Shell’s UK HQ move typifies surge in corporate demand

The decision by the Dutch oil company to relocate its headquarters to the UK comes as corporate demand in the rental market reaches pre-Covid levels for the first time.

3 minutes to read

The path to normality after the global pandemic will feature a series of milestones.

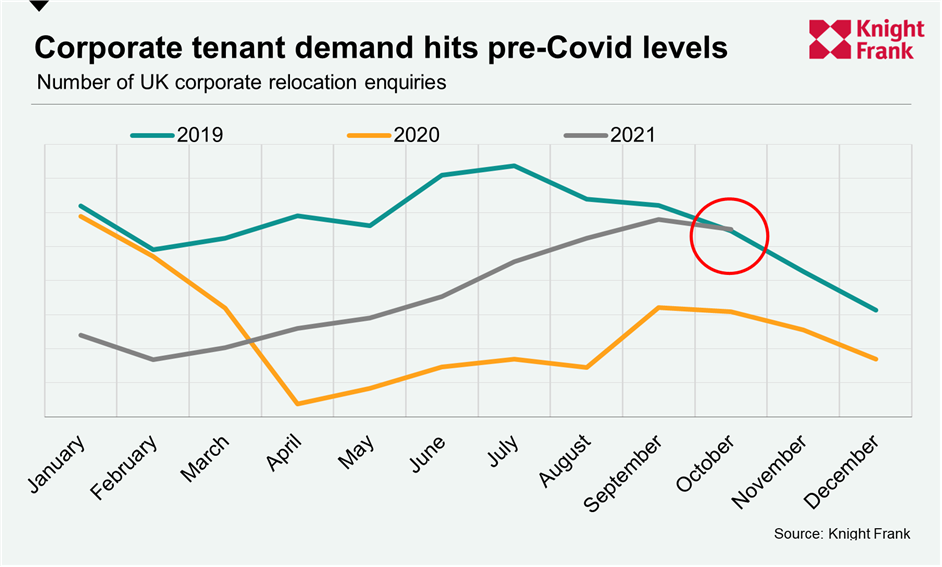

Here’s one from the residential property sector: October was the month that demand from companies looking to relocate staff to the UK returned to pre-Covid levels.

The relaxation of international travel rules at the beginning of last month helped but, as the chart shows, demand had been steadily building for months.

Successive lockdowns over the last 18 months severely reduced the number of staff relocating to the UK. However, the rapid vaccine roll-out, improving economic outlook and receding prospect of further lockdowns changed the calculations for many companies in the spring.

Last week’s strong UK employment data showed the economy was shrugging off the end of the furlough scheme, something we didn’t believe was likely to materially impact the property market in any event. It meant a further milestone was likely this year in the shape of an interest rate rise.

The announcement by oil company Shell last week that it is planning to move its HQ to the UK will only add to the growing demand for property in London and the Home Counties.

“My sense is that a lot of pent-up demand has now flowed through the system,” said John Humphris, head of relocation and corporate services at Knight Frank. “What we are dealing with now are new hires and business decisions taken since the summer.”

We have previously explored the supply shortages facing corporate tenants and the fact they are often beaten to the punch by students due to the fact that their decision-making processes are slower.

Tight supply is likely to remain an issue for companies, according to Sacha Hawkins, head of the relocation agent team and diplomatic desk at Knight Frank.

“In April we had options for 66% of our searches but that figure has fallen to 29% in November,” said Sacha. “It is especially tight below £1,000 per week. It means searches take longer and companies have to look further from central London. About 60% of searches are now in north and east London compared to a normal level of under 40%.”

Companies come from a range of sectors including financial services and energy but the tech sector still accounts for the highest proportion of demand. “Tech companies are still dominating as they did throughout the pandemic. When everyone else paused they carried on,” said Sacha.

Despite the imbalance between supply and demand, the availability of higher-value lettings properties has increased marginally. It is the result of more owners switching from the sales to the rental market after being unable to achieve their asking price, as trend we explored here.

What does all of this mean for current and prospective landlords?

The first thing to expect is another wave of demand from students in January due to the fact universities have staggered their return to face-to-face learning.

The second reasonable assumption to make is that rental values agreed in the depths of the pandemic are probably too low today. Supply has shrunk dramatically in some areas as the flood of short-let properties onto the long-let market has dried up as staycation rules were relaxed.

At the same time, demand has surged.

Average quarterly rental value growth in prime central London was 4.2% in the three months to October. It is the highest figure since March 2011, a time when the rental market was shaking off the effects of the global financial crisis.

As we shake off the pandemic, landlords and tenants in London and the Home Counties need to be aware how quickly things are moving.