Will a base rate of 3% cause the UK housing market to reverse?

How will continued rate rises impact the housing market and mortgage affordability in the short and long-term?

5 minutes to read

Last updated: 5th August 2022

Four Bank of England (BoE) Monetary Policy Committee (MPC) meetings lie ahead in 2022, with the next announcement on August 4. The current Hawkish tones suggest to me that rates are likely to end 2022 around 2.25%, up from the current 1.75%. This will be conducive to a moderation in the housing market but not a correction.

The rate of 1.75% is the highest since the global financial crisis with the market implied expectations now of 3% by the end of 2022, forecasters such as Oxford Economics and Capital Economics (CE) expect lower at 2% and 2.5%, respectively, with CE forecasting 3% next year. The BoE’s market implied path for rates puts it at 2% this year, rising to 2.75% in 2023.

There has been a 50bps hike in August taking the rate to 1.75%. One big reason for this is the exchange rate. In 2022, so far, the pound has tumbled around 9% against the US dollar, meaning imports are becoming more expensive which could add to inflationary pressure – something the BoE wants to limit. The Federal Reserve implementing a 75bps rise in June added to this and the possibility of at least one more of this size, maybe two, will make the hawks louder.

What this means for housing markets is up for debate, some, such as Capital Economics, forecast price corrections where we believe there will be a softening in price growth.

Here we explore five ways the housing market could be impacted by rising interest rates.

1. In the short-term there will be limited impact due to those who have fixed in a rate in the past year or so, through re-mortgaging or acquiring a new mortgage

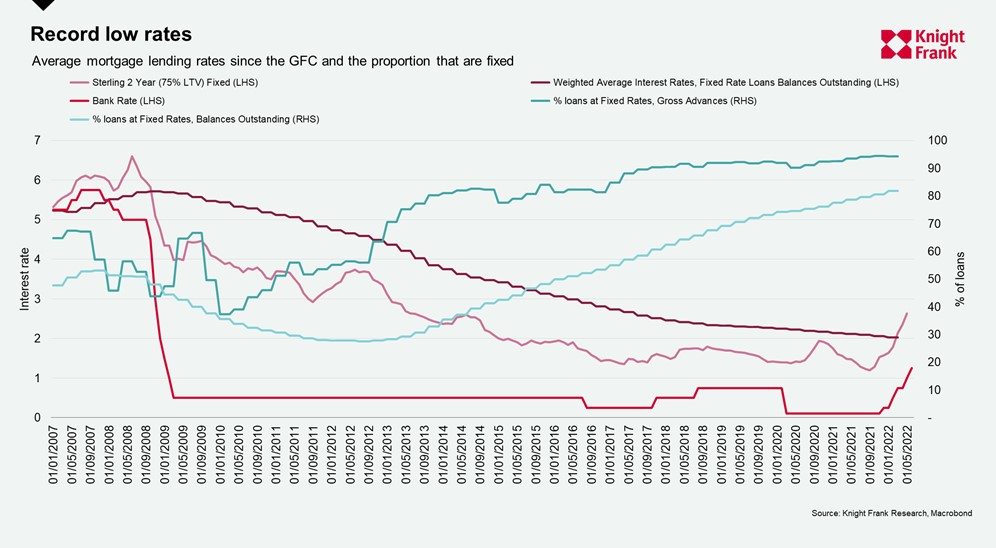

More than 90% of borrowers have been locking in rates since 2017, according to statistics from the Mortgage Lenders & Administrators. Cumulatively, this means that almost 82% of outstanding mortgages are now on a fixed rate, up from less than 30% in 2013, and the average interest rate for these has fallen to a new low of 2%. Many borrowers will be unaffected in the near-term.

2. Those existing borrowers can move with their mortgage and other new borrowers may have locked in rates already

There is still underlying demand in housing markets, perhaps those who have been waiting to see what their work patterns are like post-Covid. First-time buyers or those looking for second homes, without existing mortgages, may have already locked in rates which can be valid for up to nine months, according to Knight Frank Finance. Existing homeowners, those who have re-mortgaged or on existing rates (see above) can ‘port’ to a new property, i.e. transfer their mortgage, and therefore avoid a higher rate. Estimates say that previously around 20% of home movers ‘ported’ their mortgage but we may see an increase.

