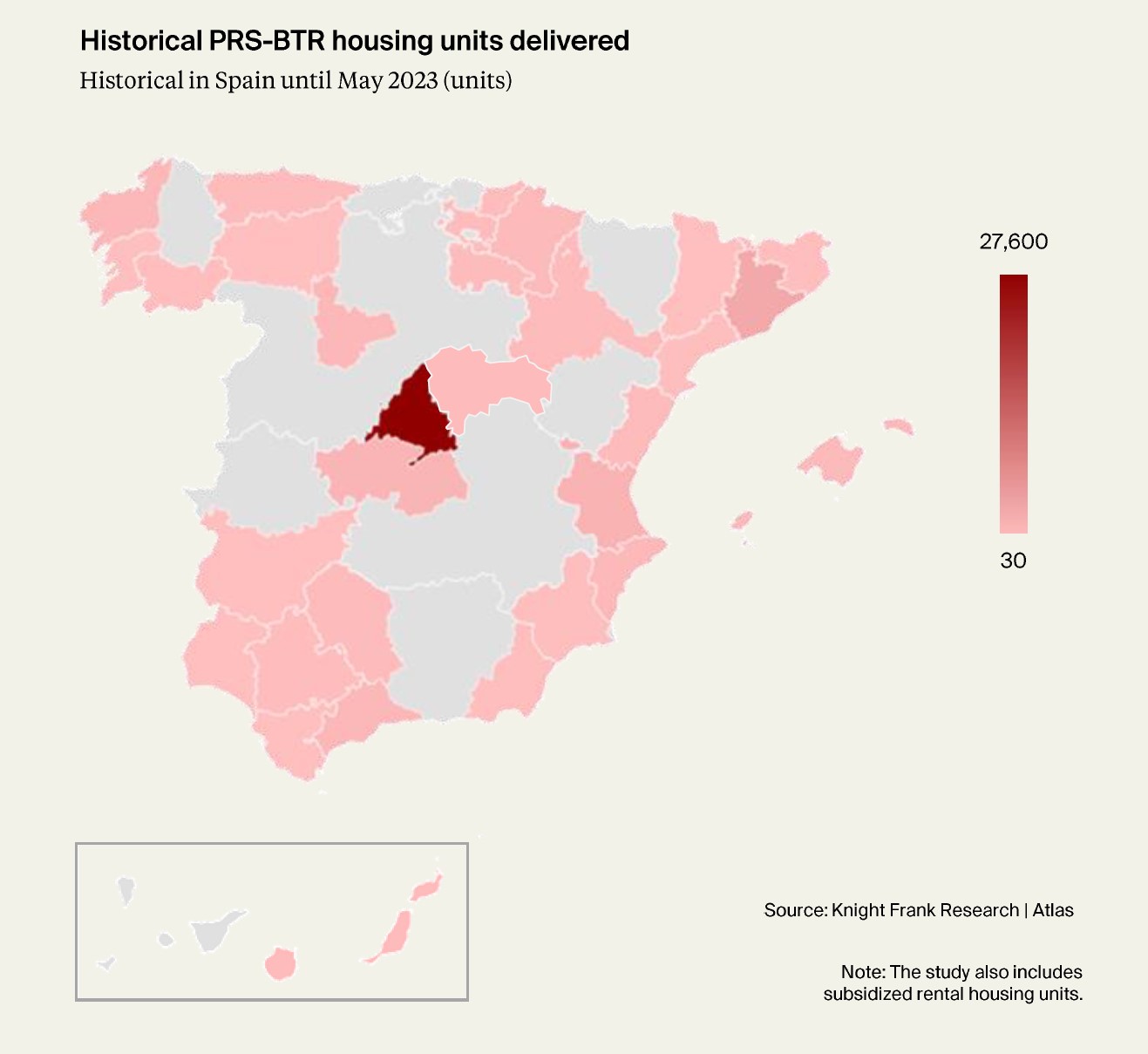

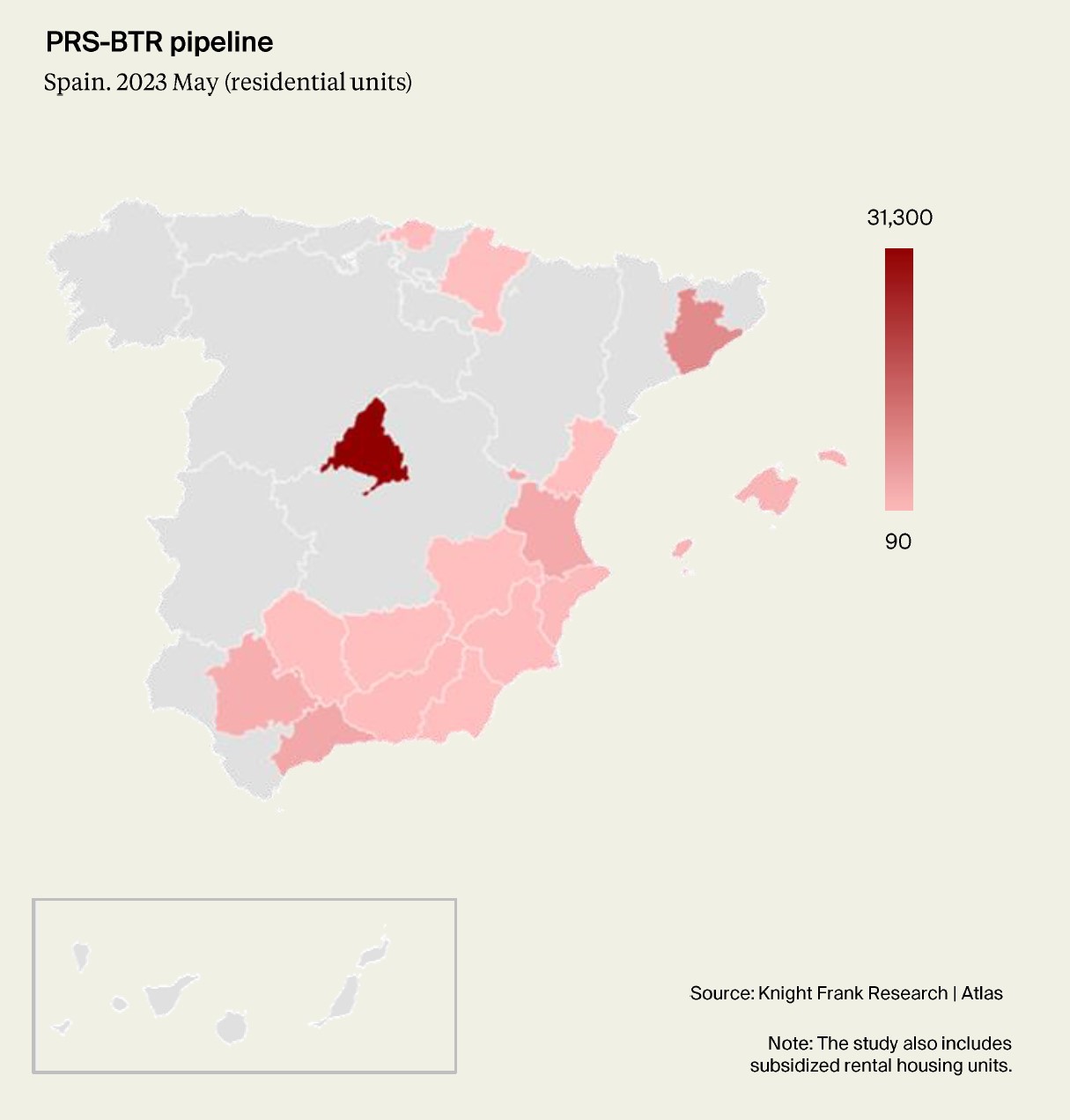

Historically, large investors and operators have favoured Madrid for the development of these typologies, and it also concentrates major future projects.

Its distinctive advantages compared to Barcelona, such as its rapidly growing population, attractiveness to students, job opportunities, certain administrative advantages in this segment, and a lesser limitation of land compared to the Catalan capital, reinforce this trend.

Spain housing pipeline at a glance

Housing units in the pipeline:

55,000 residential units

Top provinces with major developments:

Madrid | 31,300 residential units

Barcelona | 8,380 residential units

Malaga | 3,770 residential units

Valencia | 3,570 residential units

Seville | 2,730 residential units

Balearic Islands | 1,660 residential units

Average rental price of the delivered housing:

From 975 €/month

Estimation based on published prices.

Current stock

During the last few years, rental housing experienced significant growth, especially after the pandemic, when there was an increased demand for larger and more financially feasible rental properties compared to owned homes. This trend continues due to rising interest rates and inflation.

Madrid stands out prominently, occupying the first position in the development of professionally managed rental housing, currently accounting for a stock of around 28,000 units. Barcelona follows, with approximately 3,300 units under this model, and Valencia ranks third with around 1,800 units.

Furthermore, both investors and developers have identified opportunities in secondary cities, which are less saturated and have significant growth potential. This has led to the expansion of this type of rental offering throughout the country.

