Around the world in five charts

Everything you need to know about the global economy, distilled.

2 minutes to read

Daily health data paints a mixed picture, with cases beginning to ebb in some locations while rising in others. Despite that, business sentiment remains robust, though it’s becoming increasingly clear the road back to full mobility is long. Meanwhile, commodity prices hint at a realism among investors that activity, though recovering, will remain subdued by historic standards for some time.

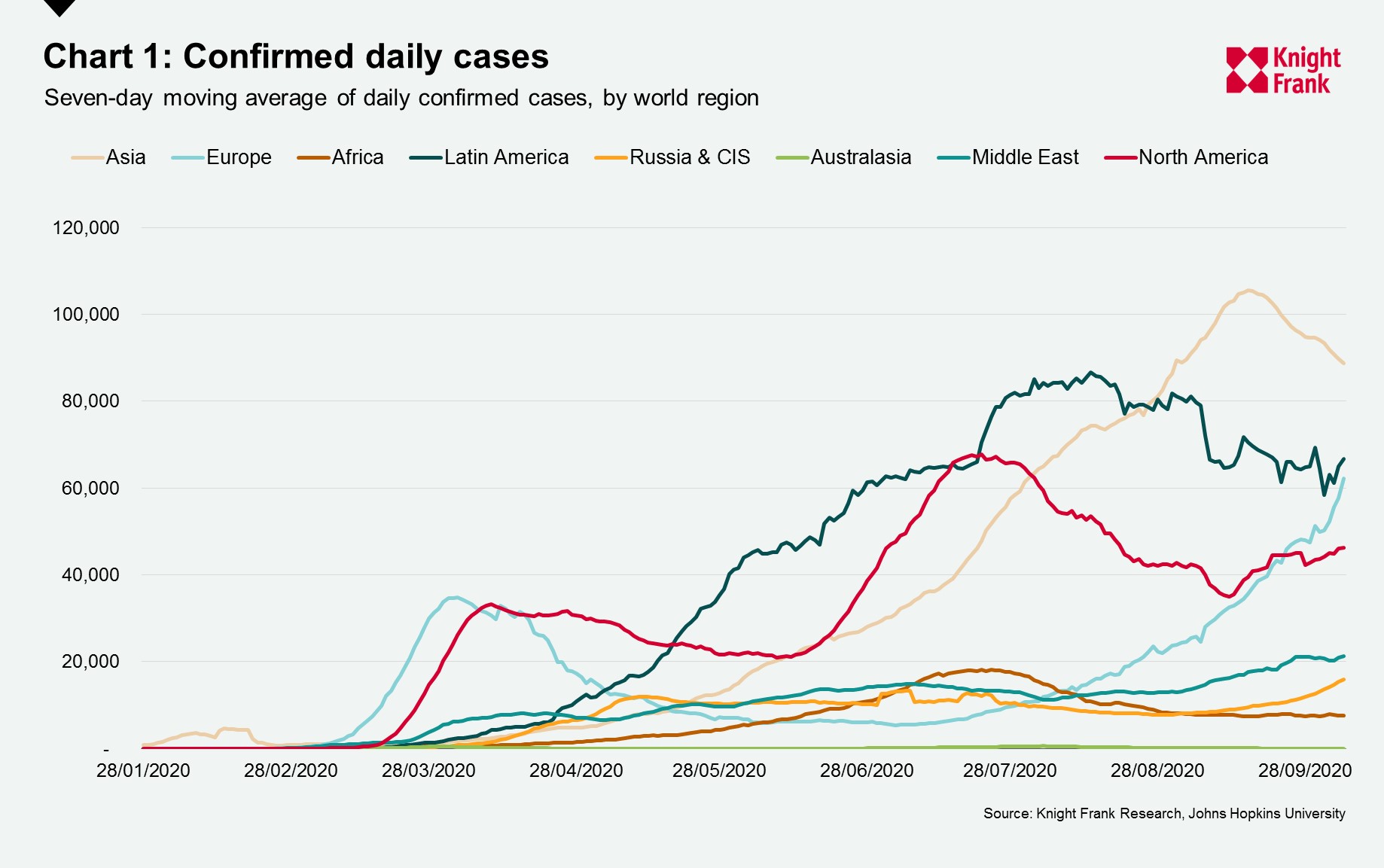

This week, the number of confirmed Covid-19 cases globally surpassed 36 million. The seven-day moving average across world regions suggests the spread of the virus is ebbing in Asia and Latin America and rising across Europe, North America and the Middle East.

