UK country market sales surge as pent-up demand keeps race for space alive

Prospective buyers who are renting move quickly to buy as supply improves.

2 minutes to read

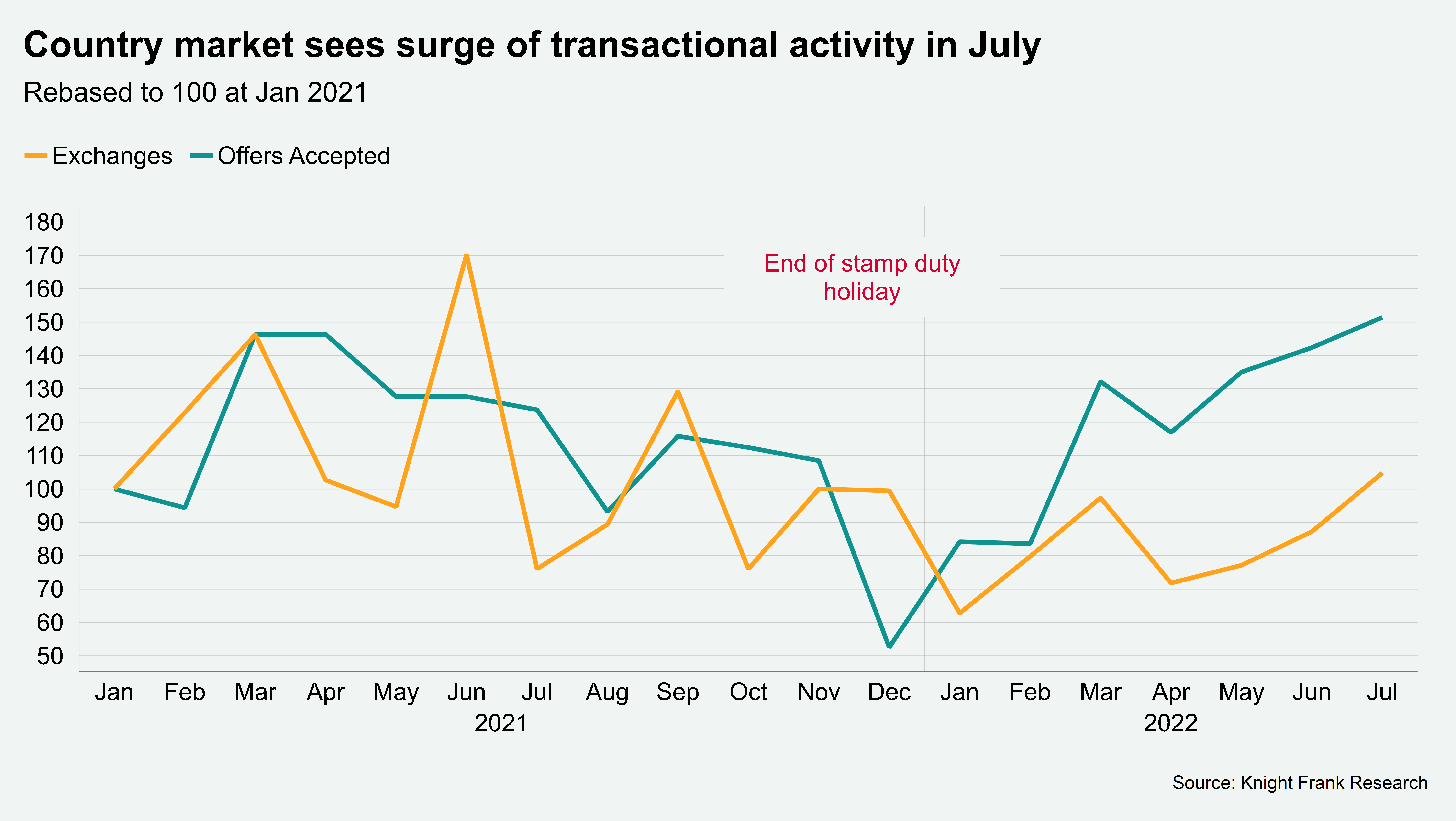

Frustrated demand helped drive July’s country market to its strongest period of transactional activity since the end of the stamp duty holiday last September.

With interest rates on an upwards trajectory, buyers and sellers have moved at pace to lock-in mortgage deals.

As we explored in June, supply outside of London has improved. The ratio of new prospective buyers (demand) to new instructions (supply) is close to the pre-pandemic five-year average of 7.6. Meanwhile, demand has remained strong, in many cases driven by prospective buyers who took rental properties as they continued their search.

“There are many prospective buyers who have been in rental for 12 months, having missed out on multiple properties, which means pent-up demand remains huge,” said Mark Proctor, head of the South West region at Knight Frank.

The number of exchanges in July was the highest since the end of the stamp duty holiday last year (see chart).

Buoyed by a strong performance across town and city markets, the number of offers accepted in Knight Frank’s Country business in July reached its highest since October 2020. This was the initial wave of the escape to the country trend after the UK’s first national lockdown, which lead to buyers seeking more space and greenery and delivered a record-breaking period in the country market.

The frenetic conditions created by the stamp duty holiday last year saw increasing numbers of sellers holding off from listing their homes due to a lack of purchase options, creating a vicious cycle of low supply. Supply has been building in recent months and with demand proving resilient activity has been high.

While price growth has moderated in the country market, in part due to an improvement in supply, demand remains strong with the number of active buyers in the market unchanged from the same period last year.

Quarterly growth in June vs March was 0.7%.

“We seem to have returned to more traditional rhythms in the country market in August after two frenetic years, with people able to holiday abroad again. However, I’m optimistic for September as the prospect of what’s ahead is encouraging sellers to act and while there’s been a slight flattening in demand from where we were early this year it is still outstripping supply,” said George Clarendon, head of Knight Frank’s Winchester office.

We forecast annual growth in the country market to finish the year at 7% as demand softens and supply continues to improve.