Future construction pipeline

Regarding future developments, the Community of Madrid records the highest number of new rental housing units and has around 31,300 projected units, representing almost 60% of the total pipeline in Spain. Barcelona, on the other hand, accounts for 15% of the future housing units (8,380 units).

One of the largest national developments is the construction of 4,500 social rental homes in Barcelona under the brand Neinor Rental Home, thanks to the partnership between Cevasa, Neinor, and the City Council, which provides the land. Their completion is expected in 2024.

Avalon will also have significant activity in Madrid, where it is projected to operate around 4,300 new rental homes between 2023 and 2024.

Of the total planned housing units in Spain, slightly over 50% are classified as subsidized or public housing, mainly located in peripheral areas of the city in the case of Madrid. This includes the case of the 11,000 publicly funded rental units planned in the Campamento area, which will be promoted by SEPES (State-owned Land Development and Equipment Company).

In terms of private developments, there is also a noteworthy construction of over 2,300 housing units in the capital, distributed between Valdebebas and San Sebastián de los Reyes. In both developments, Greystar has been the investor, and Momentum the promoter, operating under the brand Be Casa, which emphasizes flexibility in the duration of stays, likely starting in 2023.

Subscribe for more

For more market-leading research, expert opinions and forecasts, subscribe below.

Subscribe here