The Rural Update: Nature-based solutions here to stay

Your weekly dose of news, views and insight from Knight Frank on the world of farming, food and landownership

7 minutes to read

Viewpoint

The formerly upbeat mood music around ESG is becoming distinctly more muted of late. BlackRock, the world’s biggest investor, whose founder Larry Fink lit the touchpaper that fired up the ESG movement when he decreed that companies needed to focus on purpose as well as profit, has tempered its enthusiasm substantially (see story below).

Why does that matter to landowners in the UK? Well, when you own assets worth trillions of dollars your proclamations will have an impact on the behaviour of companies around the world. If their investors like BlackRock are less focused on delivering environmental and social goods maybe they won’t feel obliged to worry so much about it either.

Conceivably, if your glass is half empty, this could slow down corporate demand for farmland-derived, nature-based offsetting products like carbon credits. But those who prefer to take the half-full approach will point to data, such as the latest flood insurance claim figures (see below), that highlight why nature-based solutions are set to become more important.

They might also say with some justification that corporate demand will increasingly focus on genuine high-integrity carbon and biodiversity credits that can withstand any greenwashing allegations. The kind of credits UK landowners are well placed to provide.

In this week's update:

• Red diesel drop

• Wheat import hike

• Unfair dismissal warning

• Phone mast boost

• Plant-based food

• Fund backtracks on ESG

• Rain claims rise

• BNG exemptions

• Country houses - Dipping but outlook brighter

• Farmland - Values hold firm

• Development land - Market stays flat

• Worcester wildlife wonder

Commodity markets

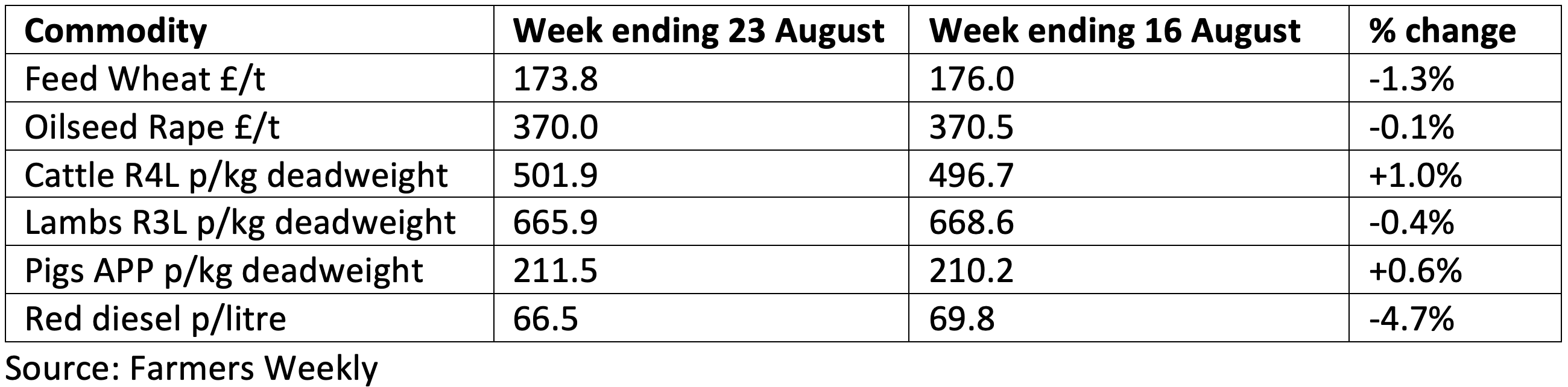

Red diesel drop

Red diesel prices slid sharply last week. The drop comes too late for the bulk of harvest but offers a decent buying opportunity to cover autumn cultivations. The market looks jittery with traders reacting nervously to any weak economic data, particularly from China and the US, and the latest updates from the Gaza peace talks.

Wheat import hike

Poor demand for EU wheat exports has helped weaken prices further. Paris wheat futures have slipped to their lowest levels since the middle of March. The UK, however, is now the fifth-largest importer of EU wheat with over 200,000 tonnes purchased so far, according to Frontier. A good chunk of that is German milling wheat due to quality issues with breadmaking wheat here. Total imports could hit 1 million tonnes, the most since 2012.

News in brief

Unfair dismissal warning

The results of a recent employment tribunal highlight the need to follow proper procedures when making staff redundant. Although the judge found that the claimant, a worker on a livestock farm accused of gross misconduct, would have faced a 70% chance of being dismissed fairly if the correct protocols had been followed, he said procedural breaches, including a wholesale failure to comply with the Acas code of practice on disciplinary and grievance procedures, constituted unfair dismissal and awarded the worker compensation.

