Industrial investment market poised for growth

Real Estate fundraising is on the rise, and with the UK industrial and logistics sector top of investors shopping list, industrial investment volumes look set to climb.

5 minutes to read

Restocking

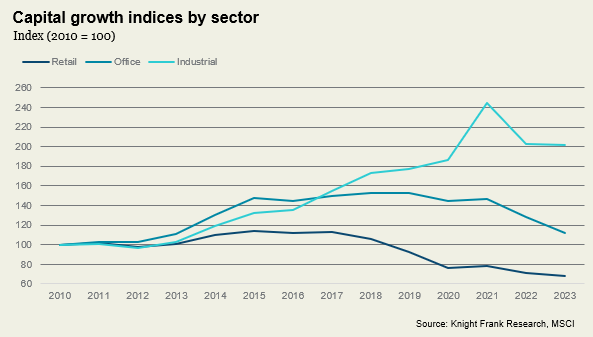

In recent quarters, investment volumes have been lower relative to totals recorded in recent years. Much of the standing investment stock lacked motivated sellers, and while capital values did decrease in 2022/23, the significant capital growth over the past ten years, coupled with robust rental growth has protected most investors. Meanwhile, the rise in development and financing costs coupled with softening of exit yields has led to a sharp fall in development, further reducing the stock available for investors. Many would-be purchasers face have faced limited options. But that appears to be changing….

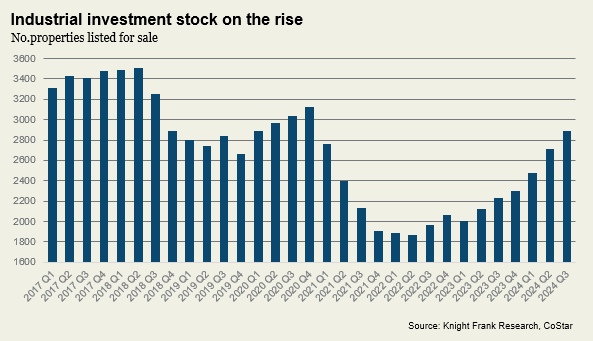

CoStar data shows an upward trajectory for the number of industrial properties listed for sale, with just under 3,000 industrial (including light industrial) properties currently listed as available for sale, up 55% from Q2 2022.

Investors at the ready

Preqin reported that real estate fundraising is increasing, rising 1.9% in Q2 2024, to $33.0 billion. Meanwhile, the latest INREV investor intentions survey (2024) found that the UK’s industrial and logistics sector stood out as the frontrunner for investors country/sector preferences, with London dominating as the most preferred city destination. Sixty-seven percent of European respondents to the survey rated the UK industrial and logistics sector as their most preferred country/sector combination, compared to 77% of non-European respondents.

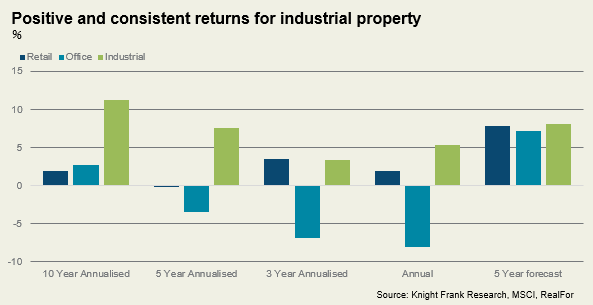

The strong and consistent performance of the sector continues to pique investor interest. Total returns for industrial property have consistently outperformed other property sectors over the one-, three-, five-, and ten-year horizons. Furthermore, over the next five years, total returns for industrial are expected to outpace those of other sectors (RealFor).

When interest rates rose, the greater liquidity of the industrial sector, meant that it repriced more quickly than other sectors. However, most sellers remained unwilling to transact at these lower values, while volatile interest rates led to a pullback from lenders and made it difficult for would-be buyers to determine the correct entry point.

Having spent the past two years on pause, real estate private equity funds have amassed huge strongholds of dry powder.

Yields have been broadly stable for several quarters now, and this is giving investors confidence in pricing for the sector. Meanwhile, we are now in the early stages of a rate cutting cycle, which is helping to lower debt costs and provide increasing impetus for investment.

