Capital Markets overview – Looking forward to 2024

4 minutes to read

Undoubtedly, 2023 proved challenging for the South East office investment market, with volumes finishing at £1.3bn, 54% below the 10-year annual average. This low total should come as no surprise - a downward spiral of macroeconomic and geopolitical conditions heightened risk, while the high cost of debt and the structural shift legacy of COVID-19 questioned viability. The conclusion for most investors, therefore, was simple: to wait.

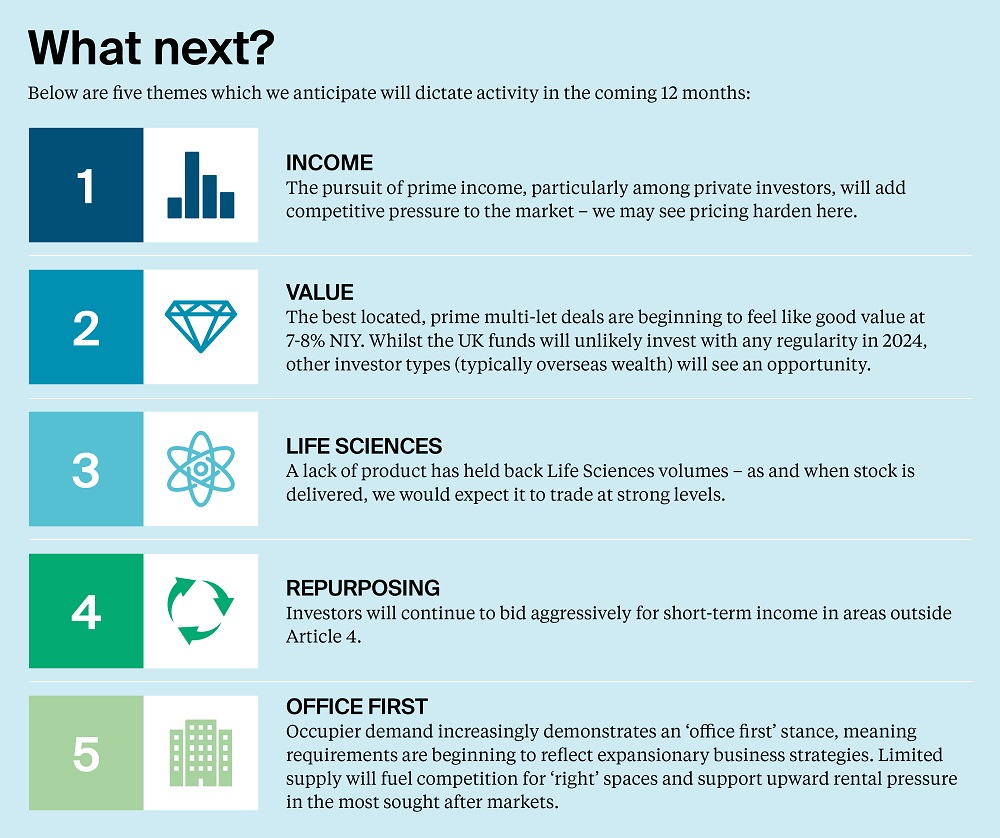

A retreat from the market is not a long-term option, however. Opportunities began to develop towards year-end as inflation sustained a downward trajectory and debt markets showed small reductions. Crucially, pricing has now shifted to an agreeable level for some purchasers and vendors. Activity is consequently beginning to pick up, and, following a period of concentrated attention in the sub-£15 million market, a handful of larger lot sizes have gone under offer.

But not all markets are created equal.

Undeniably, the South East office market has shrunk. Once comprised of 50+ individual markets, investor and occupier activity now concentrates on a selection of growth areas. Polarisation has widened, with the best buildings in the most active locations recording record rents, often 10-25% ahead of previous peaks. Conversely, older stock in less favoured peripheral locations is subject to material change. The recent relaxation of Permitted Development Rights means office acquisition interest is often accompanied by an ‘alternative use’ underwrite.

So, what will underpin momentum in South East office markets moving forward?

Whilst the office market sees a general trend of declining stock, the Life Sciences market remains an area of demand, innovation and growth. The sector is subject to substantial investment from both the public purse and private capital. In 2023, two of the three transactions above £50m were Life Sciences deals, highlighting the level of liquidity and the lower cost of capital available for this type of asset.

Oxford and Cambridge - the principal ‘Life Sciences’ hubs of the South East - have carried strong favour. The two cities accounted for 44% of total market development in 2023, and these markets account for 45% of speculative development currently under construction.

But it’s not just Life Sciences. The market for prime and income is regathering pace.

Investor focus is concentrated in locations that offer the strongest occupational backdrops, but quality is vital to pricing. After an outward shift, prime office yields in the South East (excluding Life Sciences) stabilised at 7.00%, reflecting a margin to City offices of 175bps and 325bps to West End offices.

A steadfast occupier preference for the best and greenest buildings underpins this level. Recent deals that support this include the sale of North Bailey House in Oxford, which exchanged at 6.85%, as well as the sales of 10 Bricket Road, St Albans, and St Paul’s House, Winchester, which both traded at 7.25% NIY.

Private investors, particularly from the Middle East, have grown in number in recent months and shown particular interest in secure, longincome streams. In Q3 2023, the Kia HQ in Walton-on-Thames transacted at 7.00%, and 22 Market Street in Maidenhead at 7.28% - both 11 years income, purchased by Kuwaiti money. The pursuit of prime and income will be the mainstay of the market in 2024.

At the other end of the spectrum, many secondary and tertiary markets are experiencing a relative oversupply of offices. The shifting dynamics of occupier demand combined with a lower rental tone and elevated build costs are challenging the viability of some offices. More recently, the higher cost of capital has exacerbated the situation, with investors requiring higher returns and more cautious exit yields. The result? Stranded assets and obsolescence.

In early March 2024, however, the Government relaxed the criteria around Permitted Development, with the size limit (previously 1,500 sq m) and the three-month vacancy rule both scrapped. The saleability and value of many office buildings across the South East could now experience a positive shift following this change.

Moving into 2024, the market registered £398m in investment volumes in the first quarter. A positive start to the year, notably 23% ahead of 2023’s quarterly average. Inflation continues to fall, and a reduction in interest rates is forecast for the second half of 2024. A lower cost of debt will support activity, especially with investors seeking strategic opportunities during a countercyclical point in the market. Undeniably, the marketplace retains many challenges, but investors are beginning to see price, project and timing in a more favourable light.