Digital nomads, housing delivery and the $75 trillion asset bubble

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

Housing delivery

Anna Ward checks in on the rate of housebuilding using Energy Performance Certificates awarded to new homes, a good leading indicator of housing delivery.

Pre-pandemic, net additions stood at over 240,000 for the previous two years, matched closely by the number of EPC registrations. In 2020/21 the number of EPCs awarded dropped to 220,726, broadly in line with the net additions total for that year of 216,489.

In total, a little more than 195,000 new EPCs have been granted to new homes since the start of the 2021/22 financial year up until the end of January, suggesting the total is likely to come in broadly on par with last year. How long it will take to return to pre-pandemic totals remains unclear - housebuilders face a number of headwinds, from the wind down of the SDLT holiday and the phasing out of Help to Buy to the sharp increases in build costs, which are going to take some time to unwind.

As Anna notes, while recent housing output rates appear healthy, the next couple of months will be a key test for the market as it enters a more challenging period.

Green buildings

We've talked before about some of the pitfalls with using EPCs to measure energy efficiency.

Linking policy to EPCs has various flaws, including the fact that replacing a gas boiler with a heat pump can have a detrimental impact on the rating of a building due to the fact that heat pumps can increase energy usage. EPCs measure energy consumption rather than carbon emissions.

The government has a Net Zero Scrutiny group working to iron out these kinks and the government is now planning an overhaul of the system, today's Telegraph reports - there is little detail beyond that.

Separately, today's Times covers research from investment bank RBC which puts the total bill for upgrading buildings to meet future EPC targets at £100 billion.

Digital nomads

Foreign nationals working for non-Spanish companies will be allowed to live and work in Spain without needing to apply for a full work visa. The visa will permit non-residents to stay between six and 12 months without the right to residency with the potential for two further extensions.

The initiative follows in the footsteps of similar digital nomad visas introduced in Barbados and Dubai since the start of the pandemic. Their goal is to capture a new cohort of footloose remote workers no longer tethered to offices.

For British residents that have had their wings clipped since Brexit and can only stay in the EU for 90 out of every 180-day period, the Spanish government’s proposal is likely to be a welcome one. Applicants will need to meet some requirements including the need to make 80% of their income from companies based outside of Spain.

The $75 trillion bubble

This week's MoneyWeek podcast with Sandy Nairn, Chairman of the Templeton Global Equity Group is worth your time. Transcript here.

Nairn has a book out - The End of the Everything Bubble - in which he argues a relatively small shift in sentiment could knock $75trn off the value of global asset prices that have been heavily inflated by quantitative easing. For current levels of pricing to be sustained, never-seen-before levels of GDP growth would be required, supported by huge productivity gains - neither of which look likely.

In other news...

In this week's retail note, Stephen Springham analyses Tesco’s decision to axe Jack’s as a standalone format and seemingly withdraw from the discount market.

In a new Rural Market Update, Andrew Shirley tackles Levelling Up.

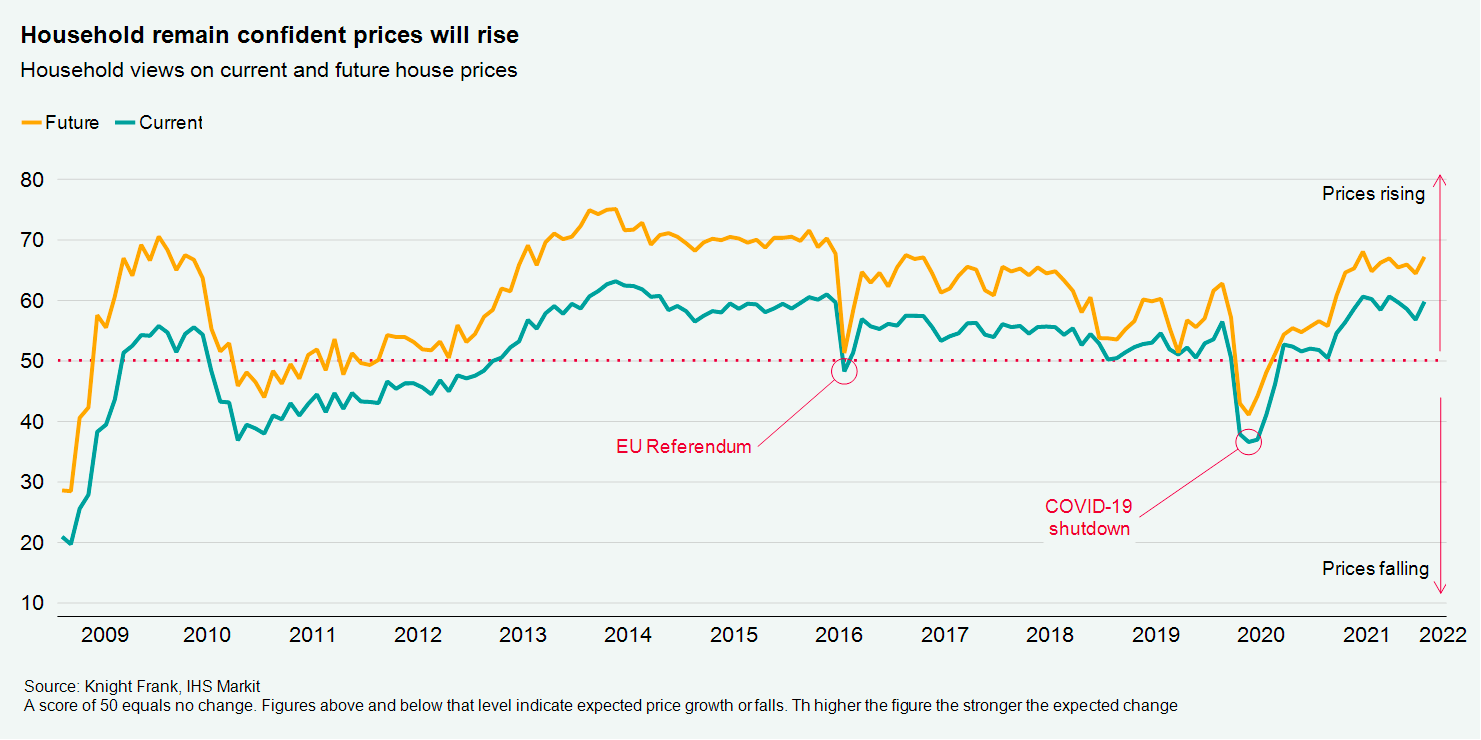

Sentiment watch: UK households grew more confident about current and future house price growth in January.

Elsewhere - a blockbuster jobs report in the US (Reuters), stamp duty receipts hit a record high (FT), Shaftesbury says West End is on cusp of period of uninterrupted growth (FT), workers get a taste for the four-day week (Times), ECB could hike rates as soon as October (Bloomberg), and finally, Sadiq Khan calls for a property register (Bloomberg).