1 minute to read

What's changed in the last 12 months?

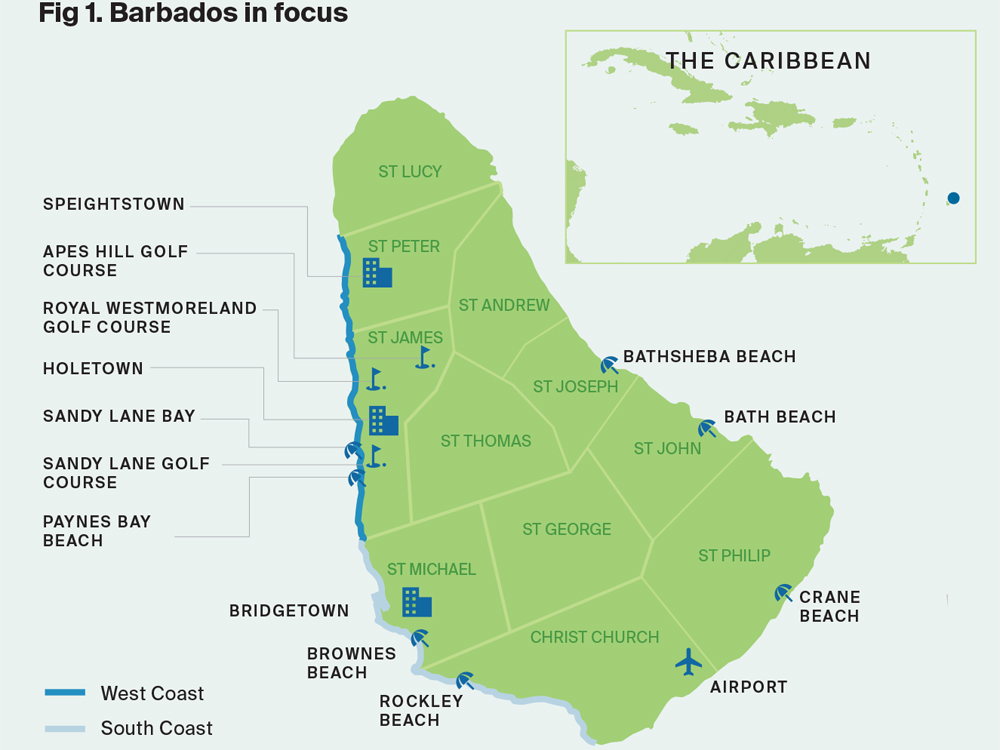

Barbados’s real estate market continues to evolve, diversify and mature. The financial crisis took a heavy toll on the Caribbean’s property markets but fast forward a decade and there are clear signs the market is stabilising. Prime price declines on Barbados’s desirable West Coast have bottomed out, sale volumes are rising, infrastructure is being upgraded (e.g. airport) and for UK buyers, a key component of demand in the prime segment, the exchange rate is finally working to their advantage.

The Barbadian dollar is pegged to the US dollar, against which, the pound has increased from 1.27 at the start of 2017 to 1.32 on 1 Jan 2020, this has not only meant that UK buyers are experiencing a discount compared to three years ago, but where UK vendors plan to sell up and move back to the UK, they are more flexible on price.

Since 2018 a number of reforms have boosted Barbados’ investment credentials. Mia Mottley's government converged corporate tax rates for domestic and international businesses and the IMF announced a US$288 million special interest rate loan as part of the Barbados Economic Recovery and Transformation (BERT) programme.

Read the report in full here

For more details contact Kate Everett-Allen