The urban/rural development divide

The latest data on construction in London makes for sobering reading

3 minutes to read

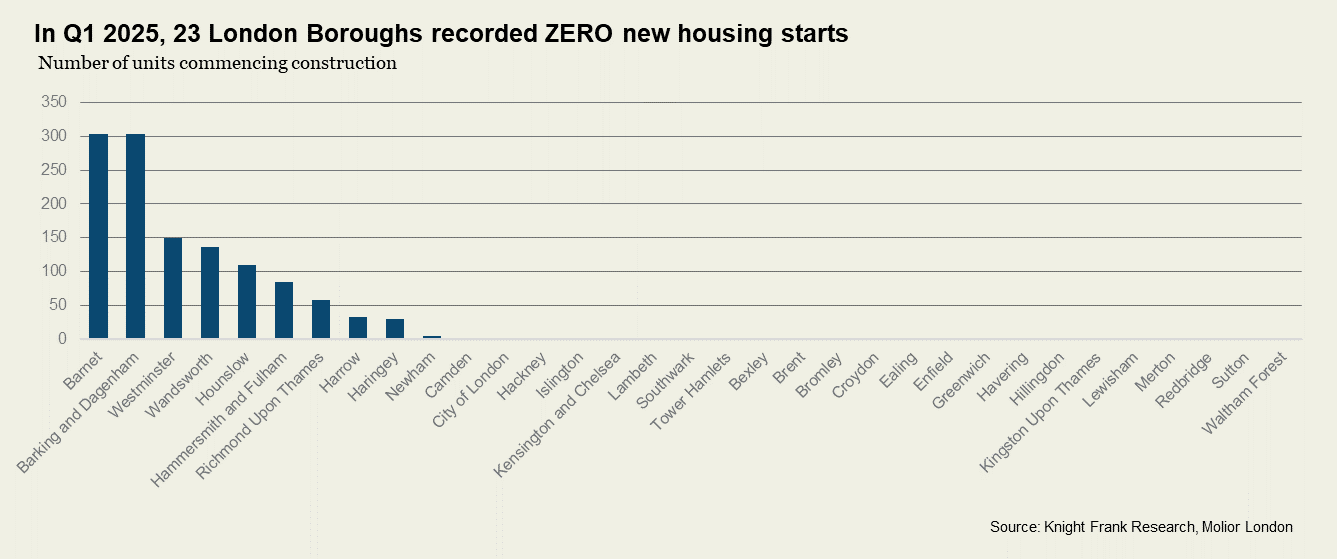

Not a single spade hit the ground in 23 of London’s 33 boroughs in the first three months of the year. That’s right - developers didn’t start a single home in all but ten boroughs. Just 1,210 new homes broke ground across the city, the lowest quarterly figure since the 2009 financial crisis.

The data, from Molior’s latest snapshot of residential delivery across London, underscores the widening gap between housing targets and expected delivery. Should Q1 performance be replicated across the remainder of the year, new starts would represent just 5.5% of the government’s annual goal of 88,000 homes for the capital.

Undoubtedly, that’s going to impact future delivery. Of the 45,000 private homes currently under construction, more than 31,000 are set to complete by 2026, Molior notes. But after that, the pipeline collapses: only 7,400 completions are expected in 2027 and 2028 – of which 45% are already pre-sold. Sixteen boroughs have zero completions scheduled for that period.

City Strains

A slowdown in new delivery isn’t just a London problem - earlier this month, we flagged a 20% drop in the number of Multifamily Build to Rent homes currently being built across the UK. Developers in urban centres face a multitude of challenges which require the attention of policymakers.

Gateway 2 delays, rising construction costs, planning bottlenecks, stricter affordable housing rules, and weak demand for Section 106 units are all big challenges. First-time buyer support is also scarce. In London, the impact of early and late stage affordable housing reviews is another barrier which is making some schemes unbuildable and difficult to fund.

Falling construction comes at a time when there are positive signs on the demand side. Lower-than-predicted UK CPI numbers means a quarter-point cut by the Bank of England next month is likely which, if markets are right, will be the first of three this year.

The SONIA five-year swap rate, which is used by lenders to price mortgages, closed at just over 3.7% on Tuesday, compared to over 3.9% at the start of the month. Already, some mortgage lenders have responded by dropping rates.

