European Lifestyle Report: Expert view

We asked three experts what they think are the key trends set to influence the property, visa and tax landscape over the next five years.

4 minutes to read

Property

With falling interest rates, widespread remote work, and longer retirements, we’re at a pivotal moment in the residential property market. Alongside heightened awareness of environmental issues, the generational transfer of wealth, wellness trends, and tourism sensitivities, several factors are shaping the demand and delivery of prime residential homes.

Below are the key trends I think are likely to impact the sector over the next five years:

- Year-round appeal: Prime buyers are increasingly seeking locations that offer year-round appeal with amenities and facilities available 365 days a year, in locations safe from environmental risks.

- Social and political stability: Geopolitical tensions highlight the need for stability. Buyers are prioritising attributes such as rule of law, good governance, ease of doing business, and social harmony, which are crucial for long- term investments.

- Consistent tax systems: Buyers are deterred by erratic tax changes. A stable and transparent tax system, including predictable income, wealth, and property taxes, is essential. They also seek reassurance about exit strategies and capital gains tax (CGT) liabilities.

Green technologies: While luxury buyers have been slow to adopt energy-efficient homes and sustainable materials, there is growing interest in green technologies. Innovations like air quality systems, living walls, solar-powered pool heaters, and smart home automation are becoming increasingly popular.

- Accessibility: Buyers choosing to relocate to Europe value easy access to work hubs, family and friends, and secondary homes. The volatility of flight routes makes tier 1 airport hubs an attractive choice for ensuring reliable connectivity and travel options.

- Flexible ownership models: Models such as rent-to-own, shared ownership, and fractional ownership are gaining traction, particularly in the US due to high property prices and financial flexibility. These models may see increased adoption in Europe, driven by high costs, remote work trends, and urbanisation.

Visas

Residency by investment, or ‘Golden Visas’, allows applicants and their families to live, work, study, and eventually access healthcare in the host country. This residency often leads to citizenship after five to ten years of physical residence, provided certain conditions, such as local language requirements, are met.

A European passport offers unmatched flexibility with free movement throughout EU Member States. Additionally, obtaining residency in an EU jurisdiction helps non-EU nationals manage their 90/180 days Schengen allowance and facilitates compliant travel in the Schengen zone.

This will be increasingly important with the implementation of ETIAS in Q2 2025, an electronic system that monitors visitors entering the Schengen Area and Cyprus from visa- exempt countries. Manual passport stamping will be replaced with EES, an electronic system that tracks the entry and exit of both visa-exempt and visa required travellers, making compliance crucial.

