UK housing begins to shake off the mini-budget

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

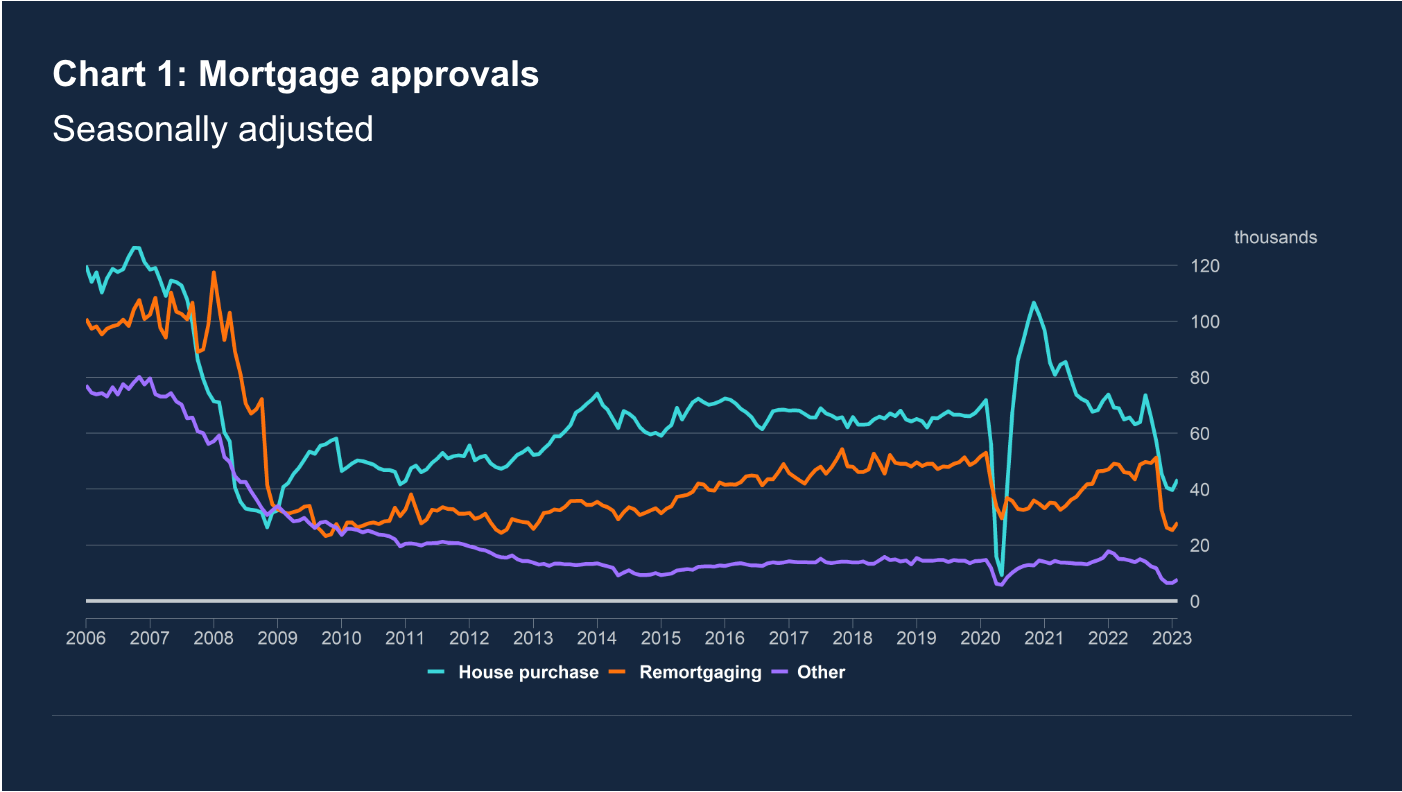

Mortgage approvals

A recovery in housing market activity that has been underway since January is now showing up in official figures. Net mortgage approvals for house purchases increased to 43,500 during the month February, from 39,600 in January, according to Bank of England figures published this morning. That's the first monthly increase since August.

Activity is still subdued relative to recent history (see chart), but things will continue to settle the further we get from the mini-budget.

The ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages increased by 36 basis points, to 4.24%. We'd expect that to stabilise in the months ahead, though much depends on whether we see any further bouts of financial instability.

Heat pumps, continued...

