UK Logistics Market Outlook 2022: Investors Look To Income To Drive Returns

UK funds continue to up their allocations, with 39.7% of the UK All Balanced Property fund index invested in the sector in Q4 2021, compared with 33.2% in Q4 2020 and just 16.4% nine years ago (MSCI/AREF).

The outlook for rental growth is positive, and rental growth for industrial is expected to outpace those in the retail and office sectors over the next five years.

3 minutes to read

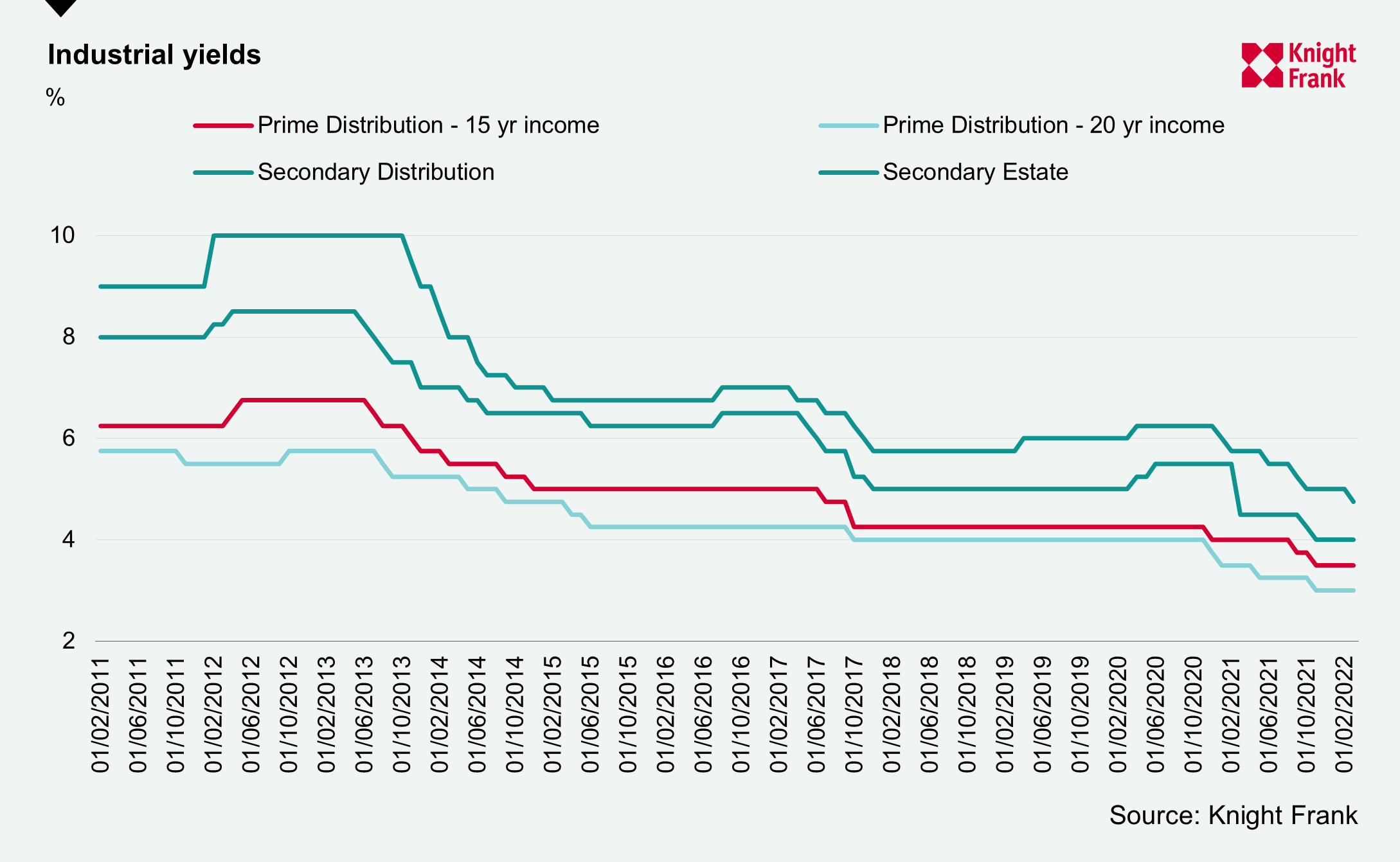

How low can they go?

Prospects for generating returns from yield compression are diminishing.

There has been a structural driven yield compression witnessed in the sector over the past ten years. A confluence of macro trends, which include the growth of e-commerce, globalisation of trade, technological advancements and the drive for supply-chain optimisation has led to a structural increase in demand for logistics along with higher levels of capital expenditure and improvements in terms of the quality of the underlying assets.

Prime distribution assets offering 15-year income with open market rent reviews are yielding 3.50-3.75%, down from 4.00% a year ago. Yields for prime distribution providing 20-year income (with fixed uplifts or indexation) are now just 3.00%, down from 3.50% a year ago.

Competition for secondary assets has led to yields narrowing over the past year, secondary distribution yields are now 4.00% having recorded 50bps compression over the past year and secondary estates have come in 75bps to 5.00%.

Yields for prime warehouse and logistics properties are expected to remain broadly flat over the next few years. UK gilt yields (10-year government bonds), on the other hand, are on the rise, they are currently around 1.5%, up from 1.0% at the end of 2021, and forecast to reach 2% by the end of 2023 (Source: Oxford Economics). However, a protracted Russian war could lead to bond yields rising faster.

The spread between prime logistics yields (15-yr income) and bond yields has narrowed from 356bps at the end of 2020 to 218bps (end of February) and is likely to narrow further as bond yields rise. Despite this narrowing risk premium, the appeal of logistics property will continue to be driven by strong sector fundamentals.

Investors buy in to the rental growth story

Despite ongoing geopolitical turbulence impacting near-term horizons, the sector’s strong occupier market fundamentals are anticipated to persist and it is these market dynamics and the continued structural shift towards higher levels of online spend, that are underpinning investors’ rental growth expectations.

The outlook for rental growth is positive, and rental growth for industrial is expected to outpace those in the retail and office sectors over the next five years. Industrial rents are expected to rise an average of 4.2% per annum over the next five years, compared with 1.7% per annum for offices and 0.6% per annum for retail.

Investors want to increase their exposure to the sector. UK funds continue to up their allocations, with 39.7% of the UK All Balanced Property fund index invested in the sector in Q4 2021, compared with 33.2% in Q4 2020 and just 16.4% nine years ago (MSCI/AREF). UK logistics property funds have been, and continue to trade at a premium to NAV (net asset value) and recent equity issuances have been oversubscribed. With more capital targeting the sector, competition for assets is strong.

Alongside the UK funds, US private equity firms are also increasing their exposure to the UK logistics market, with a series of notable investments recorded over the past few years. Investors with experience in the US market can see the potential for further rental growth in the UK. The US market has demonstrated exceptionally strong rental growth over the past couple of years, with some markets recording in excess of 20% growth – outpacing recent growth in the UK markets. Supply constraints, limited land availability, and robust occupier market fundamentals provide conviction that there is further rental growth to come in the UK and that this will drive future returns.