The impact of elections on property markets

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

We now know we'll be having an election on July 4th, but what do we know about the likely outcome?

The Labour Party has a 17-percentage point lead over the Conservatives, according to a poll published yesterday evening by More in Common, which is a member of the British Polling Council. It is the first poll taken since Prime Minister Rishi Sunak announced the date of the vote and actually paints a more favourable picture for the Conservatives than many others.

Labour has an average poll lead of 23 percentage points, according to the Economist. That's a deficit that no governing party has successfully overcome in an election campaign. The central scenario of The Economist's prediction model, which draws from polls and the results in individual constituencies in elections dating back to 1959, is that Labour will win 381 seats to the Tories’ 192, a thumping majority of 112 mps.

The model gives less than a 1% chance that the Conservatives would win a majority of seats if an election were held tomorrow. Even if Labour’s poll lead narrows to 15 points, that model still gives the Tories about a one-in-ten chance of victory (rather than 1-in-100).

The impact on housing transactions

Do elections impact the housing market?

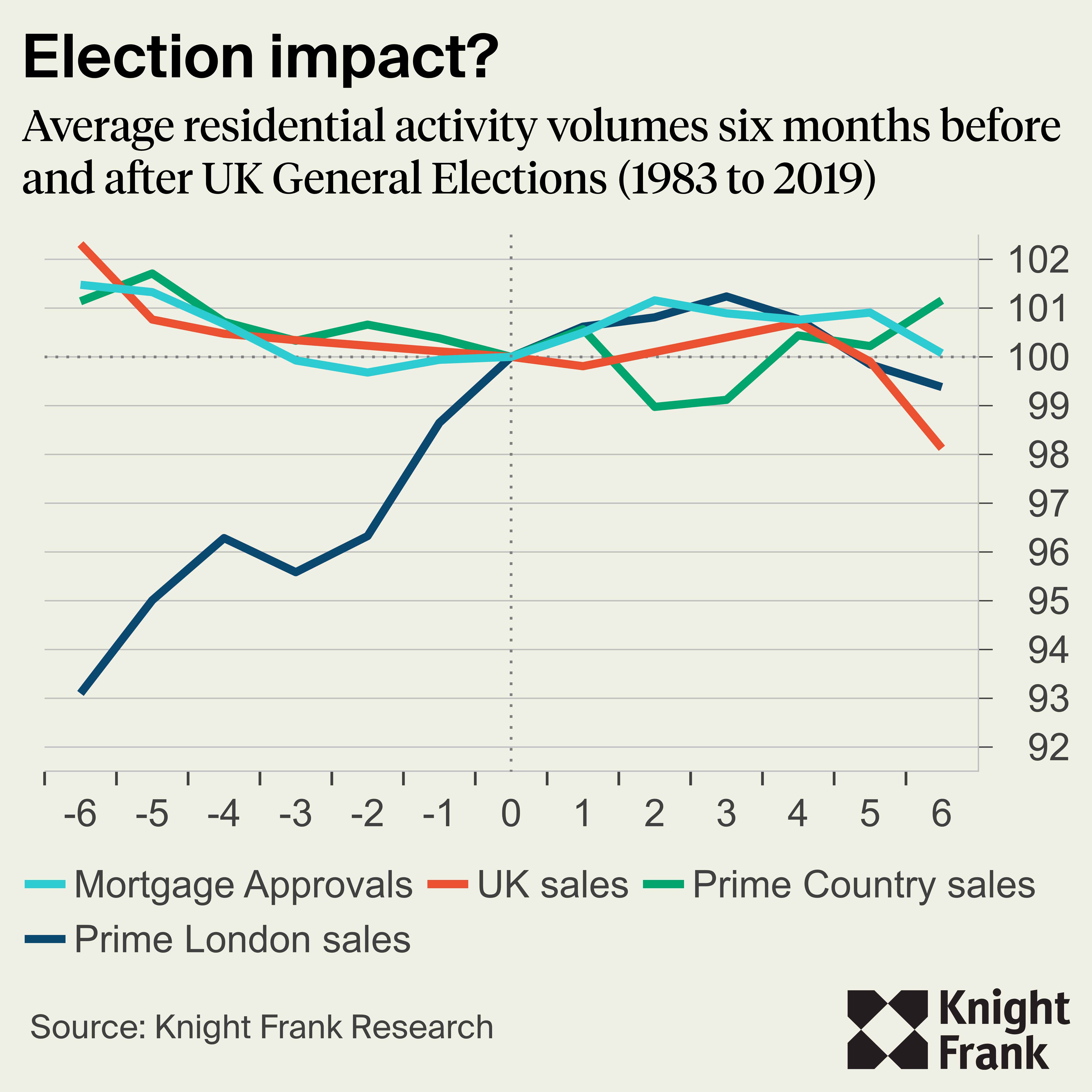

The assumption is they do, but the reality is a little less clear-cut. This chart below shows the number of transactions across the UK in the prime country and prime London markets in the six months before and after each election since 1983.

Assume 100 sales took place during the election month - how many took place leading up to and after the event? In most cases you can't really see any impact from the election. The only market that seems a little noisier in terms of the data is the prime London market, where transactions appear to rise towards the election date. After the election transactions tend to continue as before in all markets. Even when we look at a more timely indicator like mortgage approvals, there doesn't seem to be an obvious impact from general elections on activity.

The economic outlook

Economics will be among the biggest factors that dictate how people vote. As the Economist notes (linked above), Labour enjoys a rare lead over the Tories among voters as the best party on the economy, but at 8% the advantage is much narrower than its overall polling lead.