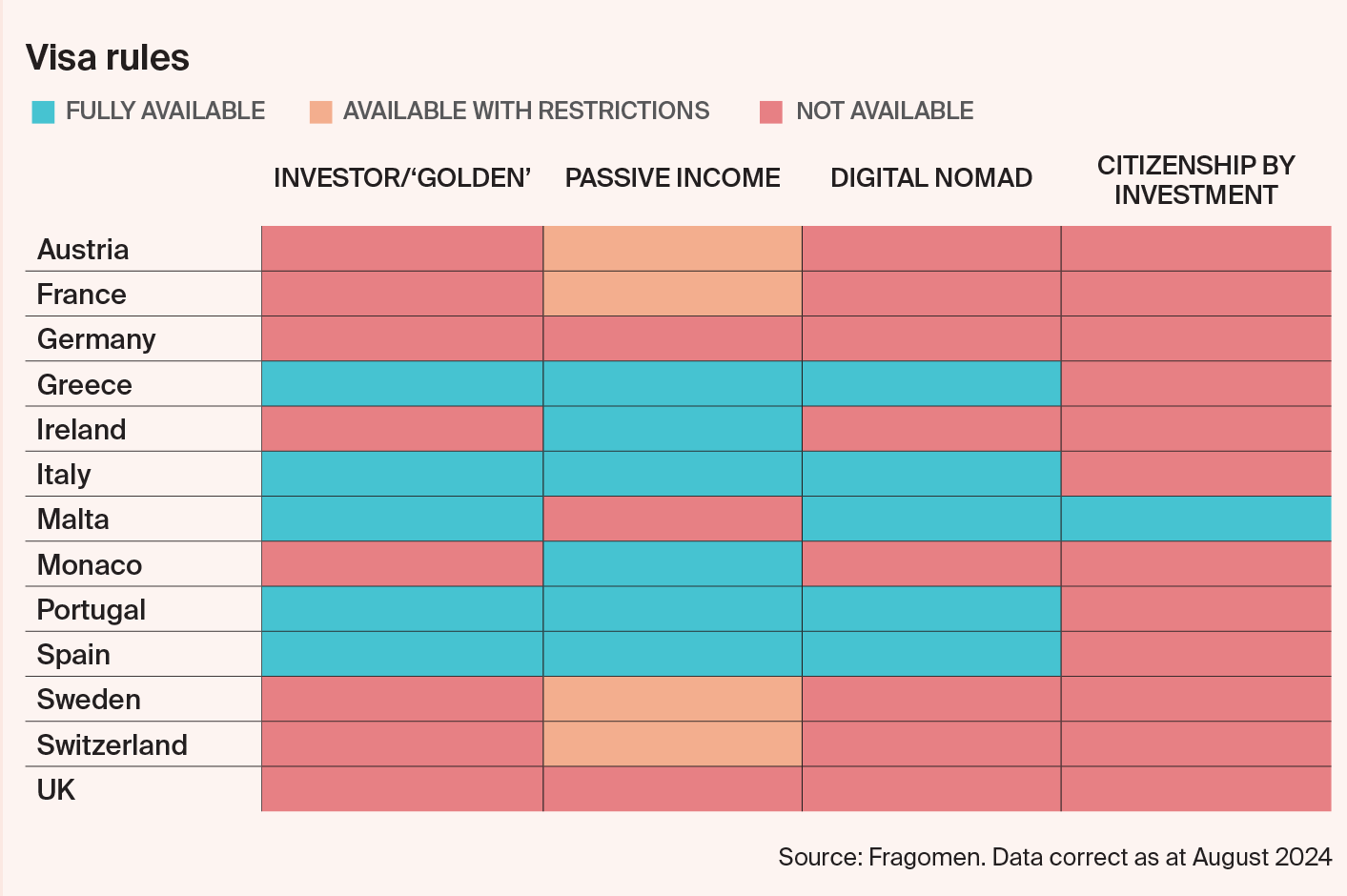

Despite the growing demand for EU citizenship and residency by investment, options are dwindling due to the closure of various programmes and the removal of popular passive investment routes. However, investment options do still exist as well as routes based on passive income, remote working, and discretionary options.

Navigating global investment migration is becoming more complex as high-net-worth individuals seek tailored and discretionary solutions. The reputation of a jurisdiction’s investment migration program is vital, requiring stringent due diligence checks to guard against illicit practices.

Future investment migration models will need to shift from passive real estate investments to more meaningful and active contributions. Traditional Golden Visa applicants may not be able to commit substantial time to any location but can demonstrate their commitment through talents, job creation, and investments in industry and infrastructure. For instance, Austria grants citizenship for valuable contributions, with job creation playing a key role.

In summary, the landscape of residency by investment is evolving, necessitating new models that prioritize active and meaningful contributions to host countries.

