Rethinking residential

In the wake of the Covid-19 pandemic, developers must be ready to adapt to a growing desire among residents for flexible living space that supports their physical and mental wellbeing as well as meeting the practical needs of everyday life.

6 minutes to read

- What people want from their homes has undergone a significant shift

- London will continue to act as a magnet for university leavers looking for jobs

- The right type of housing, in the right locations, will be key for developers and operators looking to capitalise on these new trends

The pandemic has accelerated existing trends

The past 12 months has been disruptive for residential real estate markets globally. As the Covid-19 pandemic impacts every part of our lives, existing trends in living and working which we have watched slowly gain traction over years have accelerated, and are leading to long-term change, new thinking and behaviours.

Technology, health and wellbeing are topics which have leapt to the forefront of both residents’ minds and developers’ plans, with mounting evidence suggesting that what people want from where they live has undergone a significant shift.

To better understand the impact we spoke with more than 160 leading global developers. The results emphasised a need to temper the urge to radically reshape development designs and to focus instead on those trends highlighted by the lockdowns.

An increase in home working, for example, means that 2021 will see a renewed focus on digital connectivity as well as on the provision of usable workspace within the home; change that is arguably already under way.

Fast-forward on digital connectivity

With surveys reporting that some people want to continue working from home, or at least have the choice to work remotely when possible, space for home working will be a focus in future developments, offering both flexibility and choice.

Prior to the pandemic we were already seeing buyers and tenants prioritise broadband and technology. Now, however, this is more important than ever, echoing the findings of The London Report 2020 in relation to London’s office market.

Consequently, it is of little surprise that 77% of respondents to our survey said they plan to include more advanced technology – including telecommunications, better internet connectivity and touch-free – in future developments.

77%

The proportion of respondents to the Knight Frank Global Development Survey who said they were more likely to include “advanced technology” in future developments.

Wellbeing at the fore

Healthier and greener living is now a top priority and developers and operators are seeking to support more active lifestyles. More than half (54%) of respondents said they plan to include more outdoor space in future developments and some 38% are planning to increase storage facilities for bicycles.

Wellbeing is also at the top of the agenda, with developers looking at how they can improve the living experience with a focus on amenities and lifestyle.

It is worth considering the role that operational residential real estate can play in this regard. Analysis conducted at the height of the pandemic by reviews website HomeViews, for example, drew attention to consistent references among build to rent (BTR) residents to “community” and “neighbourhood”, with management companies hosting an array of events including quiz nights, virtual wine tastings, art classes, photography lessons and virtual keep-fit sessions to keep residents and community connected.

54%

The proportion of respondents to the Knight Frank Global Development Survey who said they were more likely to include more outdoor space in future developments.

“The impulse to escape to the country has been a well-documented feature of the pandemic.”

