Saudi Vision 2030 results in close to US$1 trillion of real estate and infrastructure projects

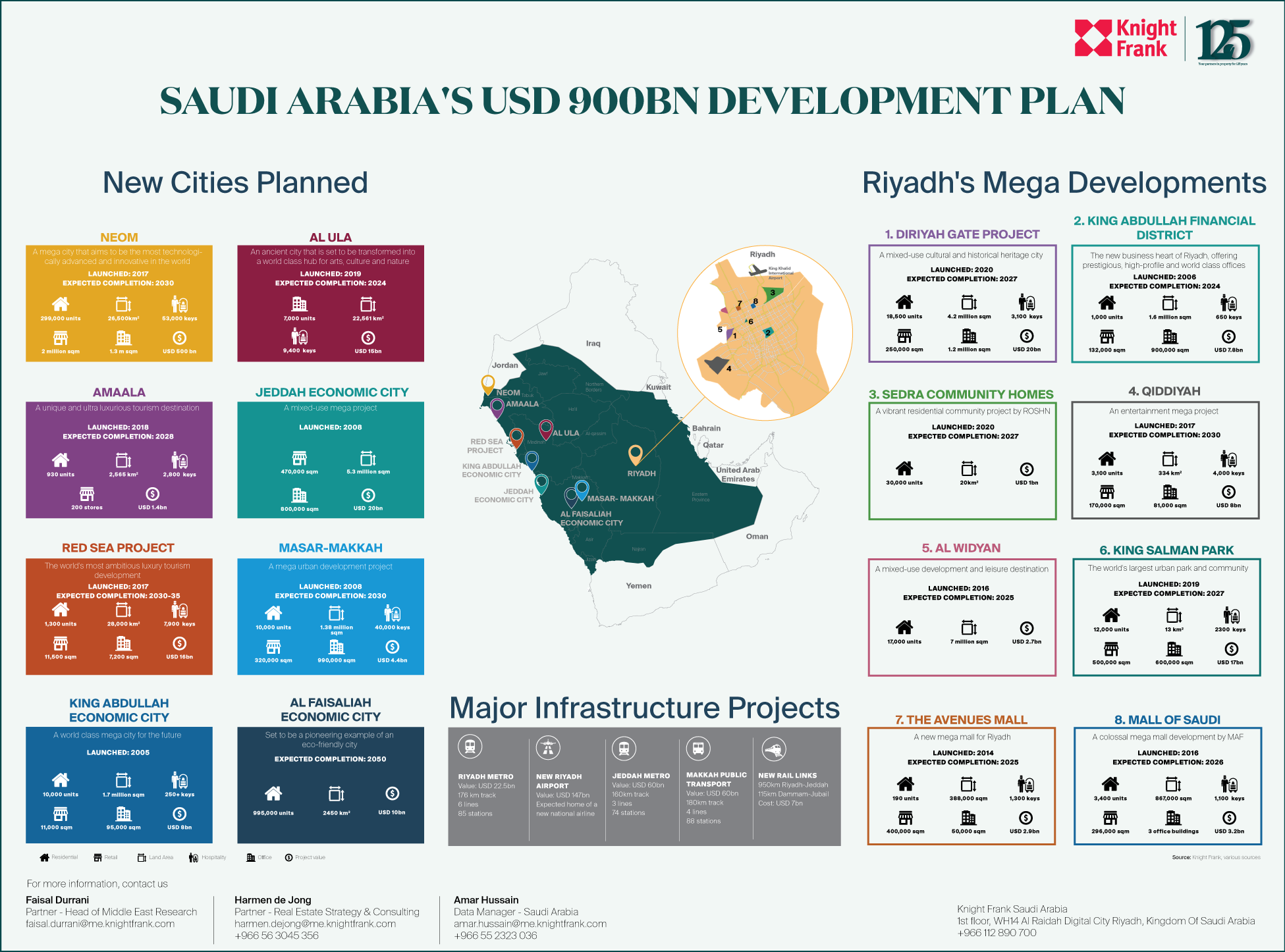

Saudi Arabia’s Vision 2030 has resulted in close to US$1 trillion of real estate and infrastructure projects being announced across Saudi Arabia since 2016.

3 minutes to read

Faisal Durrani, Partner – Head of Middle East Research at Knight Frank explained: “Saudi Arabia is a country being reborn. The ambition that underpins Vision 2030 is being borne out in reality and we are rapidly closing in on US$ 1 trillion of developments, all of which are colossal. And this is only about a third of the total spend planned.

“The number and value of mega projects around the country set to transform the country’s real estate landscape, standard of living, lifestyle offering and perhaps most importantly, showcase the Kingdom’s vision for an ultra-modern future to a global audience.”

According to Knight Frank, nearly US$ 300bn of the total spend is dedicated to new infrastructure, including vast new passenger rail networks and a brand-new airport for Riyadh (US$ 147 billion), which is expected to be the home base for a new national airline.

Durrani continued, “The scale of infrastructure improvements in the country is phenomenal. The aggressive targets laid out by the government around attracting 100 million annual visitors to the country by 2030 means both adequate and first-class gateways need to be created. And we’re already seeing the first of these trickling through. Take for instance the new cruise terminal at Jeddah Islamic Port – the first cruise routes are already in operation. And these developments are not vanity projects; they are going to have a significant impact on economic growth”.

The cruise industry itself is set to create up to 50,000 jobs nationally, according to the Public Investment Fund and 1.5 million cruise visitors are expected annually by 2028.

On the real estate front, Knight Frank highlights 8 new cities that are planned, mostly on the country’s western seaboard, along the Red Sea coast, where nearly USD 575 billion is being spent to deliver over 1.3 million new homes, more than 3 million sqm of world-class offices and over 100,000 hotel rooms.

NEOM alone will cost an estimated US$ 500 billion and is being positioned as a new vision for future cities. This new metropolis will not be another smart city, but one that sees cutting edge technology being used to create one of the most innovative and sustainable places in the world.

Meanwhile, Riyadh is poised to become entrenched as the commercial nerve centre for the Kingdom, with more than 100,000 new homes expected by the end of 2023 and close to 3 million sqm of new office space in the works, along with over 12,000 hotel rooms, spread across mega projects worth an estimated US$ 63 billion.

“Delivering these monumental projects at such speed is incredible, but clearly comes with its own challenges and opportunities. Regulations that govern the sale and lease of all property asset classes need to be carefully looked at if the Kingdom is to deliver a globally attractive investment landscape. Therein lies Saudi Arabia’s biggest opportunity: to create a regulatory framework that appeals to global blue-chip institutional investors. The investment grade assets are coming, now we just need the global capital to sit up and take note”, Durrani added.

Harmen de Jong, Partner – Real Estate Strategy and Consulting, Knight Frank, concluded: “Most private sector real estate developers were sitting on the fence during the first few years following the announcement of Vision 2030, however we have seen inquiries for development consultancy and development management services increase significantly over the last 6 to 12 months.

“While this can be partially explained by the confidence injected into the real estate sector by the government’s efficiently response to the pandemic and management of the subsequent economic, the private sector has also now got much more clarity around how the plans for Vision 2030 are to be rolled out, as momentum builds around delivering the new vision for Saudi Arabia. As a result, we have seen heightened activity in real estate development concepts involving hospitality, retail and entertainment. This trend is being further supported by the ease of access to cheap credit provided by government-backed finance agencies such as the Tourism Development Fund”.

For more information, please contact Faisal Durrani