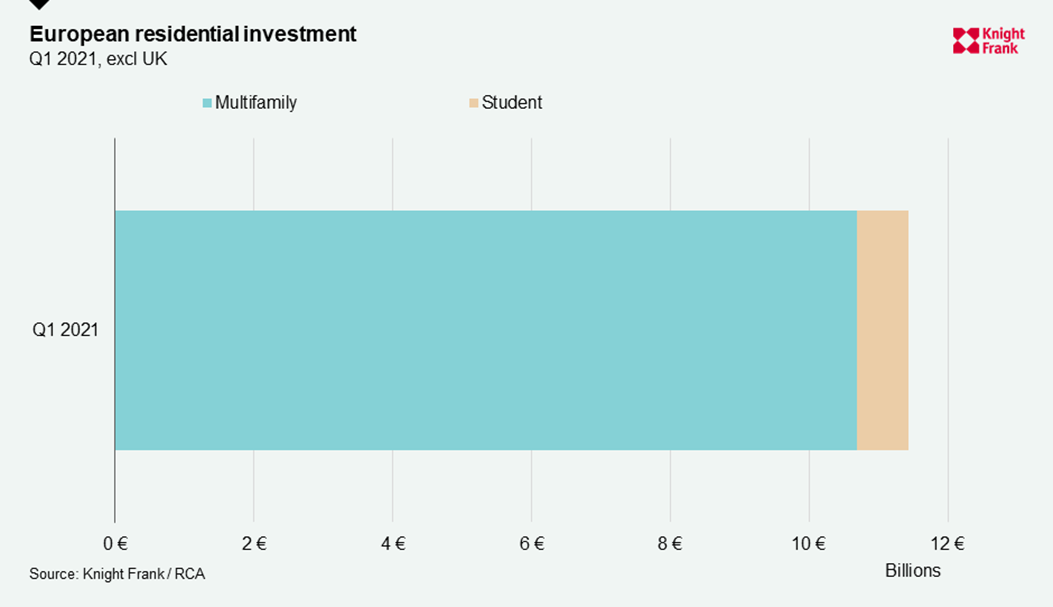

European residential investment volumes top €11bn in Q1 2021

Robust performance throughout the pandemic has underpinned investor confidence in residential assets.

2 minutes to read

Residential investment in continental Europe topped €11.4 billion in the first three months of 2021. This was a 23% increase on the first quarter of 2020. Multifamily accounted for the bulk of total investment between January and March at €10.67 billion, with the remaining €742m committed to student housing.

Strengthening investment volumes within the residential sector across continental Europe has come against a backdrop of yield compression in a number of core commercial property markets. In this environment, residential sectors offer both diversification and long-term income-driven benefits.

Robust investor demand for residential assets is supported by ongoing structural shifts in both demographics and lifestyles. Urban populations across Europe are growing and student numbers are rising, yet the supply of appropriate rental housing in many locations remains inadequate. The impact of a pause in construction in the early part of 2020 will be to exacerbate these supply shortages.

Meanwhile, data continues to suggest that the residential sector, and multifamily in particular, has weathered the impact of the pandemic well, with rent collection and occupancy rates higher compared with other managed real estate assets.

Furthermore, both undergraduate numbers and demand for rental housing tend to rise during periods of uncertainty as weaker employment markets encourage people to upskill, and lending criteria for house purchases becomes tighter. This will underpin transactional activity later this year, as well as driving new entrants to the market.

That’s not to say there aren’t challenges. Rising unemployment and jitters about the macroeconomic outlook will dampen rental growth prospects in the private rented sector, but the need for housing across tenures in major European cities has not decreased. In the student sector, disruption to this year’s academic cycle has had an impact on the operational side of the market, but the average provision rate (the number of beds relative to students) across major cities in continental Europe still only stands at around 20%.

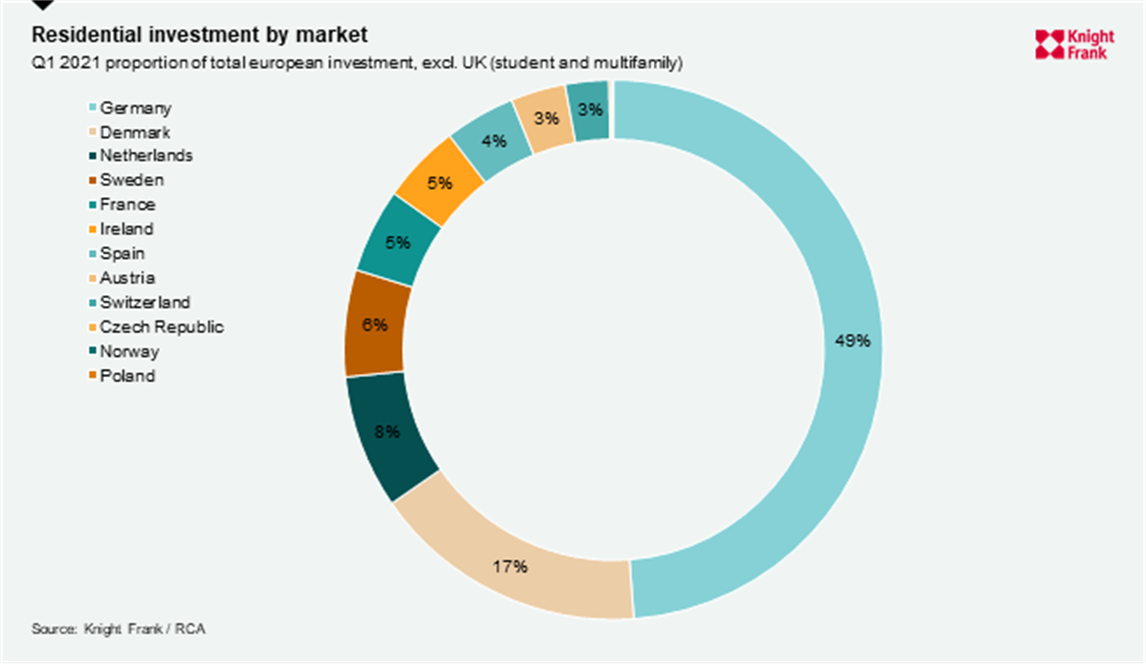

Germany attracted the largest portion of investment over the course of the first quarter, accounting for 48.8% of total capital committed. This was followed by Denmark at 16.6%, the Netherlands at 8% and Sweden at 6.4%.

Deals that completed over the course of the quarter included the acquisition of a 743-bed student accommodation development in Barcelona by Commerz Real, DWS’s forward fund of 1,000 BTR homes in Getafe for €240 million and the acquisition of Marina Village in Ireland by RealIS.

Stuart Osborn, Head of European Residential Capital Markets at Knight Frank, said: “Investors have started the year with a bang, with lack of built product continuing to drive demand and BTR funding continuing to shape the future landscape.”

“As we look ahead to a new academic year investor sentiment for student housing has been buoyed by positive data on student numbers for next year in addition to growing fund allocations to residential investment sectors, the asset class also provides sought after income producing product in many markets where there is a lack of residential income producing stock.”

Photo by Jonas Tebbe on Unsplash