Unlocking Investment Potential: Emerging Markets in Asia-Pacific

The real estate landscape across Asia-Pacific is evolving, reflecting a complex interplay of local economic conditions, investment patterns, and evolving preferences among local buyers and international investors.

4 minutes to read

This article delves into the dynamics of the real estate markets in Manila, India, Kuala Lumpur, Bangkok, and Phnom Penh, providing a snapshot of the current state and emerging trends within these diverse landscapes.

Manila, Philippines: A surge in luxury prices

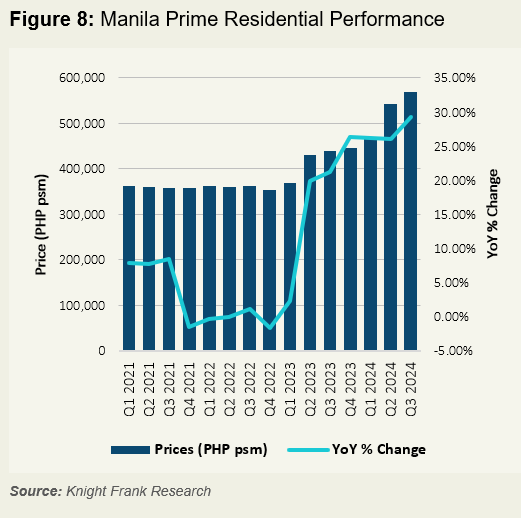

Manila has emerged as the fastest-growing market for prime residential prices globally, according to Knight Frank's Prime Global Cities Index. Luxury residential properties have seen a remarkable surge in popularity, leading to significant appreciation in market value. This growth is largely driven by high pre-selling prices of under-construction projects, reflecting investor confidence in the resilience of the luxury property segment despite rising interest and mortgage rates worldwide.

Significant local wealth creation has supported the rapid expansion of investable luxury residential developments, particularly in the central business district (CBD). Developers are proactively preparing for increased supply to meet this surge in demand, further enhancing momentum in the luxury real estate sector. As a result, Manila's luxury market is attracting both local and foreign investors eager to capitalize on this upward trend.

India: Robust sales in the premium segment

India's residential market has shown remarkable momentum in 2024, with the third quarter recording the highest quarterly sales at 87,108 units—an increase of 5% year-on-year. Notably, the premium segment (properties priced over INR 10 million) has seen significant growth, now accounting for 46% of total sales compared to 35% a year ago, driven by a demand for larger living spaces and upgraded lifestyles, a trend sparked during the pandemic.

The demand for premium properties has driven a remarkable 41% year-on-year growth in this segment, while lower-priced categories have seen declines. This shift indicates a growing focus among homebuyers on quality and luxury living options.

Kuala Lumpur, Malaysia: Sustained demand and diverse options

Kuala Lumpur's residential market remains attractive to both local buyers and investors, evidenced by sustained demand across sales and rental sectors. The diverse range of residential options caters to various demographic segments, ensuring broad market appeal. Government incentives further enhance Malaysia's residential market as an enticing choice for those seeking personal homes and long-term value appreciation.

The shift towards remote and hybrid working models has prompted affluent buyers to seek larger living spaces in prime areas that offer enhanced amenities. Notably, properties in prestigious locations like KLCC, Bukit Bintang, and Mont' Kiara are once again drawing foreign investments crucial for sustaining growth in the prime segment.

Bangkok, Thailand: Resilience and foreign investment

Bangkok's prime real estate market has demonstrated impressive resilience despite challenges such as limited land availability and rising costs in the central business district along the Chao Phraya riverside. The sector boasts a remarkable sales rate exceeding 80% of total supply, highlighting strong demand for high-quality developments. Explore the trends and growth of condominiums near international schools in Bangkok here.

Frank Khan, Executive Director, Head of Residential, Knight Frank Thailand, said, “Successful luxury housing investments hinge on developers' ability to identify and acquire locations that align with market expectations. By concentrating on these coveted areas, developers can differentiate themselves, carving a unique niche within this flourishing sector and laying the groundwork for long-term growth and success.”

Foreign buyers play a significant role in shaping Bangkok's prime real estate landscape, with Chinese investors leading the charge. According to Thailand’s Real Estate Information Center (REIC), the number of units transferred to foreign buyers rose 25% in 2023, with over 45% attributed to Chinese mainland buyers. However, tighter capital controls have slightly dampened their purchasing activity compared to previous years. International buyers are particularly focused on condominiums near mass transit systems and popular retail hubs. Developers are encouraged to prioritise land acquisition near international schools[SR1] to cater to the growing demand from families seeking higher rental returns.

Phnom Penh, Cambodia: Emerging demand for affordable housing

While only 24.2% of Cambodia's population currently residing in urban areas, this is projected to increase to 30.6% by 2030 and a further escalation to 41.1% by 2050, which presents a growing need for affordable housing, especially in Phnom Penh. As young rural populations migrate to urban centres for better opportunities, increasing disposable incomes and reduced borrowing costs drive domestic housing demand.

Ross Wheble, Country Head, Knight Frank Cambodia, said, “Developers are increasingly integrating wellness-oriented features into their projects; however, these additions are more often used as unique selling points rather than being driven by explicit buyer demand. Investment has been pouring in from key countries such as Japan, Singapore, Korea, Malaysia, Chinese mainland, Taiwan, and Hong Kong SAR, reflecting strong international interest in our market.”

In desirable areas like Boeung Keng Kang 1 (BKK1), strong demand for rental properties is attracting both local and foreign investments. The area's central location and amenities make it appealing for renters while offering healthy returns for investors. Rental yields are notably favourable at around 6% to 7%, which is competitive compared to other regional markets.

The Asia-Pacific real estate market exhibits diverse trends across different regions, each with its unique opportunities and challenges. From Manila's booming luxury sector to India's robust sales growth and Kuala Lumpur's sustained demand, these markets present compelling investment prospects. As foreign interest continues to shape these landscapes, understanding local dynamics will be essential for investors looking to capitalise on emerging opportunities in this vibrant region.

For more insights, please download the latest edition of Knight Frank’s Asia-Pacific Horizon series, Quality Life-ing: Mapping Prime Residential Hotspots, report below.