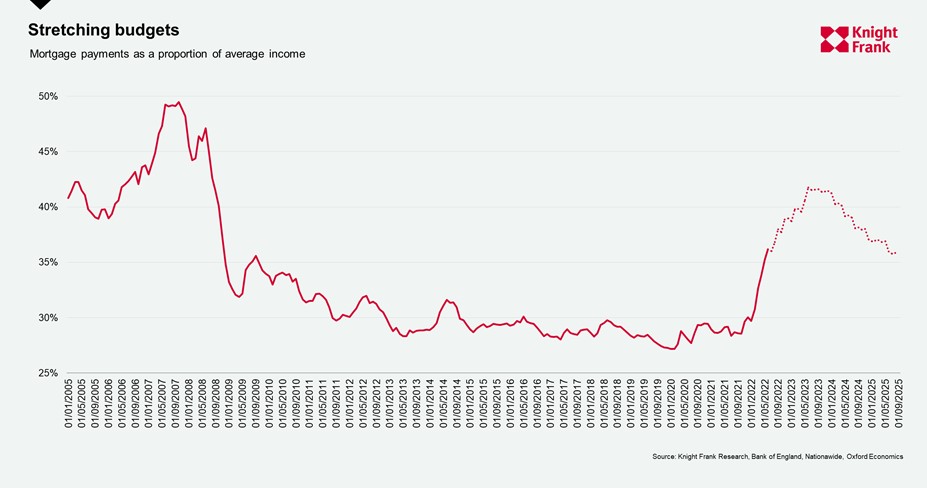

3. Stretching affordability could weigh on housing demand in the medium-term

Payments have increased by an average £230 a month, or 32%, since September 2021 when we factor in rate and house prices changes, using Nationwide averages. For a 75% loan-to-value (LTV) two-year mortgage, average rates raised by 168bps from 1.2% in September to 2.88% as of June – the base rate has moved 115bps by comparison. That pushes mortgage repayments to 36% of average income, from a low of 27% in early 2020.

If rates do continue in the expected path and reach 3% it is reasonable to expect, with our current forecasts and wage forecasts from Oxford Economics, that this proportion of mortgage repayments to average income will rise to 42% – a level not seen since the end of 2008. However, as rates are likely to peak there (or even fall in medium term, see point 4 below) we will see much lower than the 49% seen prior to the financial crisis.

On the downside, affordability is stretched further by rising energy bills, food prices and other expenditures. On the upside, wages are rising and may exceed expectations.

4. Affordability may start to weigh on new mortgage demand

Mortgage approvals have started to soften indicating that demand is cooling but not drastically. New approvals in April and May were 66,100 and 66,200, respectively from 69,500 in March. Whilst slightly below the 12-month pre-pandemic average of 66,700, this does not show a dramatic slowdown but is one indicator to watch.

5. The market expect that rates will reverse course in the medium term due to slowdown in growth

The five-year swap rate, a leading indicator for the path of mortgage rates, has risen steadily from a low in November 2020 of 1.18% to a recent high of 3.17%. However, given the increasingly muted musings and impending recession headlines, they have since receded to 2.7%. The pattern has been the same across most maturities. This ties in with higher rates in the short term but indicating there may be a cap of 3% of the policy rate which will then fall back, the BoE market implied rate path puts this happening in late 2023.

Our chart above illustrates that this will push mortgage payments as a proportion of average income back down to around 35%. Whilst still above the level seen in the last decade, this is low historically. If energy bills decline the picture looks one of easing budgets.

In short, there will be a softening in the market, but as Tom Bill, Knight Frank’s head of UK residential research highlights this is more a process of normalisation in the UK housing market. Owing to rising rates and perhaps the belief that the market may be peaking, supply has begun building which will begin to alleviate some of the price growth pressure.

The outlook is consistent with our forecasts that price growth will soften, not fall off a cliff or be subject to sizeable correction, as the market returns to a more normal pattern – taking note that the last two years has been an exceptional period. Rates will continue rising in the near-term, yet with economic clouds looming if inflation, the BoE’s primary concern, comes under control we could see a decline and therefore lower rates come into focus once more.