Though cases are declining in Asia, the region still accounts for nearly a third of new cases. Meanwhile, Europe now accounts for 11% of total confirmed cases, yet the region was responsible for a fifth of all new cases in the past seven days.

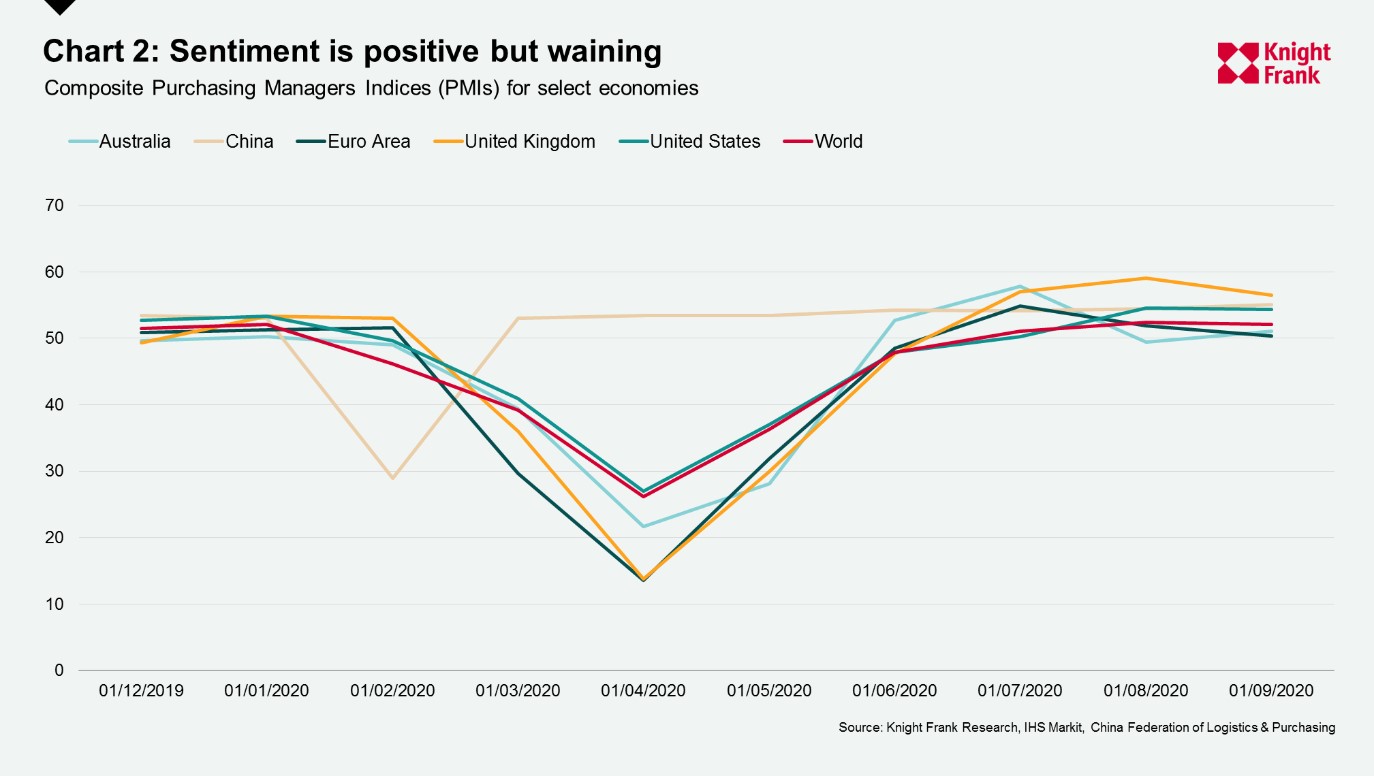

Business sentiment remains in positive territory despite rising case numbers. September’s Composite Purchasing Managers Indices (PMIs), where a reading of 50 indicates growth, suggests many economies remain on the road to recovery. However, the pace appears to be slowing. This is particularly evident for the Euro Area and the UK, where cases have been on the rise and local restrictions have been enforced.

