Covid-19 Daily Dashboard - 23 September 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 23 September 2020.

Equities: Globally, stocks are higher. Gains in Europe have been led by the CAC 40 which has added +2.0% over the morning, while both the DAX and the FTSE 250 are up +1.7%, and the STOXX 600 is +1.5% higher. In Asia, the S&P / ASX 200 was up +2.4% on close, as was the CSI 300 (+0.3%) and the Hang Seng (+0.1%). In the US, futures for the S&P 500 are +0.6%.

VIX: After declining -3.3% yesterday, the CBOE market volatility index is down a further -2.6% this morning to 26.2. The Euro Stoxx 50 vix is -7.2% lower at 26.1. Both indices remain elevated compared to their long term averages of 19.8 and 23.9.

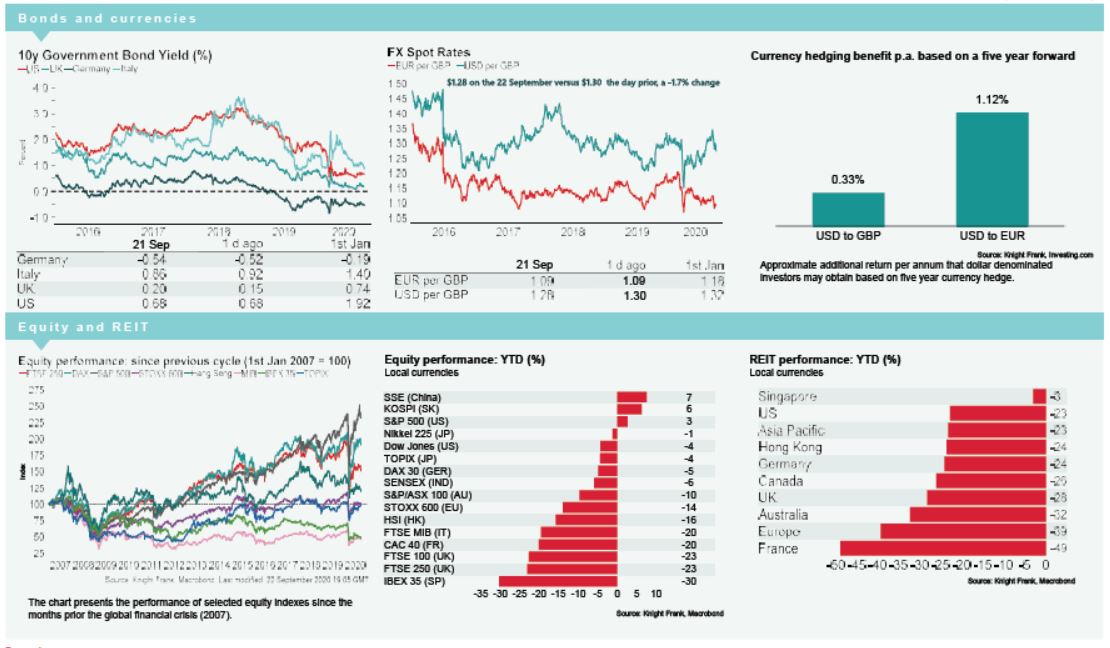

Bonds: The UK 10-year gilt yield, US 10-year treasury yield and the German 10-year bund yield are all flat, currently at 0.20%, 0.67% and -0.50%, respectively. Meanwhile, the Italian 10-year bond yield has compressed -2bps to 0.85%, the lowest it has been since October 2019.

Currency: Sterling has depreciated to $1.27, its lowest level since July, while the euro is currently $1.17. Hedging benefits for US dollar denominated investors into the UK and the eurozone are currently 0.33% and 1.12% per annum on a five-year basis.

Oil: Following a +1.2% increase over the morning, the West Texas Intermediate (WTI) has risen back above $40 per barrel at $40.06, while Brent Crude is currently $42.07.

Baltic Dry: The Baltic Dry increased for the fourth consecutive session yesterday, up +3.8% to 1,364. The index is now +25% higher than it was in January, albeit -30% down from the peak in July.

Gold: Gold declined -1% yesterday to $1,901 per troy ounce, the lowest it has been since July.

UK PMIs: The UK Manufacturing PMI was 54.3 in September, above market expectations of 54.1, albeit a decline from 55.2 in August which was the strongest reading since February 2018. The UK Services PMI also declined from August’s 5-year high of 58.8 to 55.1 and below market expectations of 56.0. However, both the Manufacturing and Services PMI remain above 50, which is indicative of expansion.