The Luxury Market Awakened by Private Wealth

For today's wealthy, priorities and preferences when it comes to home purchases has changed, with many leaning towards larger non-landed homes in the prime districts to accommodate living and working in the comfort.

2 minutes to read

There are early signs that Singapore’s attractiveness to foreign and local private wealth is just beginning to make its mark on the prime residential market with increased activity supporting prices. Especially so given the stable business and political environment, when measured against the global COVID-19 crisis as well as political tensions in other parts of the Asia-Pacific.

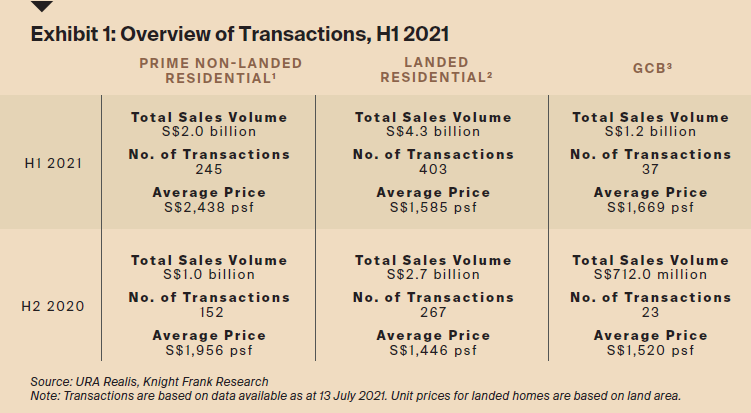

In the first half of 2021 alone, the prime non-landed residential segment recorded a flurry of deals amounting to S$2.0 billion, the highest since H2 2010 where sales within the luxury market segment totalled some S$2.4 billion. Rebounding from the pandemic-led recession in 2020, the sales activity in H1 2021 was double the amount of S$1.0 billion registered in the later half of 2020, and surpassed the S$1.7 billion transacted in the whole year 2020.

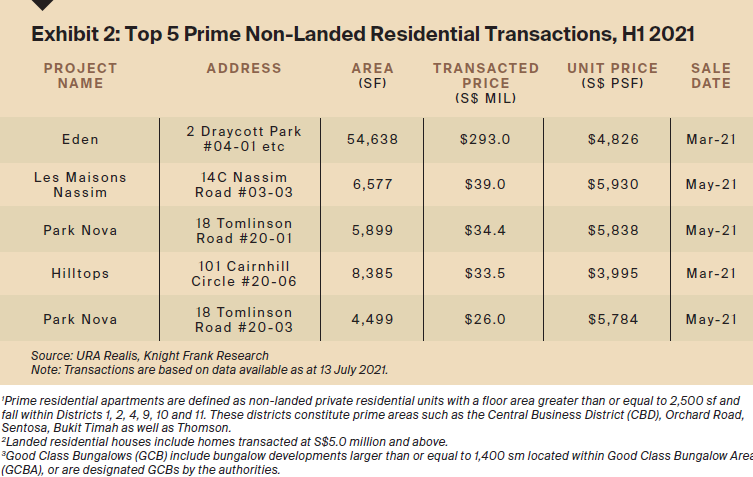

As the pandemic changed the priorities and preferences of many home purchasers, with many leaning towards larger floorplates to accommodate for both living and working in the comfort of their homes, demand for larger non-landed homes in the prime districts increased.

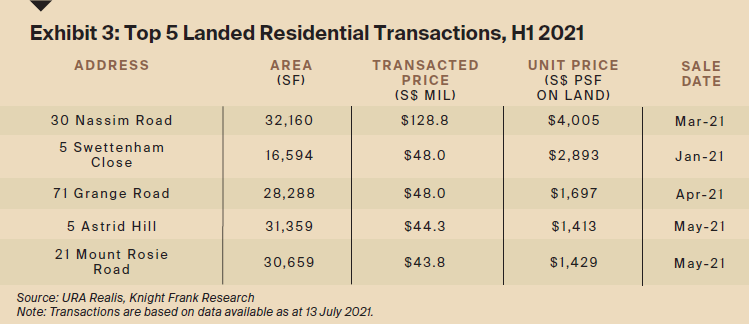

Singapore continues to grow in appeal among family offices. It was observed that both foreign and local homebuyers/investors were looking to penthouses or larger units with more than 3,000 square feet (sf) in the first six months of 2021. While newly launched penthouses at Park Nova and Midtown Modern were sought after by the ultra-rich, most were sourced from the resale market, especially so for foreign buyers/investors due to the restrictive nature of landed homes.

Locally, the risk elements that might upset or disrupt the prime residential demand would not likely come from possible cooling measures, as the Monetary Authority of Singapore (MAS) recently stated that the private home market is currently not overheated. However, increasingly prohibitive restrictions that the government would have to implement when there are sudden and less-than-expected eruptions in community COVID-19 infections could prove to be more worrying.

With the current limited inventory of large luxury homes in the Core Central Region (CCR) coupled with the expected pent-up demand arising from prospective high-net-worth foreign buyers once travel measures ease, prices of these houses within the prime vicinity are expected to rise.

Written by:

Evan Chung, Head of KF Property Network, Knight Frank Singapore

Leonard Tay, Head of Research, Knight Frank Singapore

Nicholas Keong, Head of Residential (International Project Marketing), Knight Frank Singapore