High rents persist in prime London lettings market as politics trumps economics

March 2023 PCL lettings index: 208.0

March 2023 POL lettings index: 210.2

2 minutes to read

In the three years since the pandemic struck, rental values have risen by 27% in prime central London (PCL) and by 23% in prime outer London (POL).

Supply dwindled while demand surged, which means tenants have struggled with surging rents and properties that were let out before being advertised.

The frenetic conditions of the last 18 months have calmed down but not disappeared altogether.

Annual rental value growth in March was 16.9% in PCL and 15.2% in POL, the lowest figures since November 2021.

Although the numbers compare to 25%-plus this time last year, they are still high by historical standards.

A better-than-expected sales market means lettings supply has not risen to the extent some expected since Christmas, as we explored here. It has produced fewer so-called ‘accidental landlords’, or owners that decide to let out their property after failing to achieve their asking price.

New listings in London in February were down by around a third versus the five-year average, Rightmove data shows.

For higher-value properties, lettings supply is less scarce because owners are typically more discretionary about their options and more have chosen the rental route in recent months due to the economic turbulence.

The number of market valuation appraisals, which is a leading indicator of supply, was 11% higher than the five-year average for properties valued at less than £1,000 per week in February. Between £1,000 and £5,000 per week, there was a 132% increase.

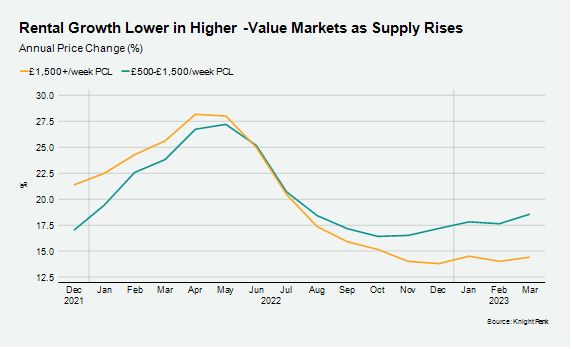

The higher supply of higher-value properties is reflected in lower levels of rental value growth, as the chart below shows.

As the general election moves onto the radar, the growing cost-of-living pressures faced by tenants will come under renewed focus.

In the last month, there have been reports here and here of how far tenants are being squeezed across the UK. It was also reflected in recent figures from the ONS, showing rents rose last month by the most since records began in 2016.

The problem has been aggravated by landlords leaving the sector in recent years due to a series of tax and legislative changes.

Landlords have been targeted for political capital, but lower supply mean tenants have also suffered.

More institutional capital is flowing into the rental sector but Build-to-Rent still only accounts for less than 2% of stock so it doesn’t make a material difference to how rents move.

The bad news for tenants is that politics rather than economics will be in the ascendancy as the election countdown begins.