Sentiment in Australia rose in September as restrictions began to lift and new fiscal support measures were announced. China’s PMI has been steady since March.

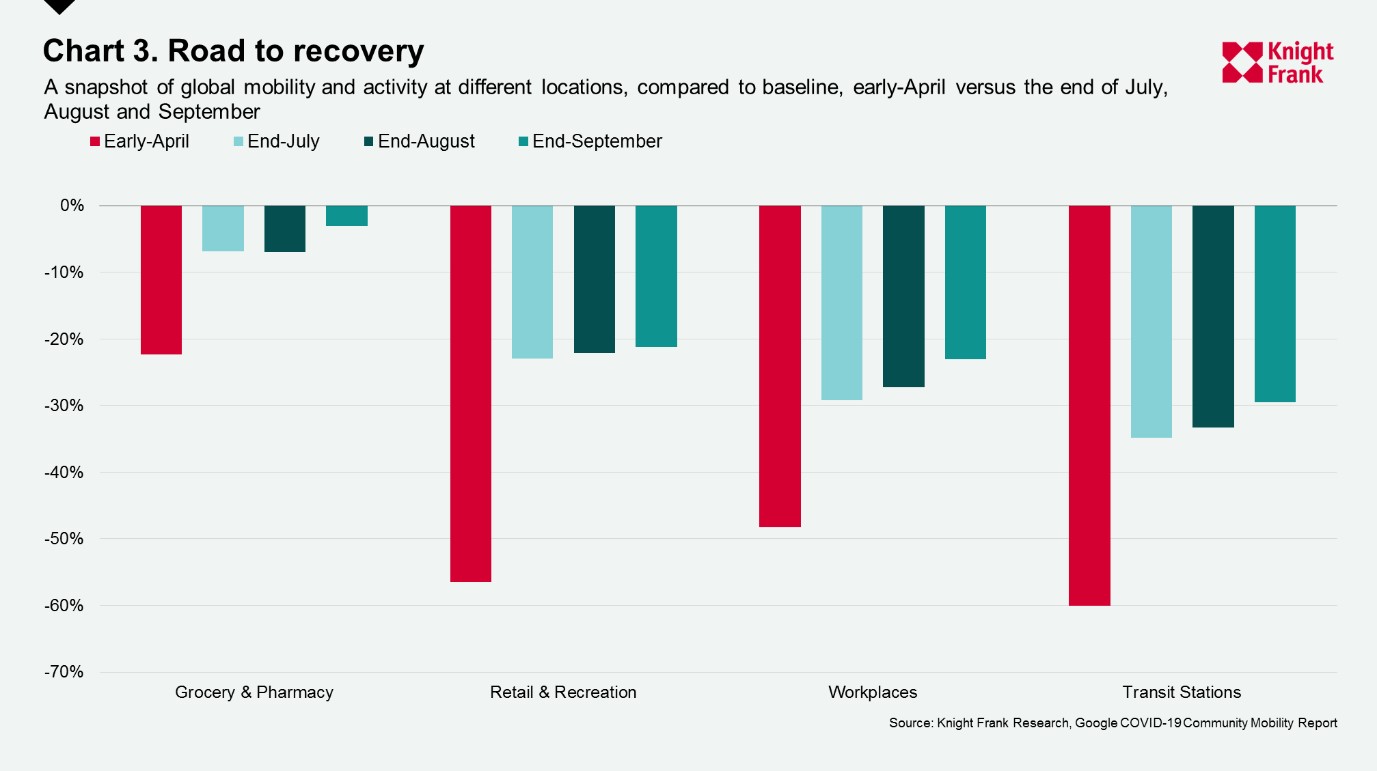

The mobility of populations is still increasing but at a slower pace. The Economist in April wrote of the 90% economy: better than a severe lockdown, but far from normal. The latest activity and mobility monitors indicate more of an 80% economy.