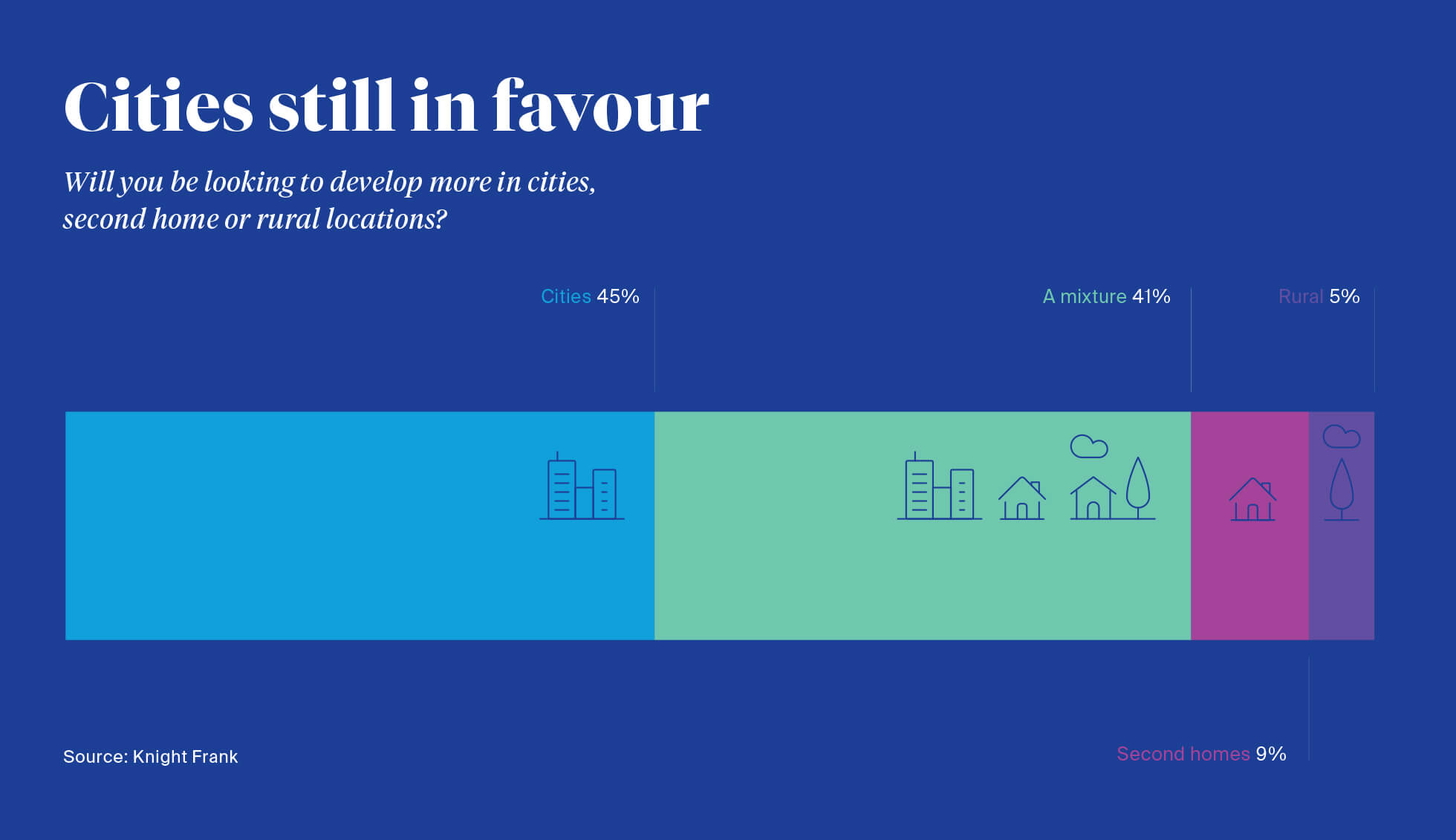

The lure of the city

The impulse to escape to the country has been a well-documented feature of the pandemic. The aspiration for a larger home, with room for an office, space to unwind and a garden is understandable given the circumstances and one confirmed by our own data at Knight Frank.

Indeed, while in recent years seven out of every ten London-based home buyers wanted to buy in London, post-lockdown this figure dropped to three in ten. It is uncertain how long this trend will last, though the attraction of the city is unlikely to remain subdued for long.

People have been moving to cities for many centuries for good reasons, albeit not all of these have been apparent over the past year. Once the immediate crisis is behind us and the attractions of city living and associated lifestyle perks such as bars, restaurants, galleries and parks are reopened, without unusual distancing, potential new residents will be reminded of the attractiveness of city living.

Read: The evolution of global cities

London will also continue to act as a magnet for university leavers looking for jobs, or joining graduate schemes. Our 2020/21 Student Accommodation Survey, conducted in partnership with UCAS, suggests that 67% of London graduates plan to stay in the capital after they graduate.

Read: Knight Frank & UCAS Student Accommodation Survey Report - 2020

Three in ten

The number of London-based home buyers looking to buy in London in the immediate aftermath of lockdown, down from seven in ten previously.

Flexibility is key

Flexibility and adaptability will be key to success. We need truly versatile space that supports agile working while allowing for a separation between work and home life to promote health and wellbeing, the importance of which has been brought into sharper focus by the events of 2020.

“Investors will need to be mindful of – and become more accommodating to – changing lifestyles.”

So, what does that mean for residential investment markets? Well, in the main, it means that investors will need to be mindful of – and become more accommodating to – changing lifestyles.

That means more multi-locational working, particularly in terms of the home and the office. Homes will not be built to survive further lockdowns, but to be adaptable to changes in circumstance. And it will lead to a greater focus from investors on mixed-use, mixed-income, walkable places, especially in high-density central London locations.

Read: Building walkability into new developments

Despite a recent, but temporary slide in population as a result of Covid, London is expected to reach megacity status within the next two decades, as its population swells to more than 10 million people. Providing the right type of housing, in the right locations, will be key for residential developers and operators looking to capitalise.

London’s residential investment market was undeterred by the events of 2020. As global investors continue to seek stable cash flows and development volumes rise, more will look to deploy capital in residential, complementing the buoyant commercial investment market.

Global capital targeting residential investment

In our 2020 Active Capital report, we stated that the uncertain global economic environment would lead to a renewed search for “resilient” investments among real estate investors. We defined resilient assets as those that are able to sustain tenant demand and support rents, underpinning capital values and ultimately returns for investors.

It is a profile which can be comfortably applied to the residential investment market. UK BTR in particular has continued to provide resilient income returns. Occupancy levels have remained high and rent collection rates have been robust, in contrast to many other real estate sectors.

This stability has reinforced BTR’s huge appeal to investors seeking long-term, reliable returns. More than £4 billion was invested last year, with the capital committed coming from new as well as established market players.

Included within this figure were a number of landmark sales, including AXA IM’s purchase of Dolphin Square in London. Further investment is expected in 2021 as consolidators grow platforms and new entrants look to buy into the market at scale. And one thing is clear: London will remain a key focus.

95.8%

The average monthly BTR rent collections as a percentage of rent due between March and November.