APAC investors diversify their focus in Q3 2023

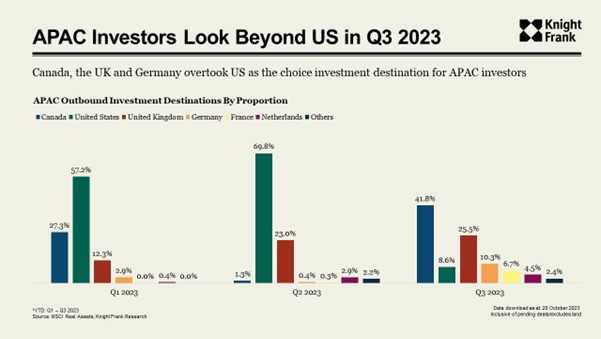

Canada, UK, and Germany surpass the US as preferred investment destinations

2 minutes to read

Knight Frank's Q3 2023 APAC Capital Markets report on capital flows showed a double-digit decline in commercial transaction volumes from APAC to North America and EMEA on both a yearly and quarterly basis.

However, the report underscores opportunities beyond the United States (US). Deal volumes from APAC to Canada surged 18-fold quarter-over-quarter, reaching US$1.02 billion in 3Q 2023. Remarkably, this surpassed the traditionally favored investment destination, the US, for the first time. During the quarter, Canada attracted the largest share of APAC outbound investments at 42%, followed by the United Kingdom (UK) at 26%, and Germany at 10%.

The shift of investment from US could be a bid from investors to diversify against rate headwinds in the world's largest economy. While worries about the US regional banking industry have eased, there is still a trend of banks reporting tighter lending conditions. In contrast, the Canadian credit market has been less volatile, albeit with tightened lending conditions.

Among APAC investors, Japan took the lead in investments into Canada, comprising 43% of 3Q investment volumes. Notably, KDDI, a Japanese telecommunications operator, was the largest investor. Their acquisition of three data centers in Toronto, Canada, amounting to US$1.02 billion, is the most substantial transaction undertaken by a Japanese investor in Canada. Securing the second position on the list was Singapore, representing 37% of the quarter's total volume, predominantly driven by GIC's involvement in multiple industrial transactions in Germany.

New economy classes gain investor interest

APAC investors are turning towards new economy assets, such as industrial and data centers, as acquiring office spaces takes a backseat. This shift is attributed to challenging business sentiments and a slow return-to-office movement.

In the case of industrial properties, the combination of scarce institutional-grade assets and sustained demand from sectors such as e-commerce, life sciences, and technology is driving heightened investment interest. Despite prevailing high interest rates, the current market conditions are creating opportunities for repricing, and the limited competition is amplifying the appeal of industrial assets for APAC investors seeking global investment opportunities.

Similarly, data centers are emerging as a stable and long-term investment prospect. The increased interest indicates a rebound in the data center market from the financial uncertainties of 2022. This resurgence is fueled by strong tenant demand, particularly with the prevalence of hybrid working arrangements and substantial rental rate growth, reflecting growing confidence among investors.

APAC's leading cross-border investor: Singapore overtakes the US in real estate investments for the first time

Singapore has surpassed the US to become the predominant source of APAC capital year-to-date. Following Singapore, the leading sources include the US, Hong Kong SAR, Japan, and China. Singapore has notably allocated nearly US$8.5 billion to APAC real estate, exceeding the investment value from the United States by almost 50%.