Meeting the Commercial Property Retrofit Challenge - Part 1: Defining a Strategy

The potential obsolescence of buildings is accelerating, driven by evolving regulatory, physical, financial, and functional risks, relating to sustainability. This report, the first in a three-part series, outlines the challenges, strategies, and solutions in light of these risks

3 minutes to read

You can find the full report here, but for the quick take and a guide of where to find the information in the report see below.

70%

Regulatory risks loom large: 70% of commercial property floor space is currently rated EPC C or below and, therefore, is at risk of being unlettable if previously proposed minimum standards are implemented in the UK. A 2030 deadline for achieving EPC B ratings in buildings would mean that the pace of retrofitting would need to double. Understanding local market supply and demand will help position asset plan timing and where to focus. Getting ahead of potential future regulation could mean a first-mover advantage, particularly where there is a demand and supply imbalance. We show sustainable office take-up in eight cities on page 5 and from a logistics and retail perspective on page 13.

65%

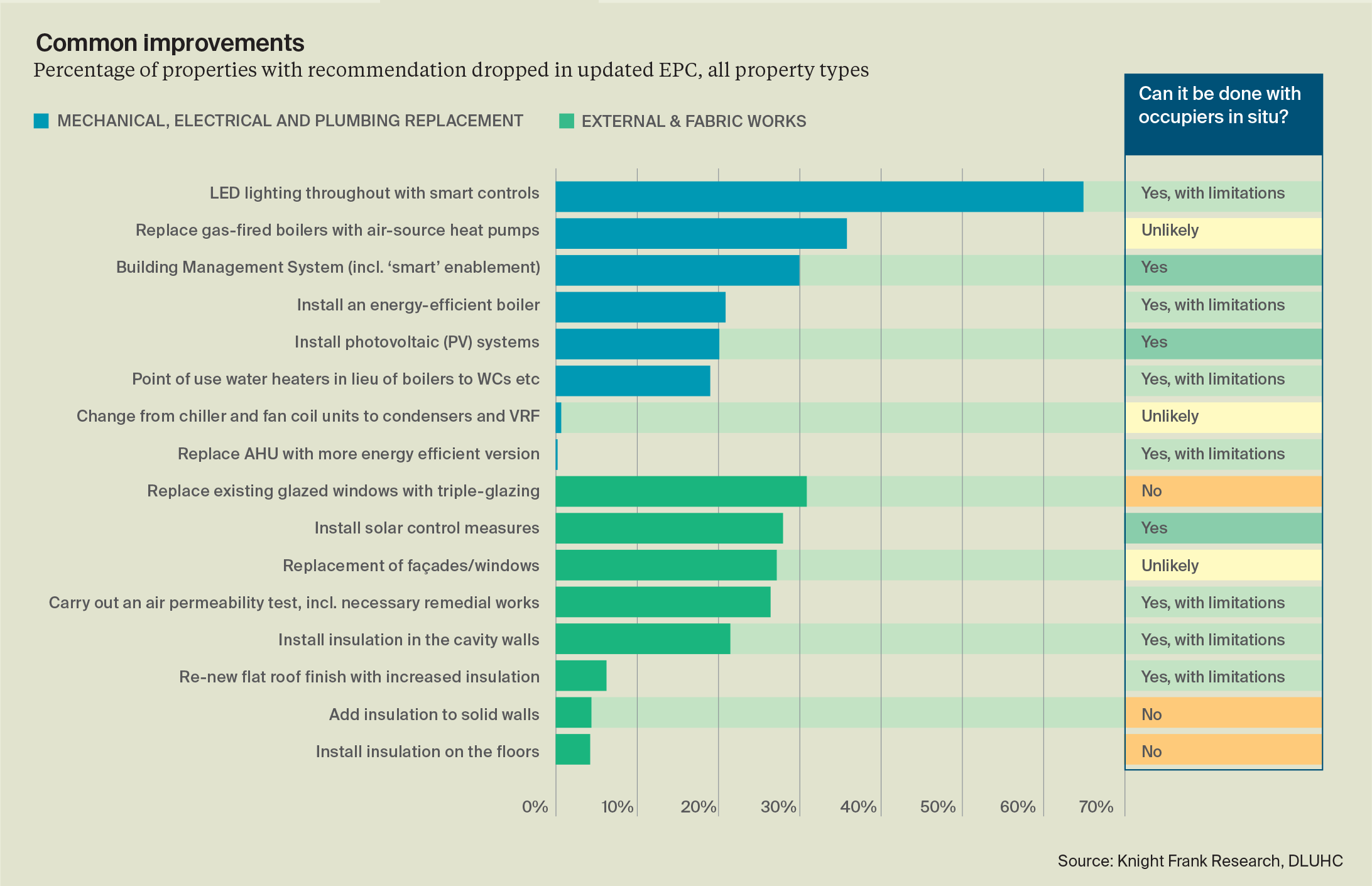

Not all solutions are capex intensive or require vacant possession to be effective: For example, whilst on average four interventions are required, 65% of properties that improved to an EPC B rating installed LED lighting with smart controls, as one of the measures, while only 36% replaced gas-fired boilers with an air-source heat pump, among other actions. Meeting regulatory and functional requirements will likely require sequencing actions and different implementation levels. We assess the prevalence of different improvements to buildings to improve EPC ratings to a minimum of B on page 7.