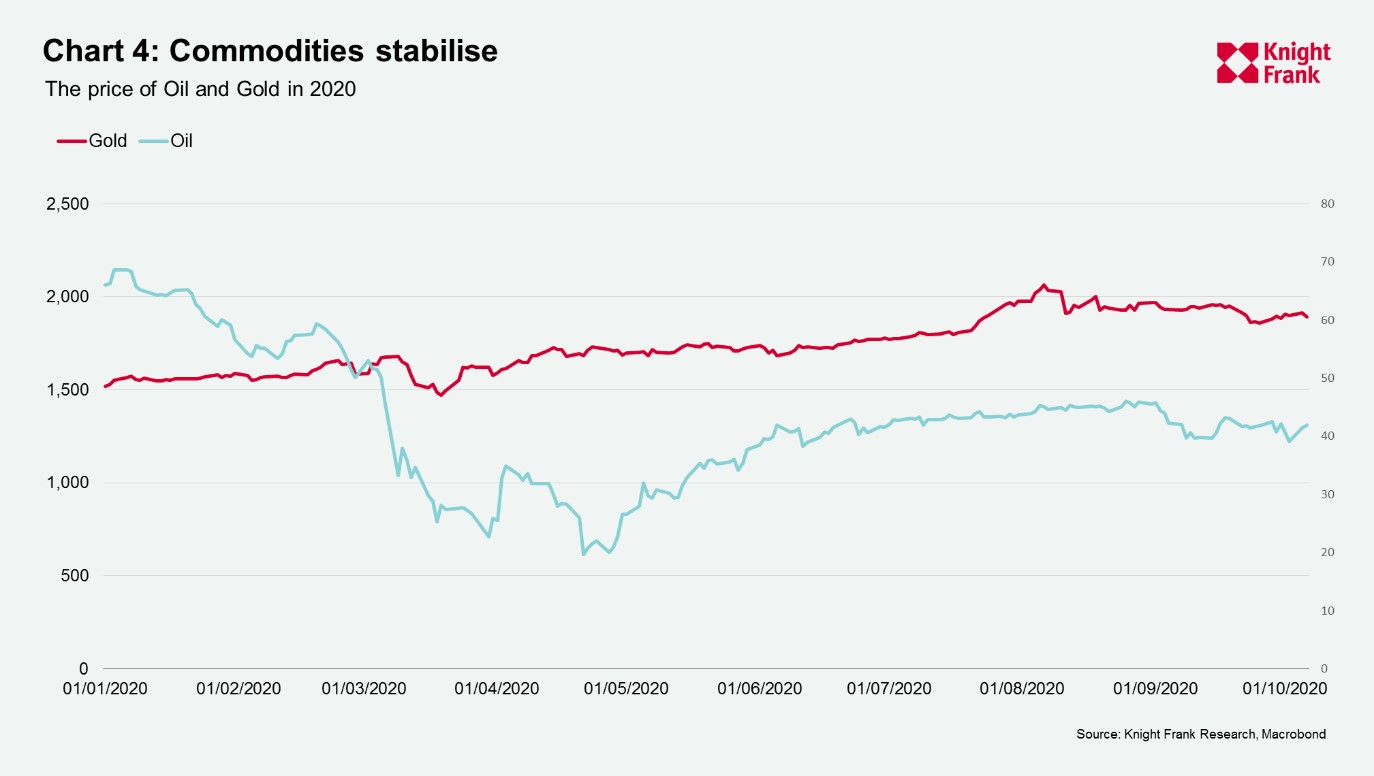

The levelling off of commodities prices indicates both positivity and realism. High uncertainty and lower economic activity pushed Gold to record highs in early August (over $2,000) and the price of oil dip to near-lows (below $20). Over the past month both seem to have levelled out following the rebound in activity, reflecting broader policy measures that suggest the effects of the virus will linger for some time.

