Walking back bets on peak interest rates

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Stability?

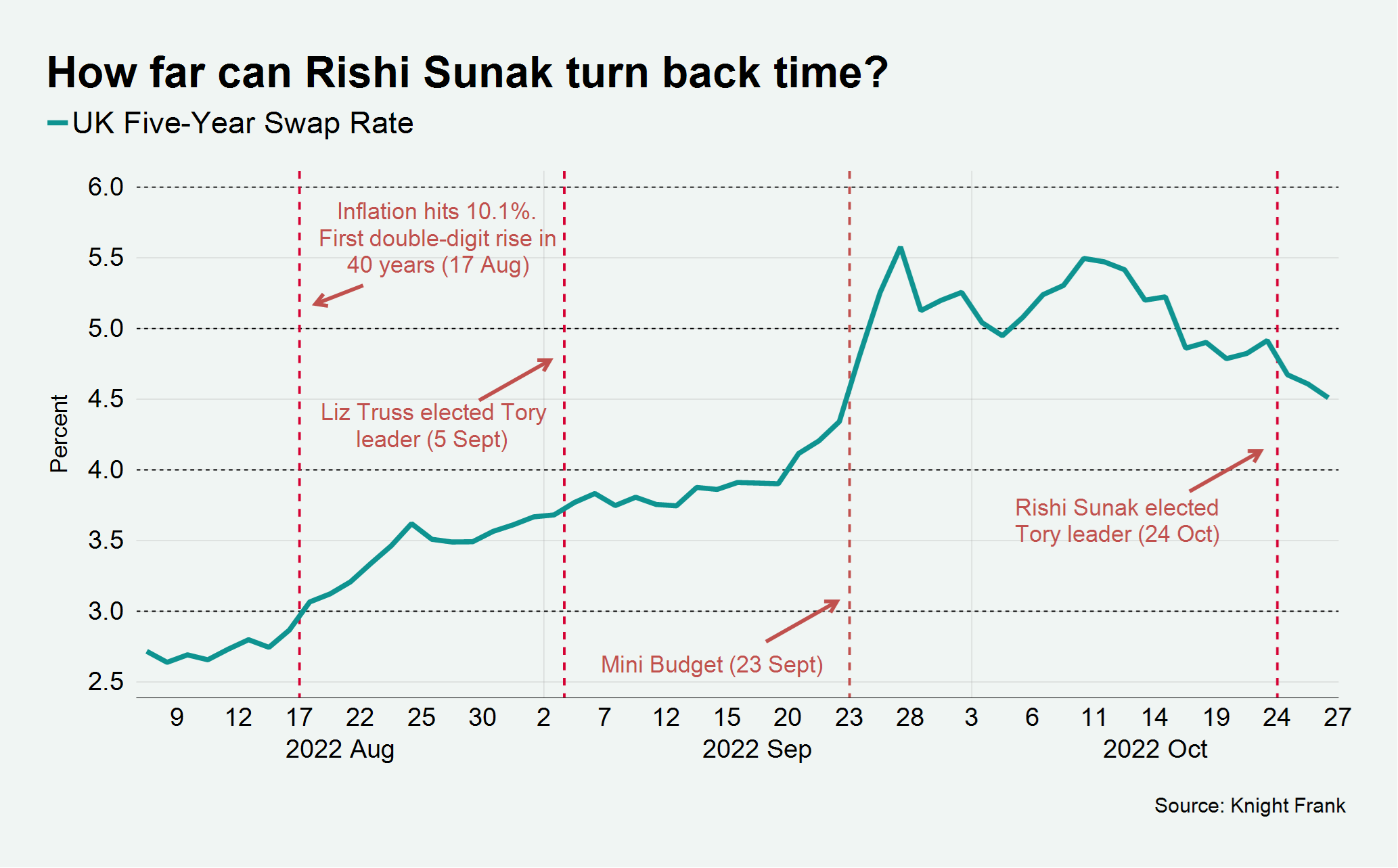

By Wednesday, three days after Rishi Sunak took office, UK gilt yields had either fallen below their pre-mini-Budget level or were heading in that direction, depending on their maturity.

