The Knight Frank Rural Property and Business Update – 16 November

As if the newly assented Agricultural Act wasn’t sufficient enough reason for rural landowners to consider reviewing their long-term strategic plans, then mooted changes to the Capital Gains Tax regime, a proposal to ban a popular fertiliser and improved incentives for tree planting provide further food for thought

5 minutes to read

Please do get in touch with me or my colleagues mentioned below if you’d like to discuss any of the issues covered. We’d love to hear from you

Andrew Shirley, Head of Rural Research

In this week’s update:

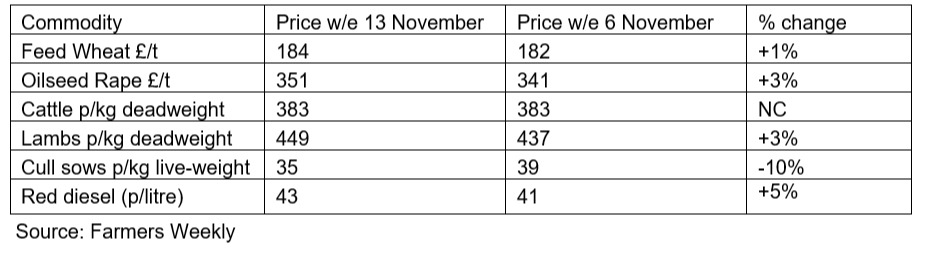

- Commodity markets – Oilseeds up, pigs down

- Agriculture Bill – Finally signed off, so now time to look at the details

- Capital Gains Tax – Simplification proposals released

- The environment – Solid urea set to be banned to ease air pollution

- Woodland – Tweaks to grant scheme announced

Photo by Christopher Carson on Unsplash

Commodity markets – Oilseeds up, pigs down

Oilseed rape prices tend to move in tandem with other oil-producing agricultural commodities like soya beans, which jumped sharply in value last week off the back of lower production estimates and increased demand. China is importing large volumes of soya as it rebuilds its pig herd following a devastating outbreak of African swine fever. Meanwhile, the ongoing spread of the disease in Germany has pulled back pig prices here. Over ten countries have banned pork from Germany, which last year sold nearly half a million tonnes of pig meat to China.

Agriculture Bill – Finally signed off, so now time to look at the details

After much toing and froing between the Houses of Commons and Lords the Agriculture Bill finally received royal assent on 11 November and became the Agriculture Act.

While much of the recent focus on the bill has regarded a few controversial amendments (repeatedly rejected by the government), which aimed to protect UK farmers from competition from food imports produced to different welfare and environmental standards, it is worth remembering that the act ushers in the most radical changes to farming the UK has seen since we joined the EU.

My colleague Edward Holloway from our Rural Asset Management has produced a handy guide detailing the act’s key areas and what they mean for rural property owners.

One of the biggest changes facilitated by the act is the phased switch from the EU’s Basic Payment Scheme (BPS), which is paid to all farmers based on the area farmed, to the Environmental Land Management Scheme (Elms), which will reward the delivery of environmental outcomes.

In a recent letter to rural MPs the CLA warns that the industry and the government itself is not ready for the transition with many farming businesses that rely on the BPS unlikely to cope.

For innovative and practical advice on how to manage the changeover from BPS to Elms please contact our Head of Agri-Consultancy Tom Heathcote

Read our guide to the Agricultural bill

Capital Gains Tax – Simplification proposals released

The Office of Tax Simplification (OTS) has just released the first part of its review of the Capital Gains Tax regime. The report recommends a significant overhaul of the current system and will affect the majority of our clients.

Key recommendations for simplification are to either align CGT with income tax rates to reduce the current disparity and, or, cut down on the number of rates. Both options will clearly have an immense impact on property disposals, although they are likely come with alterations to existing allowances and reliefs and the potential introduction of a new rebasing period.

Investors Relief is mooted for the scrap heap in response to the lack of uptake since it was introduced, but the changes to the criteria for Business Asset Disposal Relief, aka Entrepreneurs’ relief, will be a concern for many.

"Entrepreneurs and investors, second home owners, and buy-to-let landlords could potentially be some of the hardest hit by the proposals."

While the above are currently recommendations, they have been on the horizon for a while, points out my valuations colleague Alice Huxley, who reckons that the timing of the report’s release is an intentional test of the electorate’s response, and a warning shot of what is to come.

“It would therefore be relatively safe to say that these recommendations will not be implemented immediately, but change will come. As professional advisers, we therefore have a window of opportunity to help our clients prepare, and utilise the current rates and reliefs/allowances.”

Read the full Capital Gains Tax review Simplifying by Design

For more information on how to prepare for the changes please contact Alice

The environment – Solid urea set to be banned to ease air pollution

One of the biggest gripes of farmers when something is banned by the government is that it invariably puts them at a cost disadvantage compared with farmers from other countries.

The latest agricultural input to face the axe in England is solid urea fertiliser because it releases ammonia that reacts with other chemicals in the atmosphere to create wildlife and health-threatening particulates. The government wants to cut ammonia emissions by 16% before 2030.

Farmers, however, fear the ban will force up the price of other fertilisers and claim there are other less financially damaging ways, such as the use of urease inhibitors, to bring down emissions.

The proposal, which is part of the government’s 2019 Clean Air Strategy is open for consultation until 26 January.

For advice on how to make your soil healthier and more productive please contact our Head of Agri-Consultancy Tom Heathcote

Woodland – Tweaks to grant scheme announced

Farmers and estate owners in England could find it easier to access cash to help them plant more trees following tweaks to the Woodland Creation Planning Grant, which was first introduced in 2018.

Projects as small as five hectares will now be eligible for the grant, compared with the previous ten-hectare minimum.

“The relaxation of the rules will allow farmers and landowners a greater opportunity to access financial assistance for new planting,” points out Edward Holloway, a member of Knight Frank’s Forestry Investment team.

"To have a contribution towards the costs of producing a woodland creation design plan, plus any supplementary surveys, is a huge help to those looking to establish new woodland, and now that the criteria has been expanded, more people should be eligible to take advantage”

“It is a positive move and would be welcomed in Wales if they choose to do the same,” adds Powys-based forester Andrew Bronwin, who advises Knight Frank’s clients across the UK.

Contact Edward or Andrew for more advice on woodland creation

Oilseed photo by Illiya Vjestica on Unsplash