Buoyant Scottish market, experiential crisis response and ski property prices surge

Here we round up some of latest comments, opinions and insights from the industry-leading experts from the commercial and residential research teams, so you have all you need for the week ahead.

2 minutes to read

Dive into the latest dashboards, research reports and survey analysis from our commercial and residential research teams.

Your residential round up

Scotland indices show big improvements

Price growth in the Edinburgh property market looks set to maintain its momentum against the backdrop of high demand and limited supply.

Research from Chris Druce, senior research analyst at Knight Frank, reveals that Edinburgh has continued to benefit as an option for people looking for an alternative to London and other big cities, due to its scale and ease of access to the coast and countryside.

He also analyses how annual price growth is at a decade-long high in Scotland’s Country market.

London has become a landlord's market

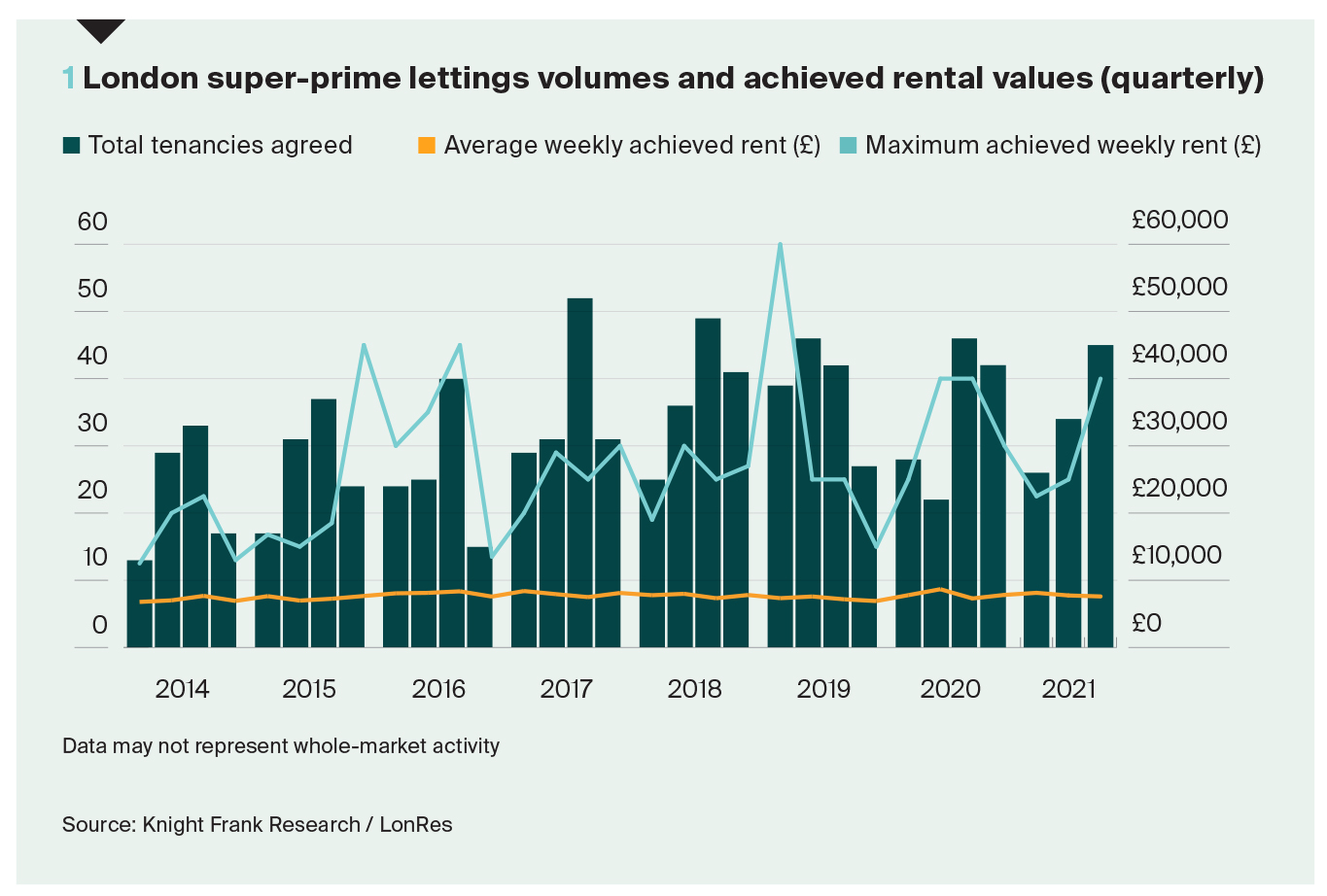

Tight supply means pre-lets are now a feature of London’s super-prime lettings market.

Tom Bill, head of UK residential research and Knight Frank, says that the forces shaping the super-prime lettings market (£5,000-plus/week) in the capital are similar to those facing the wider market.

Demand has accelerated while supply has fallen sharply.

St Moritz property price growth soars

Knight Frank’s annual Ski Property Report, launched today, reveals that Swiss resort, St Moritz recorded strongest price growth in 2021 with property prices increasing by 17% according to the firm’s Ski Property Index.

Swiss resorts lead the Ski Property Index for the first time in three years, as well as stock shortages and strong domestic demand; the pandemic also shone a spotlight on the advantage of Swiss Independence.

Kate Everett Allen, head of international residential research, explores this in further detail.

Your commercial catch up

Leisure: responding to an experiential crisis

This week’s Retail Note analyses the latest CGA data in parallel to Knight Frank’s new Leisure Research Report, which provides a comprehensive review of all aspects of the market, from F&B through to ‘big box’ leisure formats.

Stephen Springham, head of retail research, looks at the data from hospitality industry body CGA which shows very polarized, if not contradictory messages. Polarities and contradictions wholly reflected in Knight Frank’s latest major research report: Leisure: responding to an experiential crisis.

Leading Indicators

Will Matthews, head of UK commercial research at Knight Frank, looks at gas prices beginning to retreat, the UK labour market strengthening and takes a look at how UK economic output is faring.

Get in-depth analysis from the latest Leading Indicators dashboard, updated weekly.

Healthcare Development Opportunities 2021

Ryan Richards, senior research analyst at Knight Frank, has published the 2021 Healthcare Development Opportunities report.

Despite the pandemic taking its toll on the sector in 2020, new build activity remains buoyant as developers and investors endeavour to meet future demand.

Don't forget to sign up to the latest Knight Frank research for exclusive market news and opinions from our expert research teams.