Development activity could provide further boost to investment

Heightened construction and debt costs, coupled with the softening in exit yields and broader economic uncertainty have meant fewer development starts in the past 18 months. A total of just 22 million sq ft of floorspace is expected to complete this year, compared with 33.2 million sq ft last year and 37.2 million sq ft in 2022.

However, with several rate cuts anticipated throughout the rest of 2024 and into 2025, lower financing costs may help spur a rise in development activity, which, in turn, may lead to greater availability of high-quality assets for the investment market.

Mind the gap

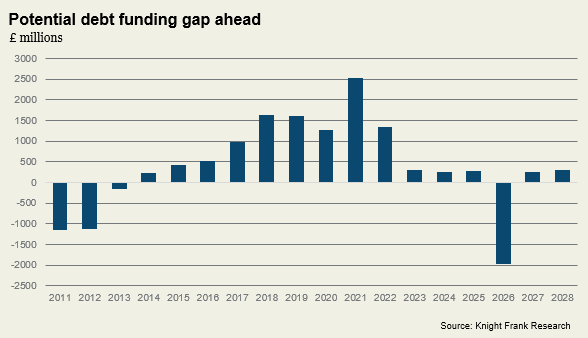

Robust capital growth over the past five years has meant that distress has not materialised in the logistics sector as it did in other property sectors. However, as the market repriced, negative capital growth was recorded in 2022 and 2023. This negative capital growth, combined with more modest expectations for capital growth over the next few years, could lead to a debt funding gap on some industrial properties purchased at the cyclical peak around 2021.

Some investors may choose to sell rather than invest additional equity to cover a potential funding gap. This could provide a further boost to investment stock.

In 2021, £20.9 billion of industrial real estate transacted. If we assume that all of this investment is leveraged and assuming an origination loan at 55% LTV and refinance at 50% and loan term of 5 years, the industrial investment market could face a debt funding gap in 2026 of £1.96 billion, or 9% of the total invested. That is, just short of £2 billion of debt, that cannot be refinanced and additional equity maybe needed to plug the shortfall.

It's important to remember however, that this is an oversimplification. Some purchasers don’t use debt at all, and those that do, don’t necessary maximise their leverage. There has also been strong rental growth since 2021, meaning that even if capital values have declined, income may have risen significantly for some investors over their hold period.

Autumn Budget

All eyes are on the 2024 Autumn Budget on 30 October. While we don’t know what to expect, Chancellor Rachel Reeves has given clear indications that tax increases will certainly feature.

The government has repeatedly claimed that National Insurance, Income Tax, and VAT rates will not rise. However, they have made no such claims about Capital Gains Tax (CGT). Some experts consider it highly likely that CGT rates will be raised to align with Income Tax rates. The 10% tax rate (business asset disposal relief) could also be abolished.

The government will need to ensure that any rise or restructuring of the CGT regime does not deter investment or risk hampering their agenda for growth. Raising CGT has the potential to impact investors in industrial property particularly hard, given the robust real returns generated in recent years, especially if the business asset disposal relief were abolished.

Some of the recent rise in industrial property coming to the market could be attributed to investors bringing forward any planned asset disposals and avoid any negative tax implications arising from the Budget.

Investment rising

Lower investment volumes are a key characteristic of a market going through capital value correction. Buyers are wary of entering a market where prices are falling, and asset owners maybe uncomfortable offering assets into a market with a shallow buyer pool. Buyers’ and sellers’ price expectations may also be misaligned.

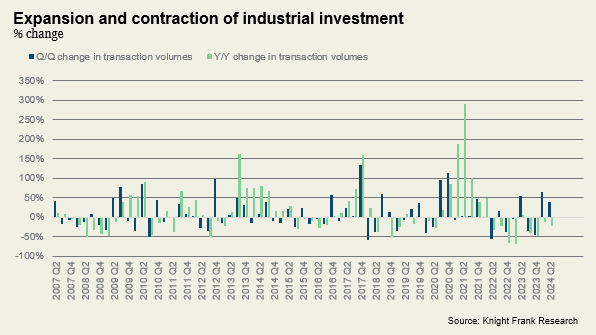

Annual investment into the UK industrial sector rose 38% Q/Q in Q2 2024, following a 63% rise in Q1, suggesting that the tide is turning, with activity picking up. Year on year comparisons remain less favourable, but the quarterly growth figures, though more volatile, provide the earliest indicator of a change in direction for the market. We expect this trend to be further confirmed in the Q3 figures.