Italy’s allure: Tourist boom, tax perks, and hybrid work drive surge in interest

Interest in Italy is strengthening. Tourist numbers are on the rise driving up investment returns for holiday accommodation.

2 minutes to read

The country’s non-dom tax policy is luring more foreign residents, enticed by the Mediterranean lifestyle and fiscal benefits. Plus, the post-pandemic rise in hybrid working has unleashed a cohort of mobile workers eager to embrace the dolce vita.

Despite tighter monetary policy, prime prices in Italy remain resilient, buoyed by constrained supply. Sales volumes experienced a decline when the European Central Bank initiated interest rate increases in 2022. However, with rates now coming down, we anticipate a resurgence in demand and sales activity. This recovery will occur against a backdrop of constrained new supply, as elevated construction costs continue to impact developers’ profit margins.

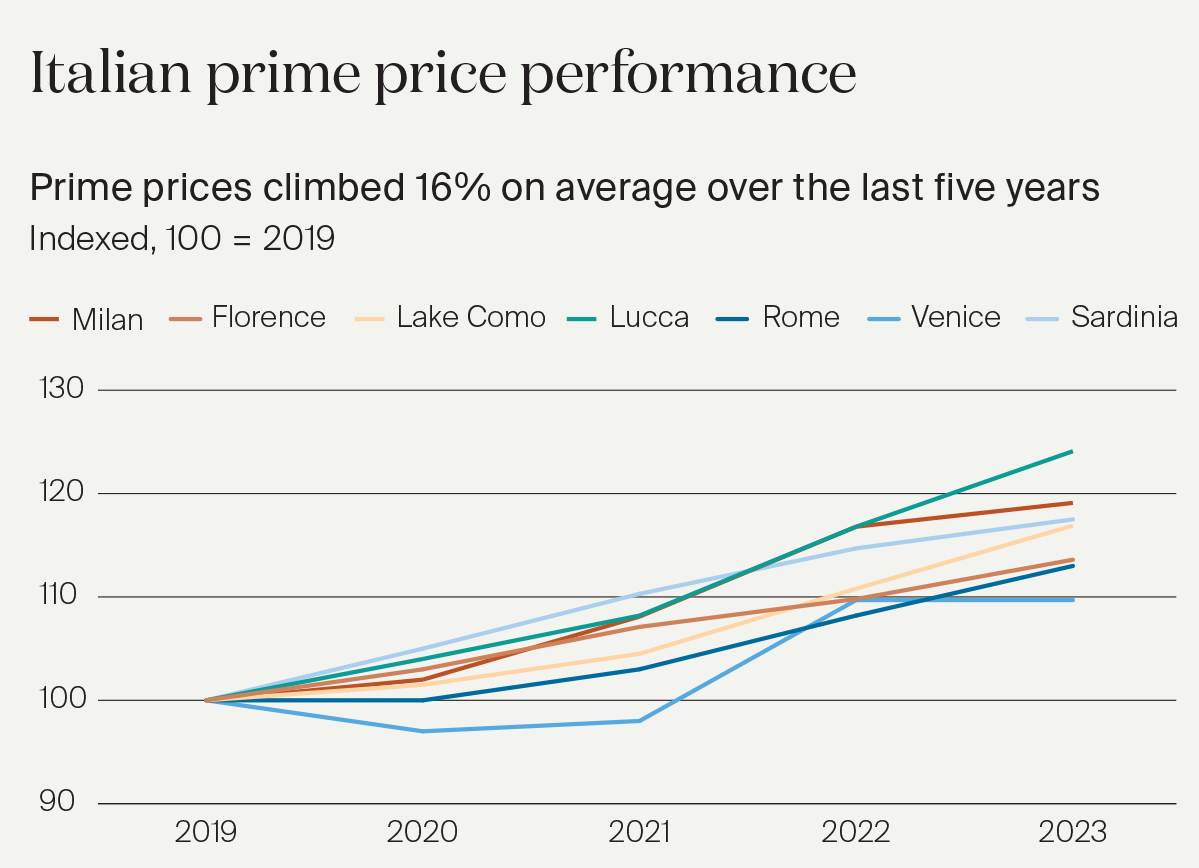

Prime prices grew by an average of 4% in 2023 and stand 16% higher than pre-pandemic levels in 2019. Lake Como and Florence led the price growth rankings for 2023, with Lucca and Milan topping the rankings over the last five years.

New visa

For non-European Union (EU) residents, including UK citizens since the UK’s official departure from the EU in January 2020, long-term stay options in Italy have been limited. However, the unveiling of a new digital nomad visa in April 2024 targeting skilled workers with an annual income of €28,000 or more, is poised to amplify rental demand in tech hubs like Milan and Rome.

Flat tax

While landmark events and visa changes may spark temporary surges in demand, the real gamechanger for Italy remains its flat tax or non-dom tax regime. Introduced in 2017, this policy continues to be a significant attraction, putting Italy on a similar footing to Monaco and Switzerland for some individuals. Ultra-high-net-worth individuals (UHNWIs) pay a single flat rate of taxation, €100,000 per annum, on foreign income in return for Italian residency.

Data from Italy’s Ministry of Finance reveals some 957 overseas residents have relocated to the country and now pay the single rate of tax.

With global wealth increasingly mobile, driven by geopolitical tensions, economic uncertainty, and a series of elections many of which are likely to trigger significant tax and policy changes, Italy is poised to be a focal point in this shifting landscape.

According to Knight Frank’s Wealth Report 2024, the number of UHNWIs in Italy, defined as those with a net worth of $30 million or more, is projected to increase by 19% over the next five years.