4 minutes to read

A key strength of Maidenhead as an office location is its connectivity to its surrounding areas. The transport infrastructure means that London can be reached in as little as 17 minutes via train and is easily accessible via the M4 motorway. Access to a diverse workforce is vital for occupiers and reaching key UK centres within a reasonable journey time.

Lifestyle and wellbeing are another of Maidenhead’s strengths. The Chapel Arches, One Maidenhead and Tempo developments have provided the town centre with abundant usable space, including housing, retail, public spaces, food and beverage, and offices. This is key for occupiers, who need to attract and retain talent. Onward, the Nicholson Quarter regeneration will be key in continuing the momentum by providing the space for employers and employees to remain and relocate.

What is the shape of the office market?

Recent occupier activity has solidified Maidenhead’s position as a growth M4 corridor market. Alongside the recent letting at Tempo to Johnson and Johnson, the town is home to various large corporations, including Maersk, Seiko, Biogen, Abbott, Blackberry and Volvo.

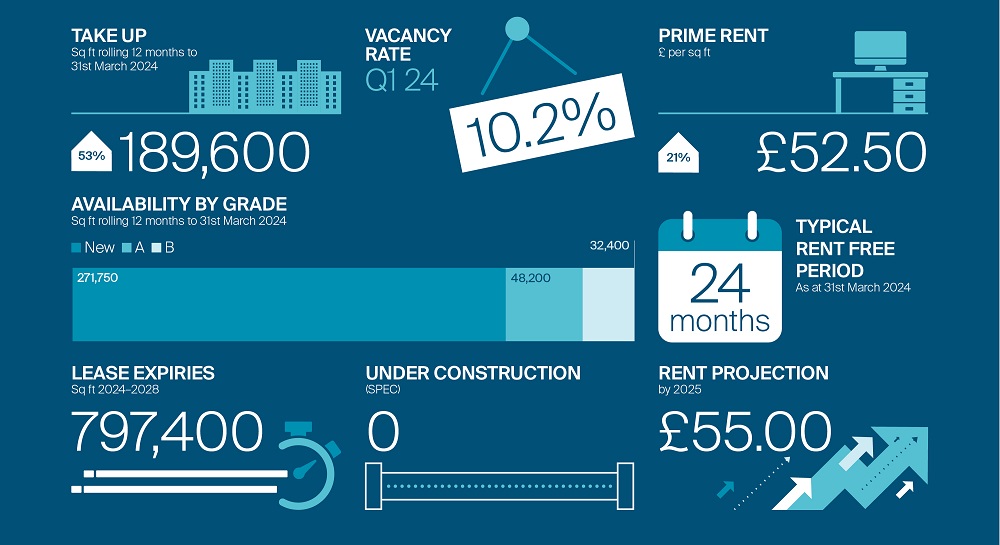

Annual take-up in 2023 reached nearly 97,000 sq ft, 19% above the 5-year annual average for Maidenhead. 2024 has already exceeded this total, with more than 100,000 sq ft of space already leased in Q1. This is 25% above the 5-year annual average and 3% above the 2023 total. Bolstering occupier activity this year was the pre-let of 97,488 sq ft of comprehensively refurbished best-quality space at Tempo to pharmaceutical giant Johnson & Johnson. With historically greater activity in Maidenhead’s out-of-town market, Tempo is set to reinforce the town centre as an important office market.

Who is taking space?

Maidenhead benefits from a diverse occupier pool, primarily across the TMT, Pharmaceutical, and Financial and Business Services sectors. Over the past five years, most occupier demand has derived from the TMT, Pharmaceutical, Healthcare, MedTech, and Manufacturing sectors. The recent pre-let to Johnson & Johnson will likely improve the attention of Pharmaceutical companies in the coming years, with the potential for clustering to occur.

Like many key centres, occupiers are focused on the best quality space. In 2023, 90% of take-up was for new or grade A space. In 2024, this has increased to all activity. The quality of the space offering at Tempo has set the benchmark for future stock in Maidenhead. Occupiers increasingly demand amenity-rich space, including end-of-trip and exercise facilities, and Tempo offers the highest environmental and well-being accreditations.

What does future demand look like?

At the time of writing, approximately 205,000 sq ft of requirements were active in the market. Notably, 75% of this derives from technology firms. Further ahead, almost 800,000 sq ft is subject to a lease event in Maidenhead before the close of 2028.

What factors will challenge growth?

A lack of sufficient office stock is restricting the Maidenhead market. There are no speculative office developments currently under construction. Availability at the end of Q1 measured 319,950 sq ft of new and grade A office space, all out-of-town. With just two buildings able to support a requirement of 50,000 sq ft or above, none of which are in the town centre, development must resume for large occupiers to continue to be drawn to Maidenhead. Trehus and the Kings Chase development site could accommodate such a requirement and provide an opportunity for pre-let, but work is yet to start.

Relatively high housing prices will undoubtedly limit a proportion of the potential talent pool from locating in Maidenhead. The average private rent in Windsor and Maidenhead stood at £1,552 in March 2024, 19% above the South East average and 25% above the rest of the UK. House prices are also above the South East and UK averages, reaching £551,000 in February 2024, making Windsor and Maidenhead the third most expensive borough to locate within the South East, and is nearly double the average price of the UK.

Is office supply to grow?

In the short term, no. The only scheme currently under construction is Tempo, with all space now leased. Further ahead, up to circa 800,000 sq ft is in the pipeline. However, with no confirmed start dates, examples of new supply coming to market are some way off.

What will underpin longer-term growth?

The new magnet occupier, Johnson & Johnson, is a positive for Maidenhead. Not only will this attract other large organisations to the town, but it may also result in the formation of a Pharmaceutical cluster in the heart of Maidenhead as companies seek the spillover effects and talent pool derived from agglomeration.

Rental growth in Maidenhead is strong. Excluding Oxford and Cambridge, Maidenhead achieves the highest rents outside of

London at £52.50 per sq ft. Maidenhead’s town centre has the highest year-on-year rental growth of any town across the South East markets at 21%. Investors and developers can reap the returns from rental growth, which may make it viable to begin the construction of proposed developments.