Country Buyers Have One Eye on the Budget as Rates Fall

Some discretionary buyers are hesitating although there may be a bounce in activity after the Budget.

3 minutes to read

The Labour Party conference last week did little to calm nerves ahead of an October Budget the government has warned will be “painful”.

Chancellor Rachel Reeves said in her speech there would be no return to austerity but warned of “tough decisions”. Meanwhile, a mood of wariness continues to spread through the wider economy.

House price expectations have reduced, according to the latest HPSI data, while September’s purchasing managers’ index showed decisions were being put on ice due to what it called “jangling nerves”.

Meanwhile, there was another survey pointing to falling consumer confidence.

A snapshot of how the UK property market outside of London performed in the third quarter provides further proof that some buyers are hesitating ahead of the Budget.

In the three months to August, the number of offers made in the Country market was 10% down on last year, Knight Frank data shows. Compared to the five-year average, which was a period marked by high levels of activity during the so-called ‘race for space’, the decline was a quarter.

The Country market covers urban and rural locations over £750,000 outside the capital.

“Parts of the market are in somewhat of a holding pattern again,” said James Cleland, head of the Country business at Knight Frank. “Some discretionary buyers are waiting but those driven by needs such as schooling and jobs are still active.”

The higher the price bracket, the greater the discretion, which was also a key finding of the London super-prime report this month.

The number of exchanges in the Country above £2 million in the three months to August was 20% down on the same period last year. Meanwhile, the drop was only 9% below the £2 million threshold.

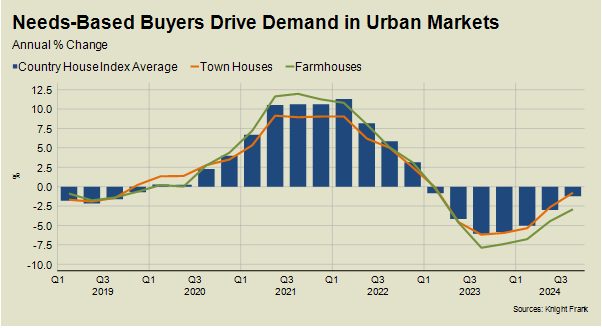

The dominance of needs-based buyers also means demand has been stronger in urban rather than rural locations.

Average prices for town houses declined 0.8% in the year to Q3 2024. Meanwhile, the average price of farmhouses fell 2.9%, in a reversal of the trend seen during the pandemic.

The general mood of uncertainty rather than the threat of any specific tax rise was the issue for some buyers, said James.

“I suspect we may see a bounce in activity after the Budget if it’s better than feared or largely as expected,” he said. “Which means now feels like a good time for a buyer to act.”

If they do, they can take advantage of average prices in the Country that are down by an average of 7.4% from their last peak in Q2 2022.

Despite the decline, the downwards trajectory is slowing. Average prices in the Country were down by 1.2% in the year to Q3 2024, which was the smallest annual drop since Q1 2023.

The primary reason is the improved outlook for rates, despite what has been happening at Westminster.

The number of sub-4% mortgages is growing as financial markets bet on multiple rate cuts over the next year as inflation is tamed.

Despite the government rhetoric, there are other positive economic signs to support housing demand in the longer-term such as a strong labour market and banking sector.

Our latest forecast is that prices in the Country will fall by 2% this year, which may be surpassed if the current trajectory continues.

That will depend on what happens on 30 October, when the economic tone for the next five years is set.