Leading Indicators | Swap Rates | Manufacturing Activity | Property Returns

Discover key economic and financial metrics, and what to look out for in the week ahead.

2 minutes to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

Markets react to moderating US rate hike expectations.

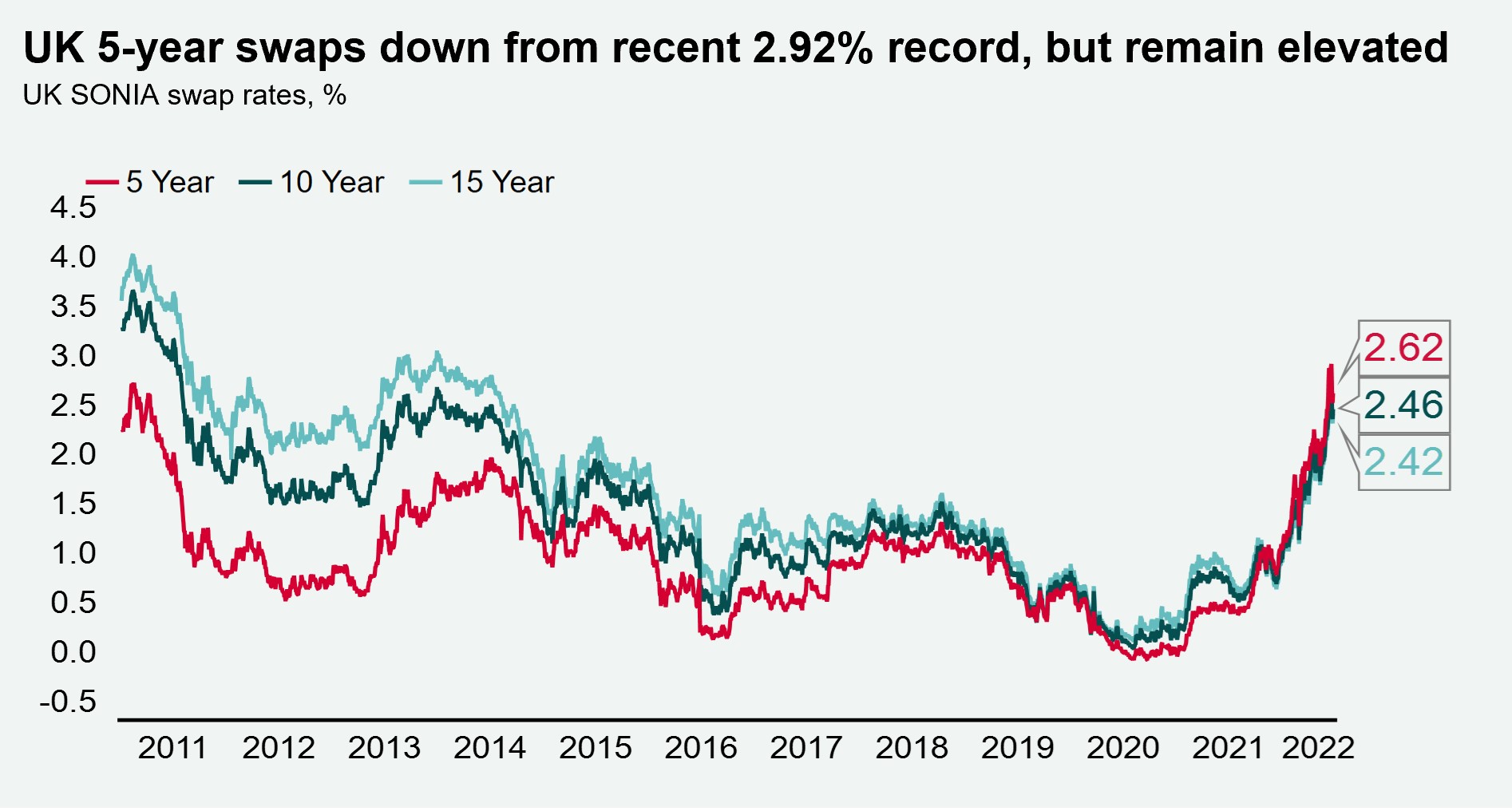

Money markets now expect the US interest rate to rise to 3.5% by 2023, down from 3.8% in the week prior. Swap rates have since fallen from recent peaks and stock markets were able to recoup some of their losses. Some Bank of England members have noted that if the central bank continues to lag behind the Fed’s pace of rate hikes, sterling could depreciate further. Weaker sterling could make UK commercial real estate more attractive to dollar denominated investors.

Lower manufacturing output to alleviate inflation pressures?

Flash PMIs point to a slowdown in global manufacturing activity in June. PMIs have fallen to a 23-month low of 53.4 in the UK, 52.4 in the US and 52.0 in Europe. While this may support evidence of a wider global economic slowdown, PMIs for the UK, US and Europe all remain in expansionary territory (above 50). Additionally, the US and UK manufacturing sectors have reported slowing demand, which could help alleviate longer term inflationary pressure.

UK CRE rides uncertainty wave

Currently, the world is contending with higher inflation, a downgraded economic outlook, supply chain pressures and the Russia / Ukraine conflict. In times of volatility and high uncertainty, investors typically move away from riskier assets such as equities. Over the last 12 months, the FTSE 250 and UK government bond total returns are -19.3% and -25.2%, respectively, whereas the All UK property total return was +25.3% in the 12 months to May. Here, investors seeking an income producing asset with strong return profiles could turn to property as a relative safe haven asset, in an uncertain world.

Download the latest dashboard