Global Residential Cities Index Q1 2020

The data in this report is backward-looking and covers the period up to 31 March when Covid-19 was at its peak in parts of Asia but had yet to take its toll on large parts of Europe, North or South America.

1 minute to read

As we’ve outlined in our regular Covid-19 daily updates since the start of the pandemic, we expect sales volumes to feel the impact of Covid-19 more than prices with employment protection schemes and mortgage holidays in many advanced economies likely to reduce the number of distressed sales and hence the likelihood of price falls.

Whilst the index’s overall performance may not drop significantly, we do expect the city rankings to look very different in six to 12 months’ time with those markets that have been effective in containing the pandemic, and where lockdowns were short-lived, most likely to show more resilience.

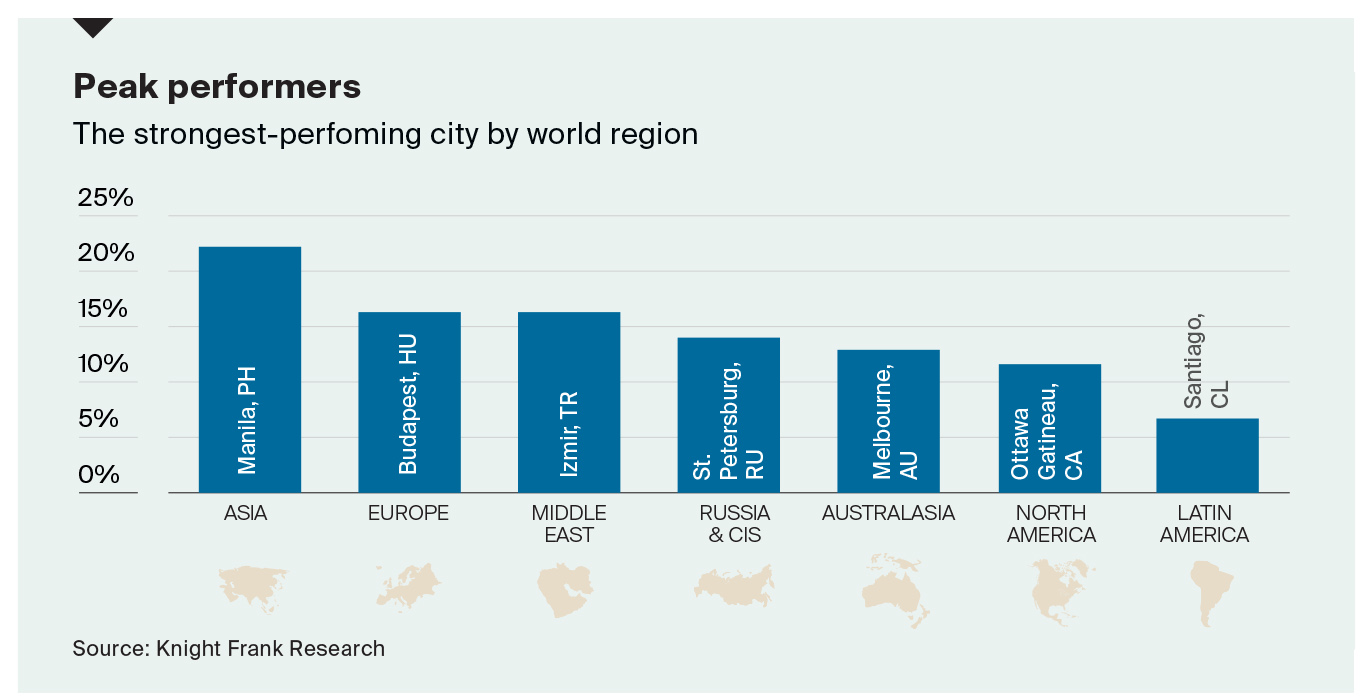

Manila leads the annual rankings for the second consecutive quarter with price growth of 22% in the year to March 2020.

Budapest continues to lead European cities with growth of 16%. Zagreb and Warsaw make up the trio of Central and Eastern European cities in the top ten.

Aside from Manila, Seoul and Melbourne are Asia Pacific’s top performers, both with annual growth of 13%. Overall, the index increased by 4.3% in the 12 months to March, its highest annual rate of growth since Q3 2017. Of the 150 cities tracked, 85% saw prices increase over the year to March.

A look at the 15 cities with largest GDP across China and the US, underlines the extent of the slowdown in China in the first quarter of 2020 with average price growth reaching just 0.4% (figure 1), the lowest average quarterly rate of growth for the 15 cities since Q1 2008.

Read the report in full here

For more information please contact Kate Everett-Allen