Asia-Pacific prime office rental index for Q4 2023 shows a continued decline in rental rates

We look closely at the factors influencing this trend and the potential implications of how the market will continue to favour tenants in 2024, with an extended flight-to-quality trend

4 minutes to read

The latest data from the Asia-Pacific Prime Office Rental Index for Q4 2023 has shown a decline in the region's rental rates, falling 2.4% from a year ago. In its quarter-on-quarter performance, the index declined 1.1%.

Concurrently, the vacancy rate remains high in the region, rising marginally by 0.5% from the past quarter. This is despite the completion of almost 12 million square meters of prime Grade A office space in 2024, mainly in the Chinese Mainland markets and India. Ho Chi Minh City and Bangkok will also likely see significant new completions.

Given this increased supply, market conditions for Asia-Pacific's prime office sector are expected to continue to favour tenants in 2024, with the vacancy rates predicted to trend upwards. The adoption of the ‘office-first hybrid’ strategy will continue to drive demand for space in the region for 2024, especially since occupier sentiment is experiencing a positive shift, as reflected in the latest Knight Frank Cresa Corporate Real Estate Sentiment Index.

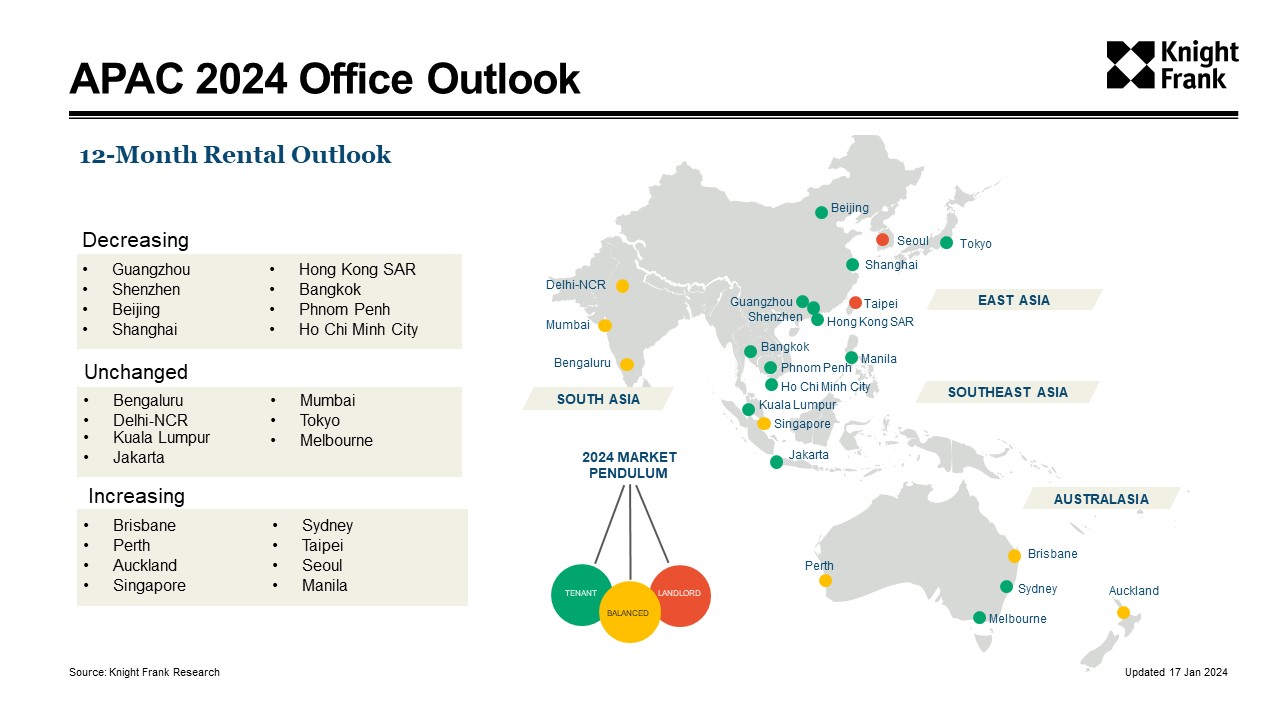

Of the 23 cities tracked, only 13 reported stable or increasing rental rates in Q4 2023, a decline from the 15 cities that reported the same in the previous quarter. Rental rates in Chinese Mainland and Hong Kong markets continued to face downward pressure due to weak demand amid a substantial amount of new supply.

A snapshot of the region

Australasia - Strong demand for prime office space in core locations drives office market, despite high vacancies and new supply

The office occupier markets in the Pacific region continue to be driven by a strong underlying demand for prime office space in core locations, resulting in a rental gap between higher-rated and lower-rated assets. Despite high vacancy rates, rents remained stable or increased in many areas, with incentives holding steady from the previous quarter. The region's resource-led cities benefited from a resurgence in the commodity sector. Sydney led the way in prime rent growth, with a 6.9% increase year-on-year in Q4 2023.

Strong demand from government agencies and professional services firms, combined with a limited supply of office space in 2023 and most of 2024, maintains upward pressure on rents and reduces incentives in the Perth market. The ongoing popularity of the West Perth area and a slight decline in incentives have contributed to a more optimistic outlook, with rental rates showing signs of stabilisation.

Southeast Asia - Emerging markets see rise in vacancies amid new supply, but rents increase marginally driven by key cities

The Southeast Asian emerging markets saw over 200,000 square meters of new office space added in the quarter, leading to higher vacancy rates in the sub-region. Despite the significant additions to inventory, rents increased marginally by about 1% from the previous quarter, the first rise in a year, powered by upturns in Jakarta, Kuala Lumpur, and Manila. Malaysia's capital, Kuala Lumpur, showed resilience in rental growth despite a 9% increase in office inventory, driven by a strong trend toward higher-quality spaces. Manila's rental growth was fueled by strong demand from the country's business process outsourcing firms. However, Bangkok and Ho Chi Minh City continued to face rental adjustments due to high completion volumes. In Singapore, the prime office market's rental growth cycle extended to become the longest in the country's history, with increases observed for the 11th consecutive quarter, although the pace of growth slowed in H2 2023 as businesses focused on maintaining stability.

East Asia - Rents decline in Chinese Mainland Tier 1 cities amid cost-cutting and new supply, while Seoul and Taipei benefit from balanced market conditions

Rental in Chinese Mainland Tier 1 office markets continued to decline, as companies focused on cost-cutting and landlords offered rental reductions. Many businesses have relocated to more cost-effective options from Shanghai's central business districts. With leasing demand expected to remain subdued amid a large supply of new office space, rents will likely decline further in 2024 as vacancies rise. Hong Kong's office market faces similar challenges, with substantial new supply and declining rents expected to lead to a trend of companies moving back toward the city center. In other parts of East Asia, rents in Tokyo softened due to increased supply, while landlords in Seoul and Taipei benefited from a more balanced supply-demand dynamic.

Occupier sentiment has improved throughout 2023, with leasing volumes in India's three largest markets increasing by 1%. Rent levels have remained stable as a result. While leasing activity from technology tenants, particularly in Bengaluru, has slowed, robust demand from global corporate centers (GCCs) and flexible workspace operators has helped offset some of the decline. As business confidence improves and economic uncertainties decrease, occupiers are more willing to make long-term commitments. The increasing confidence in India's economic stability has led to increased corporate investments, as evidenced by the growing share of GCCs in total leases, which is expected to support office market demand in 2024. Although vacancies are expected to rise due to the anticipated addition of over 2 million square meters of office space in 2024, rental levels are expected to remain steady.

The full report is available here.