4 minutes to read

South West London benefits from diverse connectivity to multiple residential and commercial markets. Richmond and Wimbledon are on the District line, and Richmond and Clapham can by reached via the London overground. Outside of London, the Surrey commuter towns of Feltham, Woking and Guildford can all be reached via London Waterloo, providing occupiers with a large pool of potential workers. By road, Heathrow Airport can be accessed from Richmond in just 16 minutes, providing global reach to clients and other markets. The M3 and surrounding A roads provide quick access to other key South East office markets and commuter towns, including the Surrey powerhouses of Guildford and Woking.

The lifestyle offer is a key draw to the market. Alongside its proximity to Central London, the area benefits from abundant green space that is more akin to suburban living, providing the best of both worlds. The recent repositioning of Centre Court, Wimbledon, to the mixed-use Wimbledon Quarter signifies investor confidence in the market. It is an example of the shift toward multi-sector developments that provide a wide range of amenities suited to both occupiers and residents. Each submarket has its offering, ranging from the UNESCO World Heritage site of Kew Gardens in Richmond to a wealth of bars and restaurants in the vibrant neighbourhood of Clapham. As such, the lifestyle offered attracts a diverse working-age population, from senior executives in Wimbledon and Richmond to young professionals in Clapham and the surrounding areas. This, in turn, gives occupiers a healthy pool of potential talent.

What is the shape of the office market?

The South West London office market comprises three core markets: Wimbledon, Richmond and Putney. However, Clapham, New Malden, Twickenham, and Kingston are increasingly registering activity.

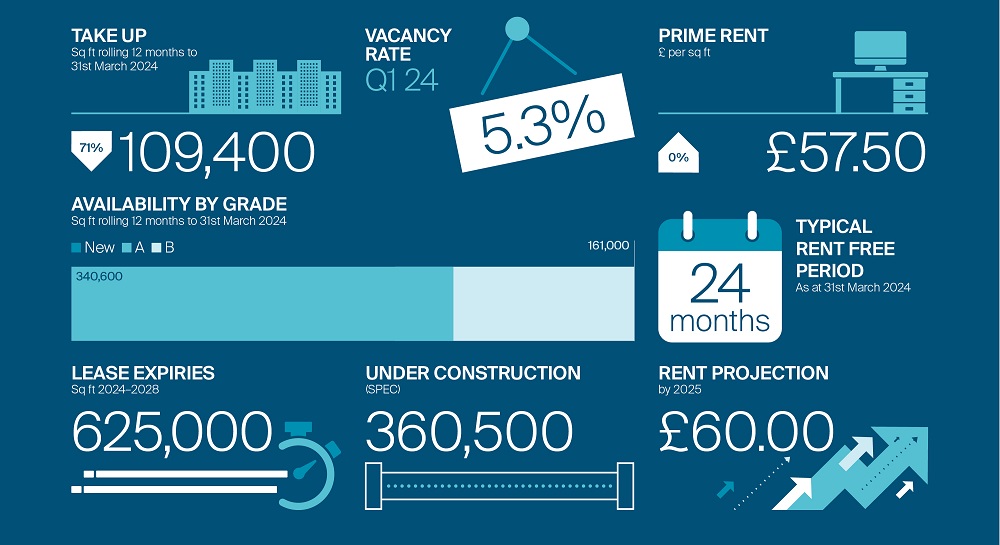

2023 saw modest occupier demand. Total take-up for the year reached 117,986 sq ft, 20% above the 10-year annual average, but reflecting a 67% fall year-on-year.

Common to all key markets in the South East, there is a marked preference for best-quality space. Over the past 5 years, 86% of office space leased was new or grade A. In 2023, 20% of take-up was accounted for by the pre-let of 24,042 sq ft of brand-new wellness-focused space at Akoya’s Parklife, Putney.

Who is taking space?

Activity in the South West London office market is underpinned by Financial and Business Services, and TMT sectors, accounting for 44% and 22% of space acquired over the past 5 years, respectively. Last year, the sectors represented over 75% of all lettings, with the 24,042 sq ft pre-let to Winch Design at Parklife bolstering activity. Other notable deals included the letting of 15,433 sq ft at Wellington House in Wimbledon to law firm Capsticks and Hays Recruitment Specialists taking 9,673 sq ft of space at Apex Tower in New Malden.

What does future demand look like?

At the time of writing, 242,000 sq ft of requirements were active in the market. Of this, the Financial and Business Services sector accounts for 74%.

Further ahead, 625,000 sq ft of space is subject to a lease event over the next 4 years.

What factors will challenge growth?

Low supply is restricting the South West London office market. There is currently 340,608 sq ft of available new and grade A stock. New and grade A vacancy sits at 3.9%, reflecting the supply shortage. Notably, only one building, APEX Tower in New Malden, could accommodate a significant requirement of 50,000 sq ft or above at the time of writing. A combination of low land availability and competition from alternative use classes is also challenging supply. Historically, there has been a lack of large anchor tenants based in the market. The 282,000 sq ft pure pre-let of the Honey Building in Kingston to Unilever signifies a larger corporate occupier interest in the market.

Is office supply to grow?

Despite the limited availability of best-quality space across the submarkets, 360,000 sq ft of speculative space will be delivered later in 2024. This will ease much of the supply pressure in South West London, providing both newly built and refurbished space capable of retaining current occupiers and attracting new ones. Regarding larger occupiers, the delivery of 90,000 sq ft at Arding & Hobbs in Clapham Junction and 45,000 sq ft at Explore Richmond is hoped to encourage further large corporates to consider South West London as a viable location to base. Notably, both schemes are comprehensive refurbishments, partly due to the lack of available land and the shifting developer and investor preference towards refurbishment to minimise the embodied carbon emissions from development.

What will underpin longer-term growth?

The shape that the South West London office market will take in the coming years will depend mainly on the fate of Crossrail 2. If the scheme goes ahead, it will connect Clapham Junction at its core and Wimbledon and New Malden via its regional branches to the rest of London and parts of the South East. The successor to the Elizabeth line is estimated to provide 200,000 new homes, 60,000 new jobs, and broader regeneration of London and the South East. With timings unknown, there is a degree of uncertainty regarding connectivity in South West London and the availability of land and future public investment into the affected areas.

Regardless, there is great optimism surrounding the South West London office market.