With dwindling stock and strong housing demand in city centres, developers who are able to start construction now have a chance to secure buyers and establish a foothold as competition lessens and new developments grow scarcer.

Green shoots

Outside the cities though, sentiment is shifting. Planning reform, including Labour’s initial moves to reintroduce mandatory housing targets and open up the greenbelt, has boosted confidence, particularly among the larger housebuilders. Meanwhile, increased funding for planning departments and the appointment of more officers should soon begin to ease local authority resourcing issues.

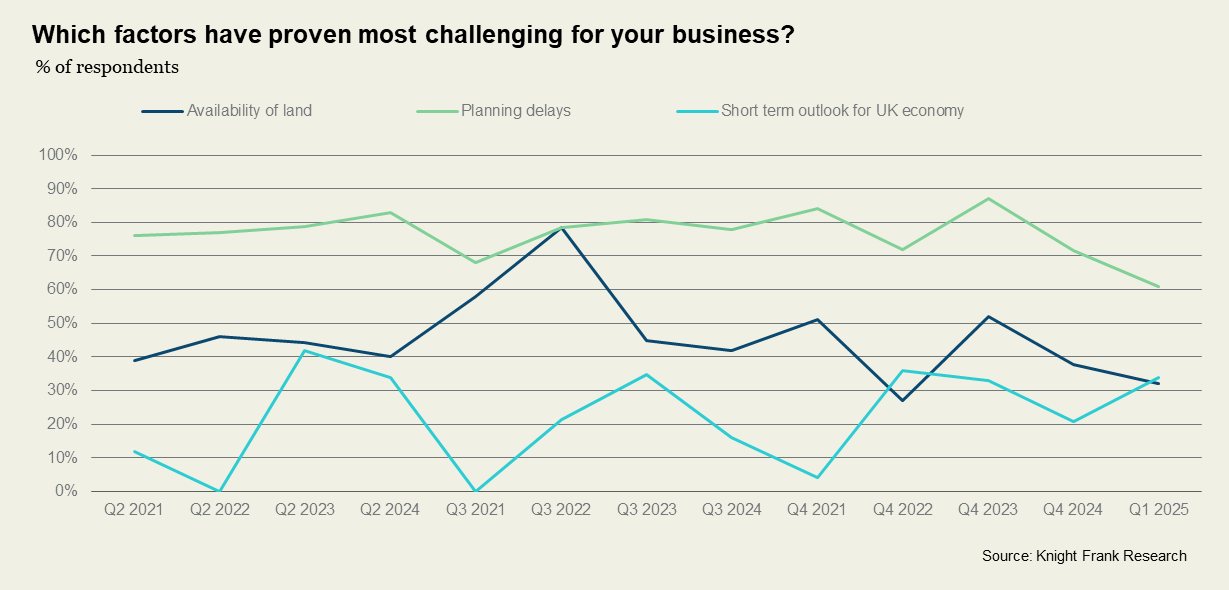

Reflecting this, just six-in-ten respondents to our quarterly survey of more than 50 volume and SME housebuilders cited planning delays as a key drag on activity in Q1, the lowest proportion since we began our survey in 2020.

The government’s grey belt policy is another key point of focus for housebuilders seeking relatively low risk sites in attractive locations. More than 70% of survey respondents are considering or actively submitting applications for grey belt land, while 60% say they are seeking or may seek consents, even where sites are not allocated in a local plan.

This points to growing confidence in testing the system, and a view that planning decisions may be winnable at appeal where housing shortfalls are acute.

Engines of growth

But while planning reforms that incentivise housebuilding beyond city centres are welcome, urban centres are the UK’s engines of productivity and growth. Without more substantial reform, the government is unlikely to meet its ambition to deliver 1.5 million homes over this parliament, and key cities will be starved of workers.

Gateway 2 is fast emerging as one of the biggest issues facing developers building tall buildings. They are having to reconsider strategy across sites, and factor in possible delays and costs into land deals. The principle of the system is good, but execution and resourcing is lacking. Action on this will be critical if delivery is to scale up in the places that need it most.

Many local authorities are falling short of their targets, creating a window of opportunity for developers to move forward with speculative applications.