Tax

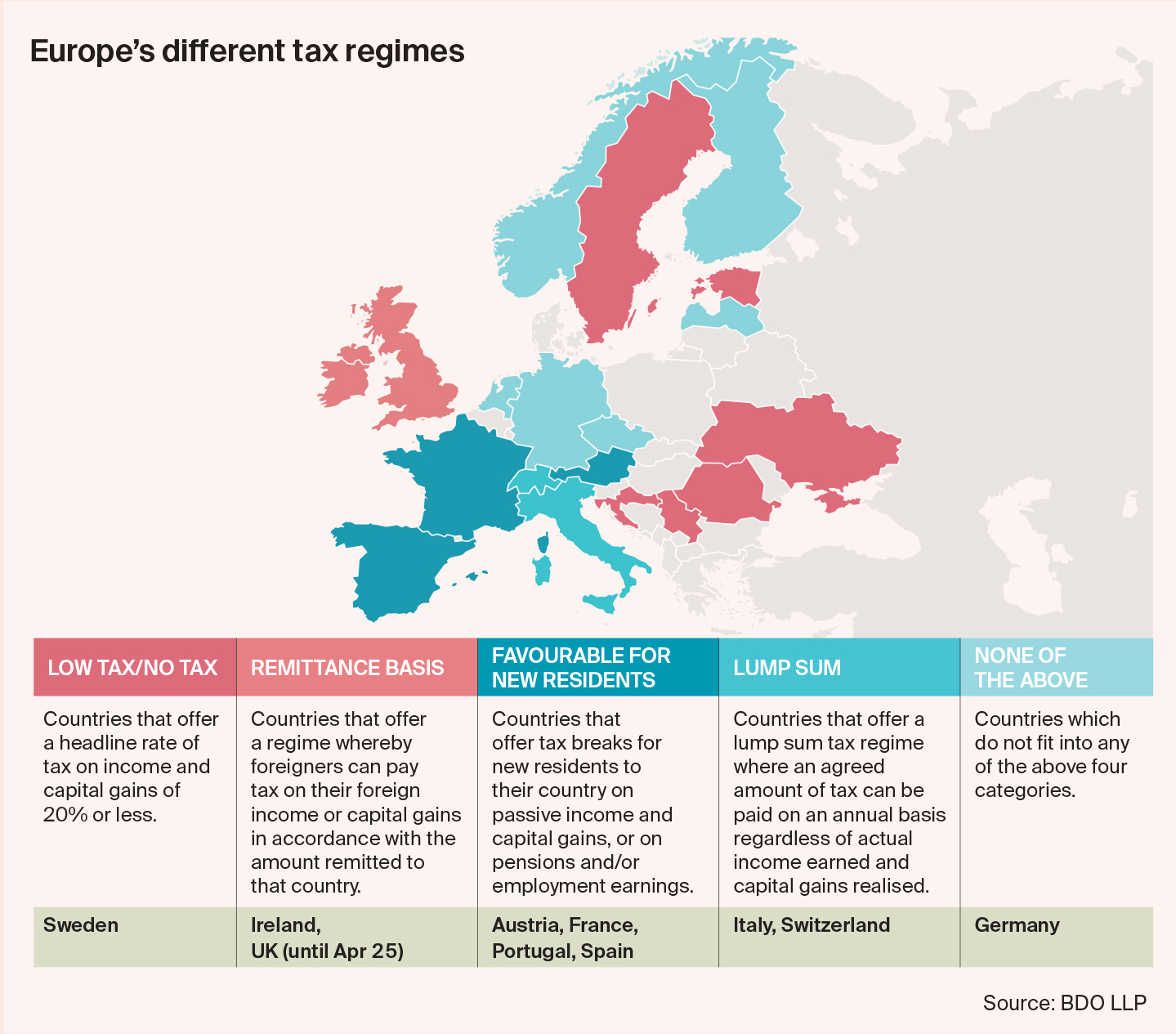

Relocation will be a significant factor. HNWIs often have multiple residences across different countries, allowing them the flexibility to choose where to spend their time. Their choice of a primary base is influenced by lifestyle factors such as safety, healthcare, economic stability, education, and climate. Historically, many European countries have attracted the super-wealthy with favourable tax regimes, but recent changes signal a shift. For instance, Portugal’s Non- Habitual Resident regime was abolished in 2023, the UK is considering ending its remittance basis regime, and Italy has doubled its flat-rate tax. As these changes unfold, governments will need to focus not only on attracting but also on retaining HNWIs as tax residents.

Another emerging theme is transparency. HNWIs are increasingly concerned with compliance in their chosen jurisdictions. Simplifying the tax system and ensuring transparency can make a country more attractive, as it allows these individuals to manage their wealth efficiently while

remaining compliant. As tax authorities become more sophisticated in sharing information and utilising technology, clarity on tax obligations and liabilities will be crucial for HNWIs.

Lastly, succession planning will play a key role in the decisions of HNWIs as they seek to preserve their wealth for future generations. As European countries consider higher taxes, wealth taxes, or inheritance tax reforms to bolster their economies, these changes could significantly influence where the super-wealthy choose to base themselves.

While many European countries will be eager to attract and retain these individuals over the next five years, HNWIs are internationally mobile and can spend time in the places they prefer. Their choice of residence will not be driven solely by tax considerations albeit the appeal of a balanced, transparent and not overly burdensome tax landscape will likely form part of any decision.

Download full report