London on track to equal and potentially exceed 2019 full-year occupancy of 82%

1 minute to read

Download the latest hotels dashboard here

In London, Q3 occupancy levels have continued to rebound, attaining 87%, the highest quarterly occupancy performance since Q3-2018. The London hotel market is now on track to equal and potentially exceed 2019 full-year occupancy of 82%. Whilst ADR across the whole of the London market remained flat, certain segments have seen room rates come under greater pressure.

Across regional UK, with Q3 trading predominantly leisure-focused, hotel demand has remained robust, and with trading further supported by sustainable levels of hotel supply. Whilst the uplift in occupancy was stronger than the previous quarter, ADR growth was considerably softer, at 1.8% growth compared to 4.5% in Q2.

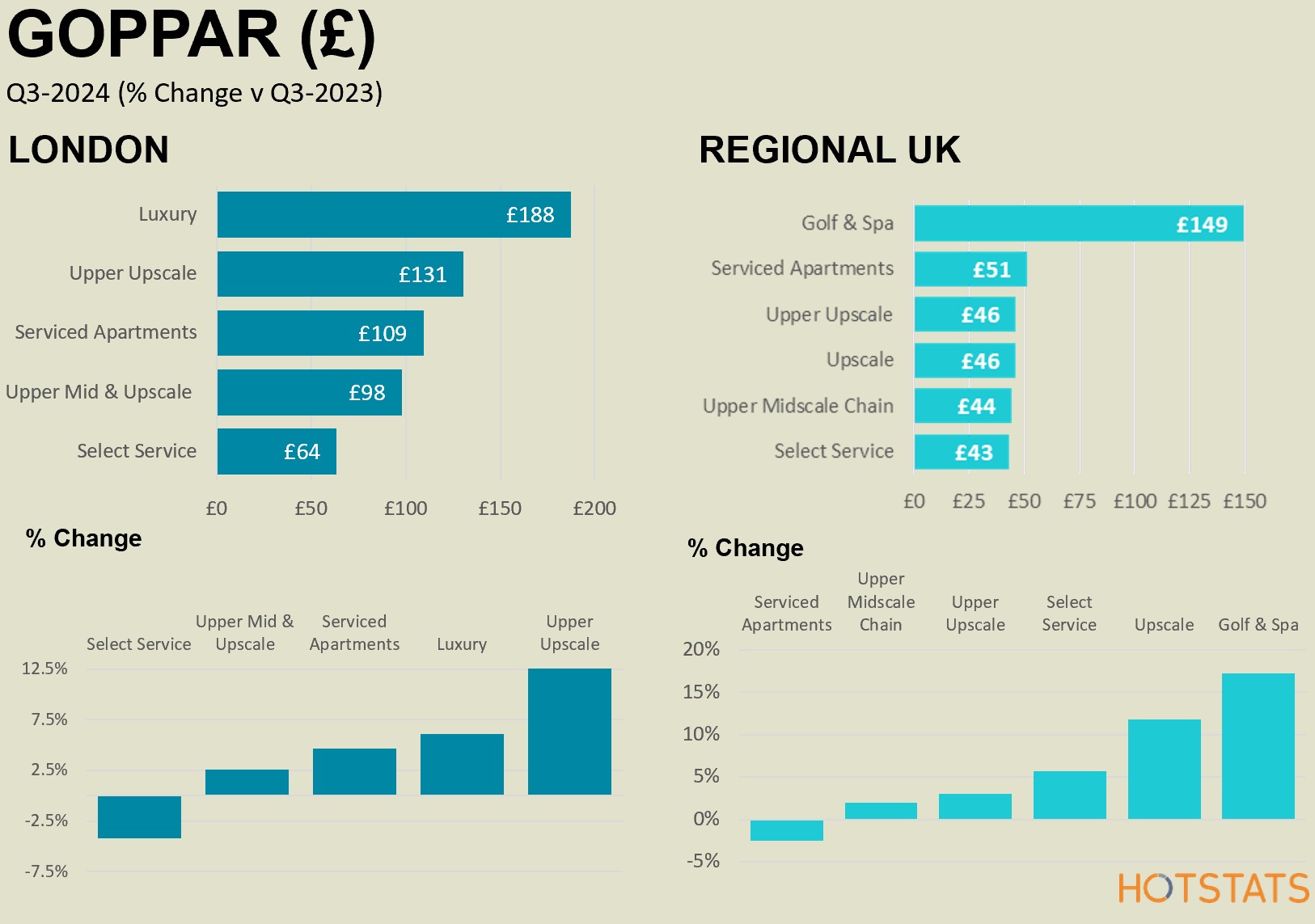

Respectable Q3 GOPPAR growth in London, has been achieved through a combination of revenue growth and costs remaining on par with the previous year. Meanwhile, for Regional UK, growth in departmental income, combined with continued declines in utility costs have supported GOPPAR growth, but with the pace by which profits are growing now slowing.

For the first nine months of 2024, London has seen GOPPAR grow by 6.6% to £99, whilst profits have increased by 7.9% to £39 across Regional UK. In Q3, GOPPAR growth in regional UK slowed to 5.0%, whilst in London a more robust performance saw GOPPAR rise by 7.3% to £122.

For further detailed analysis of the UK Hotel Market Trading Performance, including a visual overview of Q2 hotel investment volumes, take a look at Knight Frank’s new look UK Hotel Dashboard.