Was the October dip in house prices a blip?

Weak UK housing market data in October is not a reliable indicator for what comes next.

3 minutes to read

October was not a good month for the UK property market.

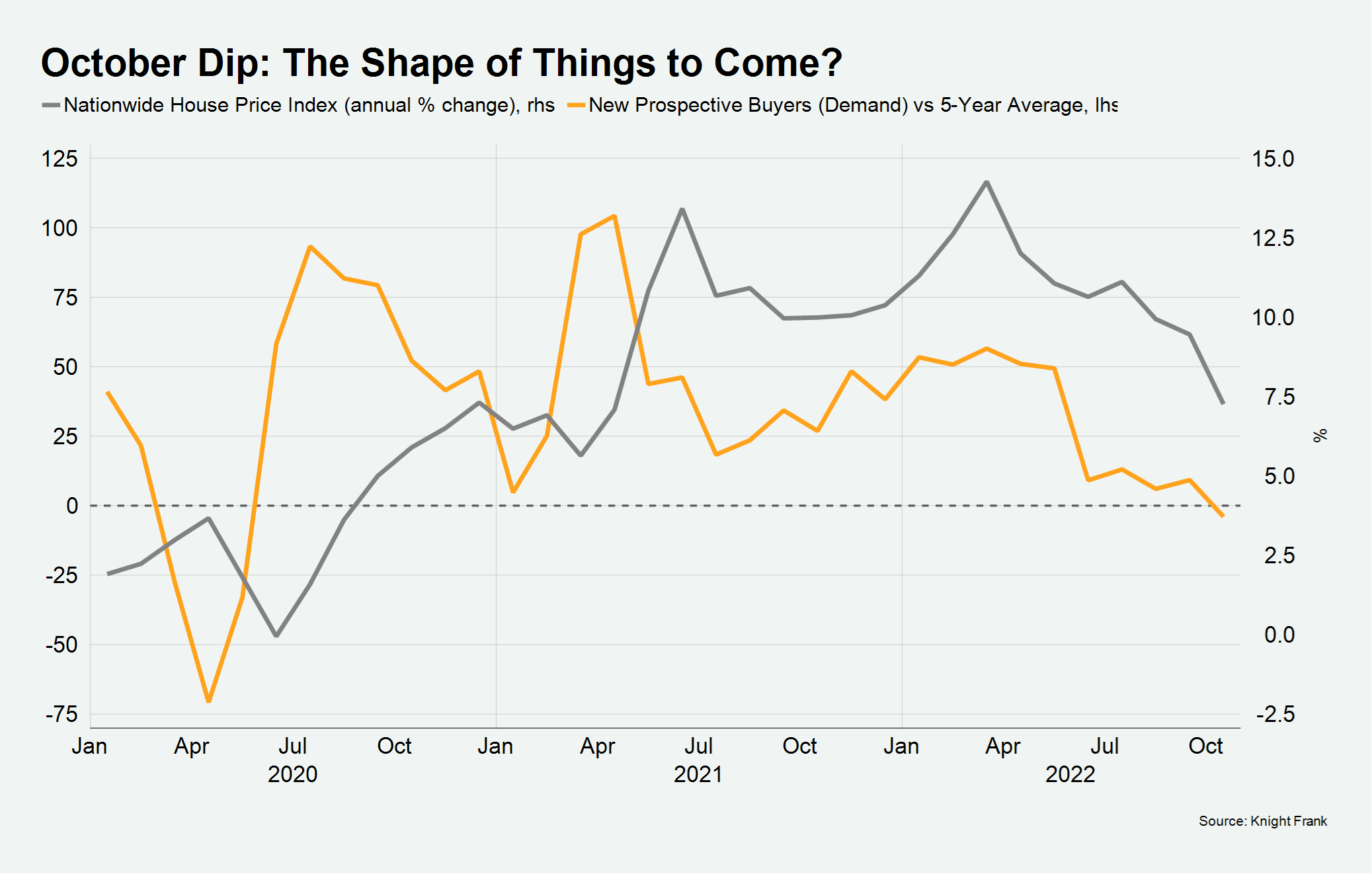

House prices fell on quarterly basis for the first time since July 2020 (Nationwide), the Bank of England announced a drop in mortgage approvals, and the number of new UK buyers registering fell below the five-year average for the first time since May 2020.

You might reasonably conclude that the period of robust house price growth that began in the summer of 2020 is turning into a nosedive.

But things rarely happen that suddenly in the UK housing market. Instead, the October dip was almost certainly magnified by the impact of the mini-Budget and accompanying mortgage market volatility that has now begun to recede. Buyers hesitated and asking prices were reduced against a disorientating backdrop.

In a market as illiquid as residential property where so many buyers are needs-driven, whatever happens next will be more gradual.

That’s not to say we don’t expect house prices to fall as mortgage rates rise – see our latest forecasts here.

However, unlike the global financial crisis, there is no reason to think there will be a cliff-edge moment.

The Bank of England said mortgage approvals “decreased significantly” to 66,800 in September from 74,400 in August, but was the decline so notable?

The figure for September was higher than the monthly average for the last ten years.

Transaction pipeline still strong

Some transactions may fall through, but the pipeline going into the final quarter of the year is in decent shape.

Indeed, the number of offers accepted across the UK in October was the tenth highest figure in a decade, Knight Frank data shows.

Some buyers and sellers are even motivated by the fact rates are rising. Decisions to sell have been brought forward and buyers are keen to transact while favourable mortgage offers made several months ago remain valid.

House price pressures

Either way, it looks likely that house prices will only come under more pressure after Christmas, as the impact of higher interest and mortgage rates spreads.

However, that doesn’t mean we expect a wave of forced selling leading to precipitous price declines.

Lenders are more insulated than they were during the global financial crisis (GFC). Mortgage capital and interest payments as a % of income was 17.7% in July this year compared to more than 23% at the end of 2007, UK Finance data shows.

After house price growth of 25% during the pandemic, negative equity will be limited.

More people also own their home than ten years ago. The figure was 8.8 million (36%) in 2020 compared to 7.3 million in 2012, ONS data shows. There are large geographical overlaps between those areas of the country where more property is owned outright and our analysis of which locations have the highest percentage of cash buyers, a group of people who will be less impacted by rising rates.

Furthermore, supply is still around 25% below pre-Covid levels, which will keep house price declines in check.

This will be even more noticeable if discretionary sellers hesitate while the market stabilises.

So, this doesn’t feel like a re-run of the GFC, when prices dropped 18% in the year to February 2009.

Instead, the housing market is on a particularly erratic path back to normality. The next bump in the road could be the autumn statement later this month, although thankfully for anyone buying a house or re-mortgaging, the impact is likely to be less dramatic than September’s mini-Budget.

Sign up for more

For more property forecasts and market-leading insight into the UK property market, subscribe to the newsletter.