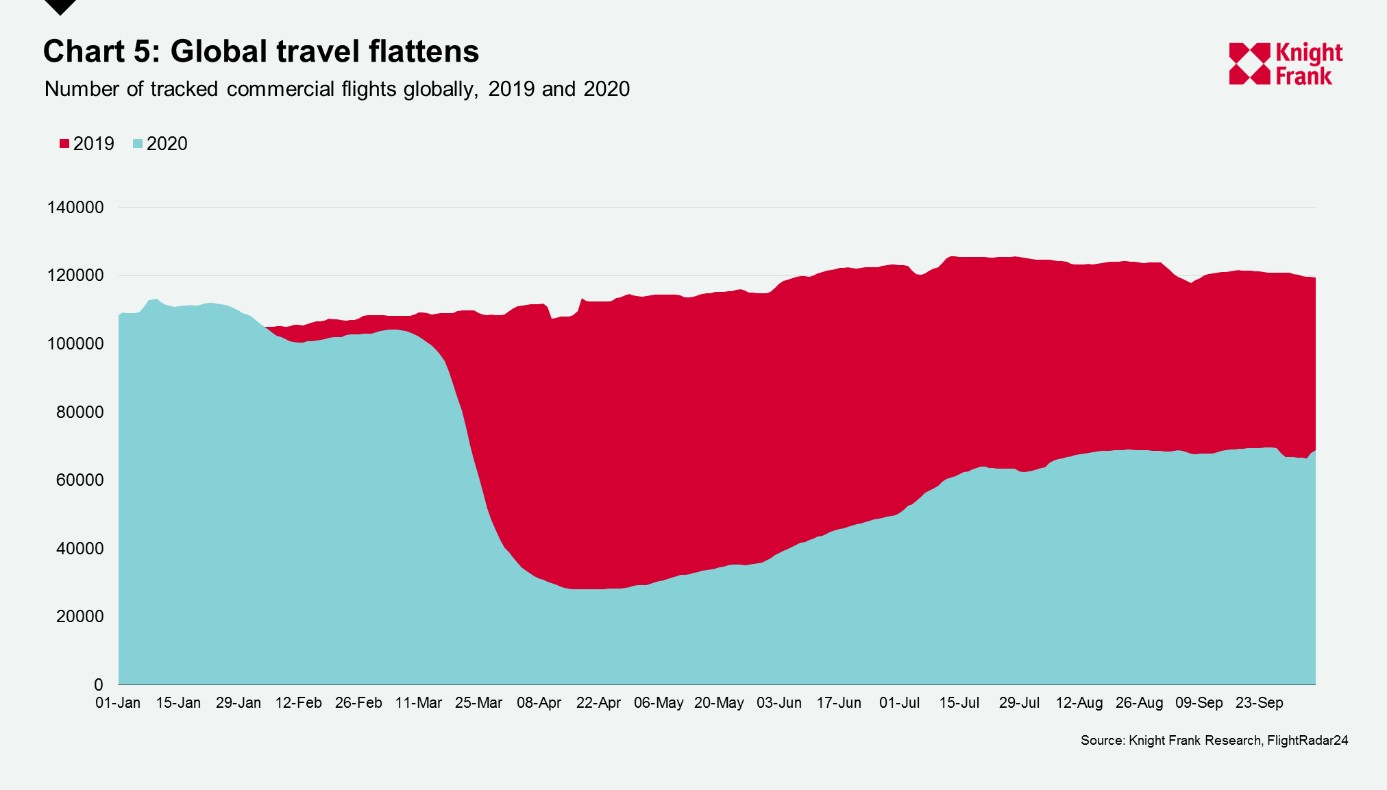

Global travel saw a steep rise with the lifting of restrictions but as quarantines and border policies change in response to rising cases the level of commercial flight activity has plateaued.

In January the number of commercial flights was 6% above 2019 levels. By April, at the onset of large restrictions on movement, the data plummeted by 75%. Activity remains around 44% below 2019 levels and will likely remain there until either cases are brought under control or a vaccine is approved.

The changing face of global travel was revealed this week by the Global Passport Power Rank. New Zealand now has the most powerful passport given the country’s handling of the pandemic. The index ranking reflects real-time changes due to Covid-19 restrictions and has seen the US tumble to 21st position with visa-free access to just 52.