What does the Labour Party mean for ESG and property?

On July 4th, the UK voted the Labour Party into power with a landslide, below we look at what this shift means for the sustainability agenda and for property.

7 minutes to read

Renewable energy front and centre

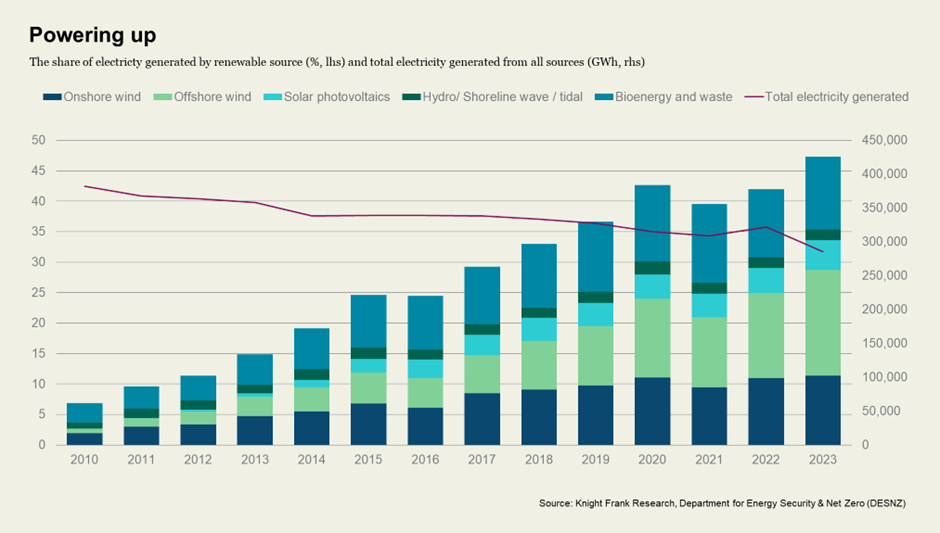

The Labour Party manifesto made clear a desire to decarbonise the UK’s energy supply to battle climate change, enhance energy security and reduce household costs. There will be a new Energy Independence Act to establish the framework for these energy and climate policies; central to this is decarbonising the grid by 2030. In 2023, renewables accounted for a record 47.3% of all electricity generated in the UK, up from 41.9% in 2022, with offshore wind accounting for 17.4%, onshore wind 11.4% and solar 4.8%.

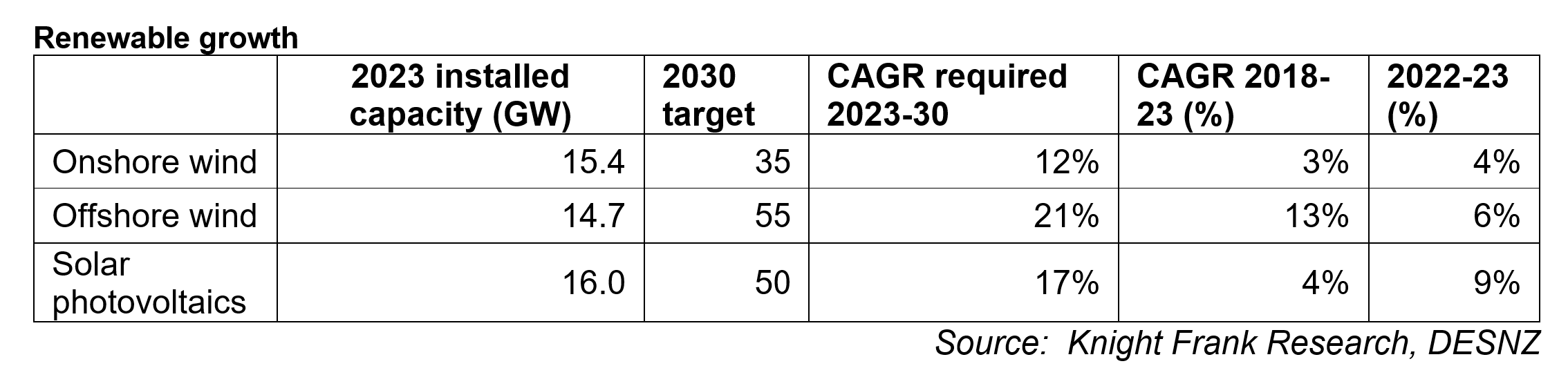

Doubling down on these technologies form the heart of the decarbonisation plan, which includes doubling onshore wind capacity to 35GW, tripling solar photovoltaics (PV) power to 50GW, and quadrupling offshore wind to 55GW. This is no small feat. Capacity of onshore wind, offshore wind and solar PV will need to grow by 12%, 21% and 17% respectively if this is to be achieved - two to four times the rate of the past five years (see table below).

Our Solar Power Report from December 2023 highlights the potential for expanding solar installations beyond green spaces to include grey spaces, like car parks, similar to moves made in both France and parts of Germany. Property owners have opportunities for ancillary income through power purchase agreements and boosting the attractiveness of sites to tenants through proven clean energy supply.

Grid capacity is also likely to be an issue, with current connection dates for some new schemes already stretching into the 2030s. The manifesto pledges to work with industry to upgrade national transmission infrastructure and “rewire Britain”. The National Grid has previously begun reforming the process by implementing active queue management and removing those not meeting critical development milestones. Some 7.8GW of clean energy projects have had their connection offer dates brought forward by up to 10 years as a result.