Phone mast boost

Another legal ruling could mean landowners will get more rent for any phone masts on their land. The case revolved around the renewal of the lease of a greenfield telecommunications site in Buckinghamshire where a tribunal was asked to re-visit the rental value of “unexceptional rural sites” that had been set at £750 per year. The owner of the site argued this was too low based on inflation and comparable evidence from non-telecoms lettings. The tribunal agreed and decided that the suitable annual rent for a rural mast site is £1,750.

Plant-based food

Although the plant-based meat sector has lost some of its lustre of late it is still a multi-billion-pound industry that retailers are looking to capitalise on, albeit it in more subtle ways that may appeal to a wider base of consumers. It’s not on the shelves here yet, but Lidl has just launched the first beef/plant mince combo in its Dutch stores. The discount supermarket chain claims the new product, which contains 40% pea protein, is 33% cheaper than all-meat mince and has a 37.5% lower carbon footprint. Dairy giant Arla, meanwhile, has just launched a plant-based version of its iconic Lurpac butter in the UK

Fund backtracks on ESG

Last week we revealed that only 5% of companies have carried out an assessment of the impact of their operations on nature. It now turns out that BlackRock, the world's largest investment manager with $10 trillion of assets under management, is becoming less keen on ESG. In 2020, in his annual note to investors, chairman Larry Fink famously said companies needed to have a “purpose beyond profit”. His latest note failed to mention ESG at all, focusing instead on “energy pragmatism” and in the 12 months to the end of June BlackRock supported just 20 (or 4%) of the environmental and social proposals put forward by shareholders at the annual meetings of the firms in which it invests.

Rain claims rise

Insurance claims related to wet weather, including flooding, hit a record high of £144 million, in the second quarter of the year, according to the Association of British Insurers. The Met Office confirmed earlier this year that the 18 months leading up to April 2024 were the wettest on record. The claim figures, which are increasing year on year, show why policymakers need to create effective catchment-level flood-prevention strategies involving farm and estate owners. Knight Frank’s Geospatial team can look at potential flooding risks to properties downstream from estates to help identify where nature-based solutions on those estates would help communities. Get in touch if you would like to find out more.

BNG exemptions

Defra has updated its guidance on what developments are exempt from the Biodiversity Net Gain (BNG) requirements that came into force on February 12th this year. More clarity has been added about what criteria a development must meet to qualify for exemption as a self-build or custom build.

Research

Country houses - Dipping but outlook brighter

The average value of country houses nudged down by a further 0.6% in the second quarter of the year taking the 12-month fall to 3%, according to the latest results from the Knight Frank Prime Country House Index. Homes priced between £1 million and £2 million recorded the biggest annual fall of almost 4%, while those worth between £4 million and £5 million dipped by just 0.4% - potential buyers at this level are less dependent on mortgage funding, points out Head of UK Residential Research Tom Bill. He predicts a total average price slide of 2% this year, with values bouncing back by 3% in 2025 as interest rate cuts boost market confidence.

Farmland - Values hold firm

The farmland market in England and Wales shrugged off the potential impact of the recent general election to register another quarterly price increase, according to the latest results from the Knight Frank Farmland Index. Average values nudged up by almost 1% in the second quarter of the year to hit £9,335/acre. For more insight and data please download the full report.

Development land - Market stays flat

The value of greenfield development sites remained static in the second quarter of the year, according to the latest results of the Knight Frank Residential Development Land Index. Over the past 12 months, the index is down 2%. According to Anna Ward, who compiles the index, developers have welcomed Labour’s commitment to reinstate local housing targets and recruit more planning officers. But with interest rates failing to shift and build costs increasing, homebuilders still face significant headwinds, she adds. Download the full report for more insight and data.

Property of the week

Worcester wildlife wonder

Bentley Court is a 170-acre Worcestershire estate, near Holt, that has been farmed in a nature-friendly way for many years. Fourteen acres of tree planting has been carried out and the estate’s 35 acres of pasture, home to a flock of rare-breed sheep, has not been fertilised or sprayed for the past 15 years. An extensive amount of straw and manure has been incorporated into the 110 acres of arable land, significantly improving soil quality. The estate sits around an attractive Grade II listed house thought to date from the 1790s. The guide price is £6.25 million. Please contact Georgie Veale for more information.