Global housing markets: the year ahead

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

The UK housing market posted a strong finish to 2024. Average prices climbed 0.7% during December to bring the annual change to 4.7%, Nationwide reported on Thursday.

That leaves values a little below the previous peak set just after the mini-budget in late 2022. It also constitutes a pretty remarkable display of resilience given the price of mortgages and the repeated knocks to consumer sentiment caused by the volatile political and economic environment.

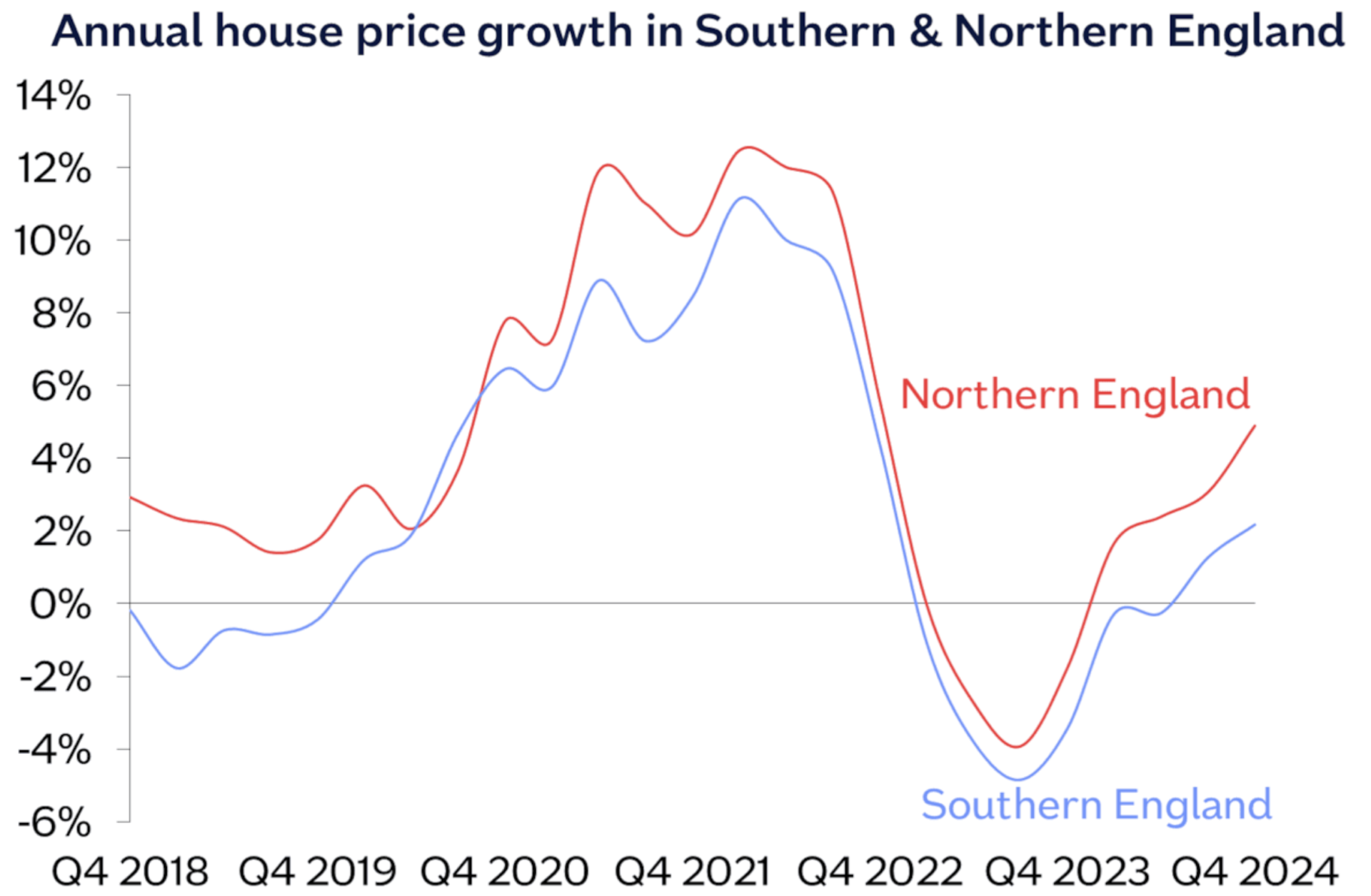

House prices across the north of England continue to make up ground lost in the 2010s (see chart). Values rose 4.9% in the Northern English regions of the North, North West, Yorkshire & The Humber, East Midlands and West Midlands, compared to a 3.1% rise across the country.

A similar pivot

Where do we go from here? Well, buyers are likely to squeeze deals through ahead of the April 1st changes to Stamp Duty Land Tax (SDLT), which will flatter the first quarter (Q1) and weigh on the figures for Q2.

Nationwide reckons we'll see house price growth of between 2 and 4%, which tallies with our November forecast of 3%, though the outlook for rates is now even less certain than it was then. Traders are now fully pricing in just two rate cuts from the Bank of England through this calendar year, though around four remains consensus among economists - see the latest survey of 51 participants published by the Times on Wednesday.

The economy has largely flatlined since Labour won power. Business sentiment remains pretty poor and activity in key sectors including manufacturing are contracting due to weak overseas demand and looming tax rises. Policymakers in the Eurozone have already turned their focus to supporting growth, rather than fret over inflation - whether the latest economic figures will prove enough to prompt a similar pivot at the Bank of England remains to be seen, though we'll know a lot more when the BoE publishes new forecasts at the February meeting.

Tight inventory

The murky outlook for interest rates clouds the outlook for housing markets globally - I shared my thoughts with Mansion Global just before the turn of the year. A reminder that you can find our forecasts for prime markets in key cities here.

Dubai leads our forecast with growth of 5% during 2025. The population is rising and inventory is failing to keep up. Listings in prime neighbourhoods have fallen by 52% over the past 12 months. The shortage is even more pronounced in the US$10 million+ segment, where available properties have dropped by 65%.

New York and Geneva complete our top three. In New York, inventory levels remain sharply below the five-year average (-54%), which will help support pricing as the selling season gathers pace in the spring. Geneva’s 3% growth forecast reflects its continued status as a safe haven for global elites.

A blockbuster deal

Blockbuster growth in values of the sort we saw immediately after the pandemic appears well and truly behind us. In Miami, where prime prices soared 84% in the past five years, annual growth slowed to 3.8% in Q4 2024. We reckon a flat year lies ahead.

That said, this is a luxury market permanently transformed and the world's wealthiest will continue to fight for the very best waterfront properties. This competition is encapsulated by the incredible US$520 million deal struck by a group of investors for 1001 Brickell Bay Drive and 1111 Brickell Bay Drive in Miami's financial district, reported by Bloomberg on New Year's eve. The group plans to build super prime apartments on the site, which includes continuous water frontage and is zoned for several towers as tall as 320 meters.

Newly minted very wealthy Americans will continue to do deals that are at odds with a broader market struggling to get out of first gear. Mortgage rates are ticking up again as markets weigh the prospect of a potentially inflationary Donal Trump second term.

In other news...

Visionary behind London’s Square Mile steps down after 44 years (FT).