But grid capacity is only one piece of the puzzle. "Whilst the incoming government have committed to a rapid rollout of renewables and to address the challenges with grid connections, the immediate issue is planning," notes David Goatman, global head of energy, sustainability, and natural resources at Knight Frank. "With over half of the renewable planning applications submitted over the past five years still undetermined, this is the clearest barrier to deployment."

Our analysis of the Renewable Energy Planning Database, which tracks projects of over 150kW capacity, finds that, on average, for onshore wind, the time from planning submitted to granted is around two years; for solar, it's just over four months. Some 87% of those applications submitted and granted in the past five years are still awaiting construction, with wind projects taking over three years from approval to construction and four years to become operational.

Great British Energy to spur investment

Labour plans to establish Great British Energy to 'partner with industry and trade unions to deliver clean power by co-investing in leading technologies; help support capital-intensive projects; and deploy local energy production to benefit communities across the country.' To support this, Labour will provide £8.3 billion worth of funding to Great British Energy over the next parliament.

In addition, establishing a National Wealth Fund is mooted to support growth and clean energy missions with £1 billion to accelerate the deployment of carbon capture and £500 million to support the manufacturing of green hydrogen. Other incentives, such as a British Jobs Bonus for clean energy developers are on the table, allocating up to £500 million per year from 2026.

Green Finance capital of the world

The UK is already seeking to make a mark on green finance with the Green Finance Strategy, set out in 2023. The government and the City of London Corporation backed the formation of the Green Finance Institute (GFI) in 2019. In a recent article by Bloomberg, Rhian-Mari Thomas, who now runs the GFI noted that “the City of London is blessed with bankers, investors and insurers able to structure deals to support the move away from fossil fuels”. The GFI is partnering with a group of UK financial firms, including Aviva and M&G, to develop investment vehicles to accelerate Britain's efforts to reach net-zero emissions. The Labour Party have also pledged to reverse the Conservatives' decision to prevent the Bank of England giving due consideration to climate change in its mandate.

To further aid the energy transition and broader net zero goals, there is a focus on unlocking finance to make the UK the green finance capital of the world. This will include mandating UK-regulated financial institutions — including banks, asset managers, pension funds, and insurers — and FTSE 100 companies to develop and implement credible transition plans that align with the 1.5°C goal of the Paris Agreement. The ambition is aligned with the EU's recently adopted Corporate Sustainability Due Diligence Directive.

For property, this could mean enhanced ESG due diligence on lending, stricter criteria, and financial repercussions for inefficient assets. On the flip side, we could see a greater level of lending for improving building efficiency. Lisa Attenborough, Knight Frank's head of debt advisory, points out: "We could see more lenders raising ESG-specific funds which are competitively priced to advance decarbonisation. For lenders, there are several potential benefits in doing this, including lowering of risk due to increasing occupier demand for sustainable assets and the positive impact that should have on estimated rental value; value enhancement and, therefore, lower LTVs; and a positive environmental impact which is a strategic consideration for many lenders at the moment." The introduction of the UK's Sustainability Disclosure Requirements includes labels for 'Sustainability Improvers', which could further advance this pool of capital.

Efficiency improvements

An area that has been spoken about extensively across all sectors is energy efficiency. We need to upgrade a significant amount of our building stock. More than half of the residential stock in England is below EPC C. Rishi Sunak, in September 2023, removed the tightening of energy efficiency standards in the private rental sector, which Labour will reverse. They have pledged to ensure homes in the private rented sector meet minimum energy efficiency standards (MEES) by 2030; whether that is EPC C remains to be seen. Some 3.7 million dwellings are below EPC C for the private-rented stock.

Labour has pledged to invest an extra £6.6 billion over the next parliament to upgrade five million homes. To cut bills, the Warm Homes Plan will offer grants and low-interest loans to support investment in insulation and other improvements such as solar panels, batteries, and low-carbon heating. The UKGBC estimates that investment in the region of £64 billion will be needed over 10 years as part of a long-term strategy – this is somewhat short.

What was not mentioned was the non-domestic sector. Some 70% of commercial floor space is below the previously proposed minimum of EPC B. Whilst many in the industry have begun looking at efficiency improvements due to mooted MEES, several other factors are at play. The increase in disclosure requirements remains (around 40% of respondents to our ESG Property Investor Survey require EU Taxonomy compliance or SFDR alignment with acquisitions), net zero targets and occupier requirements lead towards more sustainable, wellbeing-supportive buildings. In addition, the above-cited financial institution policies could add more impetus. However, certainty and clear direction are required to drive significant investment at pace to tackle climate emissions in one of the largest contributing sectors.

The British Property Federation (BPF) noted that, in addition to MEES: "Zero-rate VAT on repairs and maintenance of residential buildings, increased investment into the UK's electricity grid, sufficient resources for local authorities and simplified processes for solar panel installation are among further recommendations."

Other policies of note

The new government has also pledged to reverse another of Sunak's September 2023 announcements by restoring the phase-out date of 2030 for new cars with internal combustion engines and to enhance electric vehicle (EV) sales by supporting buyers of second-hand EVs by standardising the information supplied on the condition of batteries.

On nature, they pledge to create nine new National River Walks and three new National Forests in England, planting millions of trees and creating new woodlands. They also pledge to expand nature-rich habitats such as wetlands, peat bogs and forests and are 'committed to reducing waste by moving to a circular economy.'

Time will tell, the King's Speech and Autumn Statement will offer more detail on these manifesto pledges.