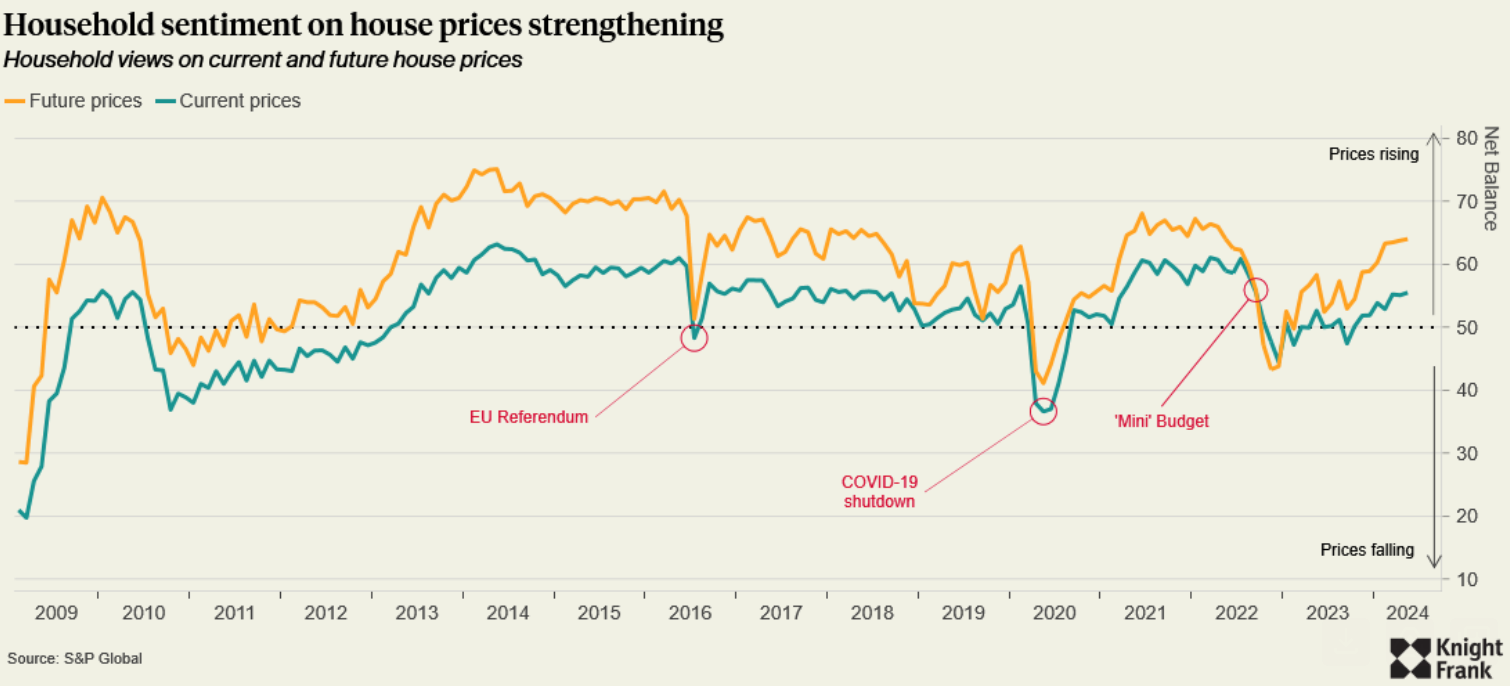

Rishi Sunak declared victory over inflation during his speech on Wednesday and by most measures, people do think conditions are improving. British consumer confidence rose in May to its highest in nearly two-and-a-half years, according to a GfK survey out this morning. Measures of household sentiment on the current and future trajectory of house prices are running at their highest levels since 2022 (see chart).

It may yet be the case that people end up voting exactly two weeks after the first rate cut by the Bank of England, which will impact sentiment further. Hopes of a June rate cut were dashed to some extent by Wednesday's inflation print that showed rising prices in the services sector are barely slowing, but figures out this morning suggest that may soon begin to shift. Respondents to the latest flash PMI, out yesterday, suggests that inflation in the services sector is running at its slowest pace for three years, weighed down by softening labour costs.

Calling the bottom

It's not just homeowners that are more bullish on property values. Last Friday I wrote about the Landsec annual results in which the company pointed out that declines in commercial property values were "coming to an end". We've since seen results from British Land and GPE.

British Land said values had been stable during the second half, while GPE chief executive Toby Courtauld told the Times that office "rents are growing and [property] yields, by and large, have stopped moving." Mr Courtauld continues in the results, which you can read here:

"We remain strong believers in London's long-term prospects; whilst its occupational markets, particularly for centrally located, Grade A space continue to power ahead with growing demand and shrinking supply, we believe its investment markets are at an inflection point; macro-economic effects ushered in a prolonged period of high inflation and elevated interest rates, triggering capital value declines of 58% in real terms since 2016, to levels we last saw after the GFC in 2009. We believe values are now at or around their cyclical trough and consequently, we turned net buyer during the year for the first time since 2013, acquiring £152 million of opportunities since March 2023 at an average 42% discount to replacement cost.

The company announced a £350 million rights issue "to take advantage of the attractive new acquisition and development opportunities emerging in central London commercial real estate."

In other news...

In a new edition of our Intelligence Talks podcast, Anna Ward is joined by Nick Alderman, Knight Frank's head of central London land. Anna uncovers where the next development hotspots are going to be, and of course covers the likely impact of the election on the land market. Listen here, or wherever you get your podcasts.

Knight Frank has launched its spring UK Residential Property Sentiment Survey, we'd be grateful if you could take part, and we'll share the results over the coming weeks.

Elsewhere - Fears on inheritance tax surface among wealthy landowners (FT).