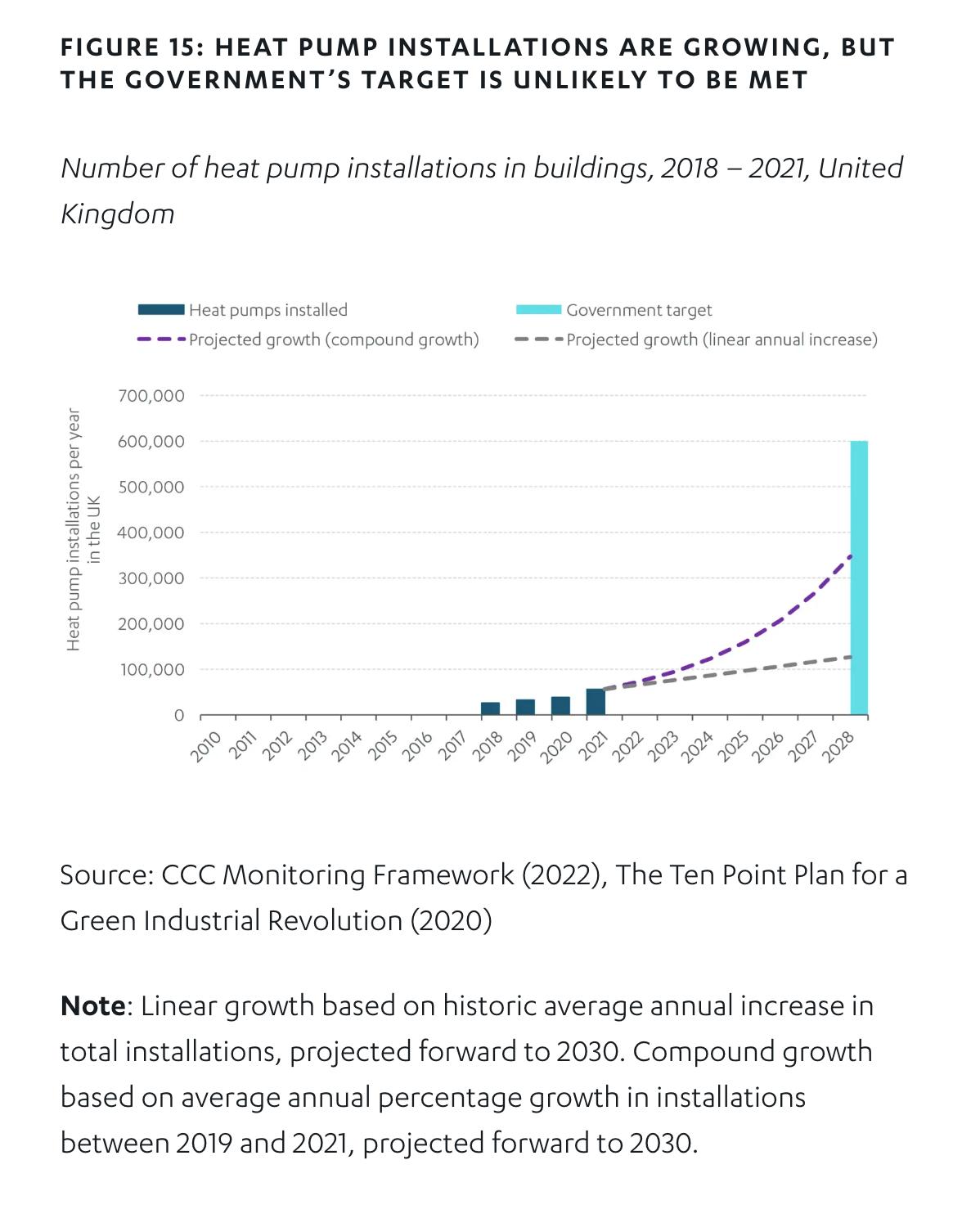

We talked on Monday about the UK's struggles in getting heat pump installations anywhere near our European neighbours, or indeed anywhere near government targets. The UK's National Infrastructure Commission published its 2023 progress review later the same day, offering an exhaustive summary of the various ways the government is failing when it comes to greening the built environment.

Let's start with the positives: there are targets in place for demand reduction and improving the energy efficiency of buildings (though the NIC says it is not clear how those targets align). The government has also committed to deciding on the role of hydrogen in home heating by 2026, however it "needs to set out more detail on how the heat transition will take place and how it will be funded." All-in-all, for "taking a long term perspective", the government gets a "partly met".

Everything else gets a fail. There is no concrete plan for improving the energy efficiency in homes, particularly in driving action for owner occupiers and the private rented sector. Key elements of the Heat and Buildings Strategy are missing detailed policies, including the planned low carbon heating obligation on boiler manufacturers. Funding announcements for energy efficiency are material, but will not be sufficient. The net zero target and interim Carbon Budgets offer indications that change is necessary, but the pace of change is currently too slow to deliver the needed reduction in emissions, and the scale of current and proposed policies, such as the Boiler Upgrade Scheme, are not sufficient to bring installations back on track to meet the Sixth Carbon Budget. And on it goes...

The common theme here is that we have plenty of pledges and targets but little in the way of viable methods or funding in place to achieve them. Perhaps that will change soon. Let's check again during the summer when the Climate Change Committee publishes its 2023 progress report to Parliament. You can read our take on the 2022 edition here.

Economic speed limits

The world has enjoyed a three-decade period of relative prosperity since the early 1990's, driven by growth in productivity, investment and labour force participation.

All three forces are now fading, ensuring growth cannot stretch beyond an economic "speed limit" without sparking inflation, according to a new outlook from the World Bank. Between 2022 and 2030, average global potential GDP growth is expected to decline by roughly a third from the rate that prevailed in the first decade of this century - to just 2.2% a year.

There are solutions - the Bank's analysis suggests that potential GDP growth can be boosted by as much as 0.7% to 2.9% - if countries adopt "sustainable, growth oriented policies". Some of those are broad, like aligning monetary, fiscal and financial frameworks to prevent crises like the banking one currently underway, cutting trade costs and boosting labour force participation.

Others are more specific and have more direct links to real estate. Ramping up investment in areas such as transportation and energy, agriculture and manufacturing, and land and water systems - could enhance potential growth by up to 0.3 percentage point per year, the group says. Meanwhile, exports of digitally delivered professional services related to information and communications technology climbed to more than 50% of total services exports in 2021, up from 40% in 2019. Continuing the shift could generate important productivity gains - "the services sector could become the new engine of economic growth," the group concludes.

In other news...

Regulators could make banks hold more cash (Times), Confident Bellway begins £100m share buyback plan (Times), and finally, S&P forecasts an 8% rebound in Hong Kong home prices (Bloomberg).