The outlook for London offices

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

London office take-up

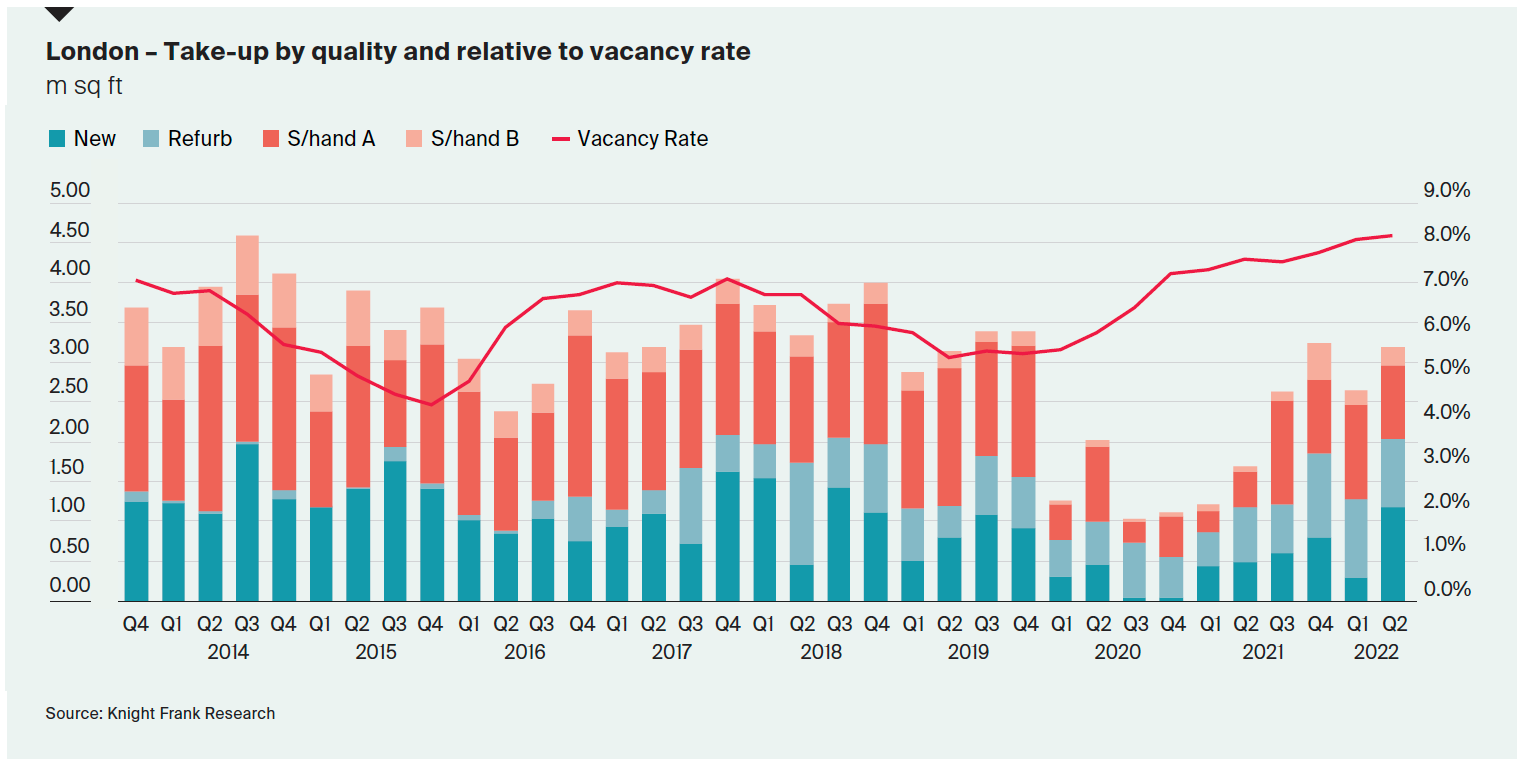

Take-up of offices across London hit 3.19 million square feet during the second quarter, a quarterly increase of 20.5% and above the long run average of 3.08m sq ft.

Two thirds of that was for new and refurbished space, up from a little below half during the previous quarter, and was driven by the completion of large deals that have been under offer for some time, according to The London Office Market Report Q2.

The vacancy rate now stands at 8.3%, which amounts to about 5m sq ft above the long run average, though excess floorspace is a greater issue in the City & Southbank compared with the West End. Take-up in the West End has risen in-line or above trend for four consecutive quarters and we have raised our assessment of current prime rents across West End submarkets.

Across London, the pipeline remains modest at 15.14m sq ft with a delivery timeframe of 2022-25. Just over 11m sq ft is space that is being built speculatively. This is 4m sq ft below the level implied by the long-term average levels of completions. In comparison to long-term average levels of take-up for new and refurbished buildings, the potential under supply of best-in-class buildings is 8.69m sq ft.

Rising yields

Transactions in London offices weakened to £3.18bn, falling from an unusually strong £5.86bn in Q1. Some of that can be attributed to a delayed seasonal slow-down usually expected in Q1, however sentiment has been impacted by rising interest costs with debt no longer accretive to income returns.

As a result, we have raised prime yields in the City & Southbank by 25bps to 4.00%. Yields in the West End and Docklands & Stratford have remained stable at 3.25% and 4.75% respectively.

Prospects for further interest rate rises and a weaker economic outlook will likely place upward pressure on yields. That should be offset to some extent by sterling’s depreciation - capital values look attractive in overseas currencies to global investors whilst the potential to hedge against inflation will intensify demand for best in-class buildings.

The rate hike calendar

June's inflation reading of 9.4%, a 40-year-high, is likely to be topped when fresh data for July is released on Wednesday. The Bank of England expects the rate of inflation to hit 13% before the end of the year.

That raises the prospect of another 50 basis point rate hike at the Bank's next meeting a month from today. More than half of economists in a new Reuters poll expect just that, which would take the base rate to 2.25%.

Most believe the Bank will begin to ease the pace of tightening from November. A large majority are expecting a 25 basis point hike at that meeting, while half expect a pause at December's meeting.

China's growth slows

Economic growth in China slowed to a crawl in July. Monthly growth of 0.38% means the economy has expanded just 3.8% over the most recent twelve months.

Regular outbreaks of Covid are understandably weighing heavily on consumer activity. Chaotic scenes of shoppers attempted to escape an Ikea store in Shanghai emerged over the weekend as authorities tried to impose a lockdown.

House prices have now declined for eleven straight months.

In other news...

Germany must cut gas use by 20% to avoid winter rationing, regulator says (FT).