The five-year swap rate, which is used to price most UK mortgages, was hovering around 4.5%, a shade higher than it was before former Chancellor Kwasi Kwarteng got to his feet to outline the government’s economic plan on 23 September.

We talked on Wednesday about the first few lenders that had made cuts to various mortgage products in response to falling swap rates. Average two-year and five-year mortgage rates have still only eased by 0.16%, according to Moneyfacts, while key swap rates have come down between 1.3 and 1.4 percentage points. Granted swaps aren't the only metric used to price mortgages, but that data suggests we could see further cuts to mortgage rates in the days ahead.

How much further can Rishi turn back the clock? Tom Bill takes a look. Meanwhile, Flora Harley takes a global perspective on the path of interest rates.

Divergent forecasts

The number of commentators expecting UK house prices to fall is growing. Lloyds Bank said yesterday that prices will fall 8% next year and remain largely flat for the following four years. Our own outlook suggests we'll see 5% falls in both 2023 and 2024 before returning to growth in 2025.

Others are taking a different approach. Baseline scenarios out this week from Barclays and HSBC predict house prices will continue to climb over the next two years at least.

The divergence can largely be explained by growing uncertainty as to how high the Bank of England will raise the base rate. We predicated our forecasts on the base rate peaking at 5% next year, as per the most likely scenario outlined by consultancy Capital Economics. That's broadly in line with pricing in financial markets, though that has been ticking down.

The Barclays baseline scenario has the GDP dropping 0.3% in 2023, unemployment rising to 4.5% and the base rate peaking at 3.5%.

A dovish ECB?

Easing expectations of peak interest rates isn't limited to the UK. The European Central Bank raised interest rates by 0.75% yesterday to their highest level since 2009, but a slight shift in tone from ECB president Christine Lagarde convinced markets that rate-setters would turn more dovish.

Largarde made her first acknowledgement that the eurozone was heading for recession, plus the following comments, as per the FT: "The ECB changed its guidance from saying last month that rates would rise “at the next several meetings” to only say that it “expects to raise rates further” having already made “substantial progress in withdrawing monetary policy accommodation”."

Eurozone bonds rallied, the euro fell below parity with the dollar and market prices implied that the key interest rate would only rise to about 2.5% by September next year, from 1.5% today. That's down by about a quarter of a percentage point on recent expectations.

There is little doubt that Europe is in for a difficult winter and a recession is a foregone conclusion according to most economists, but predictions of a dramatic downturn with winter blackouts look to have been overdone. The spot price of European natural gas, for example, has fallen from records of €300/MWh at the end of August to €50/MWh, though that's still twice the norm. Still, apparently the end of Europe's energy crisis is now in sight, the FT's Chris Giles declares in a fascinating piece this morning.

Remote work

The race to attract wealthy global citizens has a new participant: Indonesia.

The country is offering “second home” visas for five years and 10 years to those with at least 2 billion rupiah ($130,000) in their bank accounts, according to Bloomberg. The policy takes effect from Christmas.

Indonesia joins scores of countries seeking to capitalise on the boom in remote work. Kate Everett-Allen checks in on Barbados's progress. The nation was an early mover and its 12-month welcome visa has sparked the interest of 3,784 applicants with some 2,417 being approved, according to government figures.

The scheme allows non-residents to live and work in Barbados for up to 12 months provided they earn at least US$50,000 a year or have the same amount in savings.

Barbados’s property market is now struggling from a lack of stock following a decade-long glut of inventory that we witnessed post the financial crisis and prior to the pandemic.

In other news...

Want more analysis of the UK mortgage market? Download the mortgage market in minutes, with Knight Frank Finance.

What are the ESG considerations for occupiers in Asia Pacific?

Elsewhere - the US economy rebounds (NYT), US 30 year fixed rate mortgages surpass 7% for the first time since 2002 (Freddie Mac), Turning City of London into the 'Wild West' would be self-defeating, says BoE's Woods (Reuters), and finally, China's growth now seen below 5% through 2024 (Bloomberg).