Moderating price growth, Biden’s mixed signals and Asia’s stock shortage

Your international property and economics update tracking, analysing and forecasting trends from around the world.

3 minutes to read

House prices

This year has been full of surprises. A year ago, although many analysts were bullish, few predicted the sheer ferocity of the rally that pushed up global house prices.

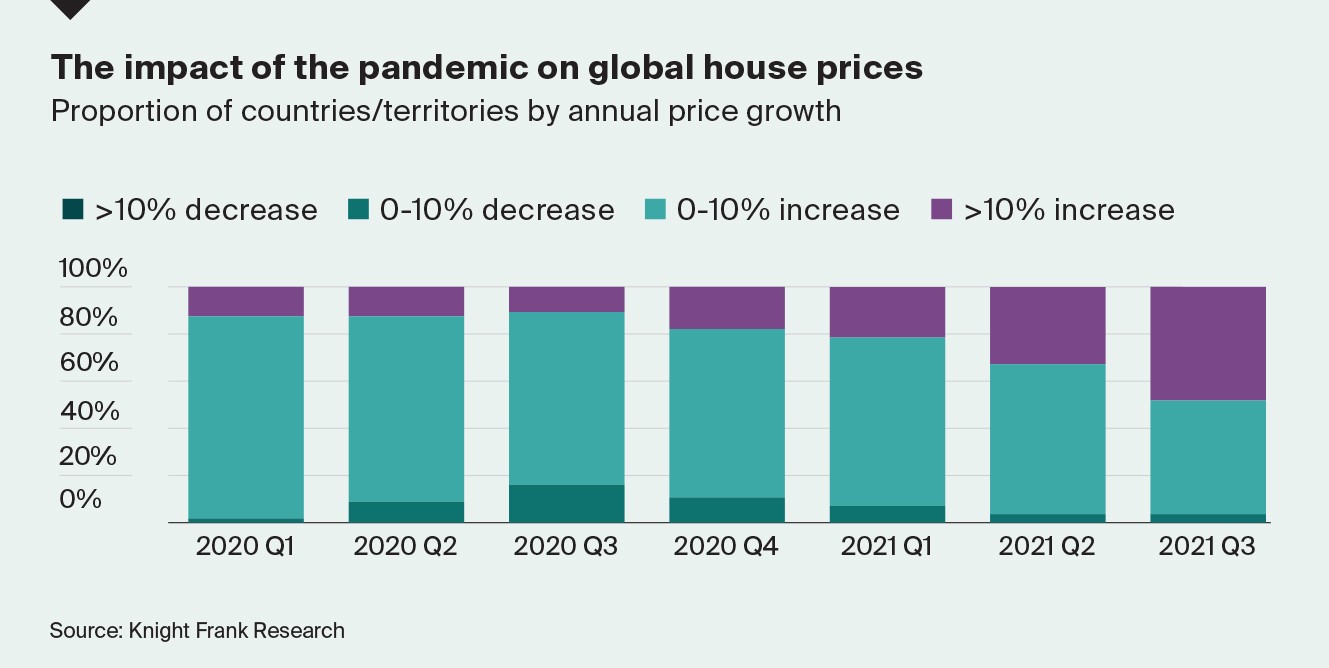

Out this week, our Global House Price Index which tracks mainstream prices across 56 countries and territories confirms the extent of that rally. Almost 50% of markets saw average prices increase by 10% or more in the year to September 2021.

Headwinds

Despite the boom, there are signs some markets are starting to cool. Eighteen countries and territories saw their rate of annual price growth decline between June and September this year, including some of the strongest performers since the start of the pandemic such as the US and New Zealand.

The less positive economic outlook and rising downside risks could hasten the slowdown in prices. The omicron variant, inflationary pressures, the withdraw of stimulus and mounting geopolitical tensions have the capacity to destabilise markets and weaken buyer sentiment.

Housing demand since the start of the pandemic has been primarily domestic in nature. International travel and as a result cross-border transaction were starting to find their feet in Q4 but omicron’s arrival brings with it renewed uncertainty.

On the flip side, new data reveals household wealth increased 8% in the UK and 21% in the US in 2020 and, as we highlighted in our Global Prime Residential Forecast, this level of wealth is looking to property as a hedge against inflation.

Biden’s Build Back Better

Biden has been busy. After a relatively quiet 2021 in terms of US real estate announcements, Q4 has seen a flurry of activity. The new Build Back Better (BBB) Act which passed last month means creaky US infrastructure will get a revamp spurring on further investment. As highlighted in the New York Market Insight, the city is expected to benefit from a new Second Avenue subway and a rail tunnel linking New York and New Jersey.

The BBB Act may yet prove a boon for US millionaires. Largely overlooked, the Act made changes to the State and Local Tax deduction (SALT), a mechanism that allows taxpayers to deduct property and state income taxes when filing tax returns. According to The Economist, days before the BBB Act’s passage, a group of Democrats from high tax yielding states secured an increase in the limit on deductible expenses from $10,000 to $80,000 for the next ten years.

Another week, another announcement, this time the White House has turned its attention to transparency. The Biden Administration is proposing that tighter reporting rules for cash purchases above $300,000 that currently exist in 12 metropolitan areas should be rolled out nationwide.

Asia Pacific

Despite inflationary pressures and the ever-present threat of new Covid-19 strains, our new Asia Pacific Outlook produced by my colleague Christine Li, confirms that 2022 is expected to be a year of reopening and recovery for the Asia Pacific region.

The lack of stock in the mainstream markets is not going to be alleviated in next 12 months, and the continued low interest rate environments will boost sale and rental activity. Appetite for home purchases will also see improvements from foreign buyers, as more travel restrictions are being lifted across APAC despite the new variant.

With capital values up 25.3% and 20.1% respectively in the first nine months of 2021, Australia and South Korea are the most likely markets to see policy intervention in the region as governments look to curb price inflation.

In other news

In Dubai residential prices are rising at their fastest rate since 2014, Aspen’s appeal as a co-primary destination is soaring, prime properties in Australia with a harbour frontage generate a premium of 114% and we take a deep dive into how buyers’ attitudes have changed in Africa since the start of the pandemic.

Finally, a reminder that you can find the research team’s latest thinking on a range of topics, UK and global, on our house view page.