55kWh/m2

Energy intensity is falling short versus future requirements: The ‘Paris proof’ energy use intensity target is 55 kWh/m² versus an average EPC B-rated office modelled consumption of 184 kWh/m² and an average of all offices of 280 kWh/m2. If the UK is to meet our pledge to be net zero by 2050, this is a significant gap to close and could indicate that the focus of asset owners needs to be on actual energy use and metrics beyond EPCs. We look at this and other metrics on page 9.

43%

Occupiers demand sustainable offices to differing degrees: High sustainability credentials are increasingly demanded, particularly by large, visible global corporates, but for other occupier types, such as education providers this requirement, at least to date, is much lower. Currently, 43% of office space leased by professional companies in London has achieved a minimum rating of BREEAM Outstanding, Excellent and/or EPC A rating. A further 30% is at least EPC B rated and/or BREEAM Very Good. We assess current demand recognising this is likely to grow, for London offices by sustainability level, occupier industry and type on page 10.

4

Planning for future occupier requirements is critical, with E and S elements playing a pivotal role: Any asset strategy needs to be driven by future demand; therefore, we look at what office occupier strategies and wish lists include to identify what amenities and features need to be considered on page 11. On average, office occupiers whose ESG commitments influence real estate decisions to a “great extent” believe their staff require four amenities: the top cited are food & beverage offers, facilities supporting mental wellbeing and gym facilities.

84%

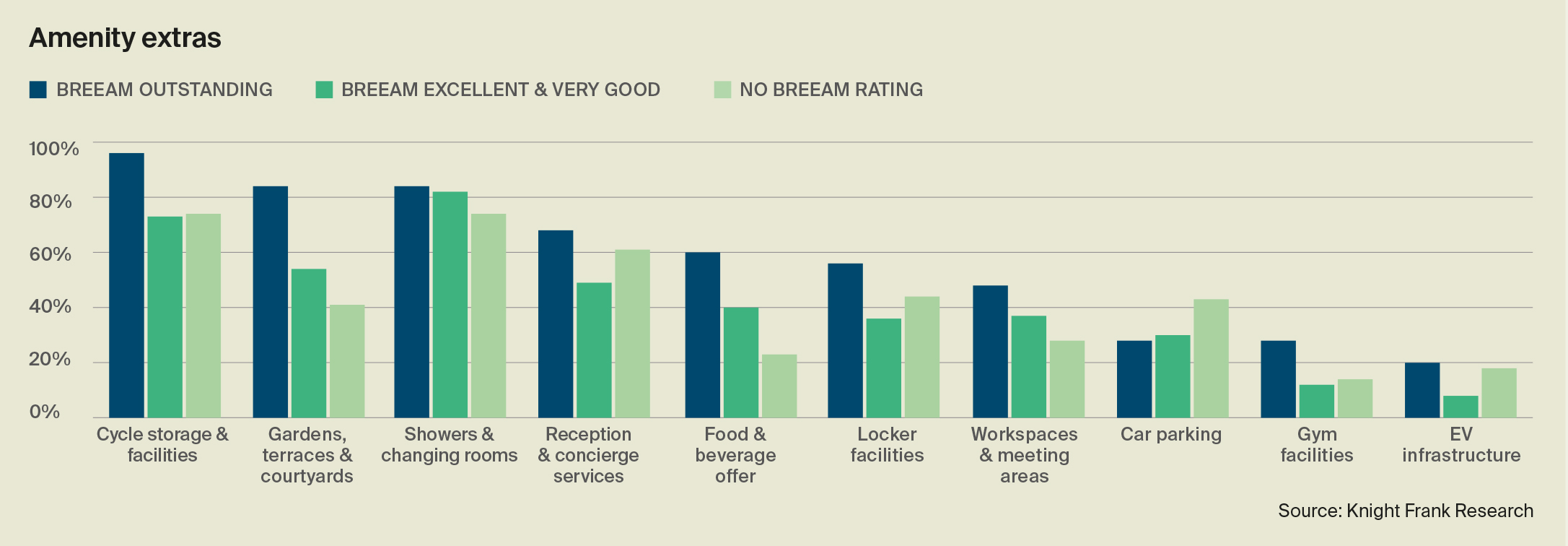

Outdoor amenity provision is high for buildings retrofitted to the best sustainability credentials: 84% of office buildings across England and Wales that have undergone refurbishment and achieved BREEAM 'Outstanding' certification have gardens, terraces, and courtyards, whereas only 54% of those achieving ‘Excellent’ or 'Very Good' have these and 40% of those without BREEAM certification. We explore data from 400 retrofit cases across the UK to understand the amenity level the market is currently delivering and the level of certification achieved on page 15.