Where are the next waves of settlements in England?

Plus the latest EPC data and our latest UK Living Investors Survey findings.

3 minutes to read

To receive this update straight to your inbox, subscribe here.

Party conference season breathed new life into new towns, and we heard some bold pledges, but now the dust has settled let's take a step back and look at the current mix of large-scale development across rural England.

The existing pipeline of large 1,500 unit plus developments consists primarily of new garden village settlements and urban extensions. While no new towns have been formally designated in England since 1970, several major schemes are underway – from the garden village Welborne, a new community of up to 6,000 homes just outside Fareham in Hampshire, to the 4,000-home Nansledan, an extension of Cornwall’s Newquay.

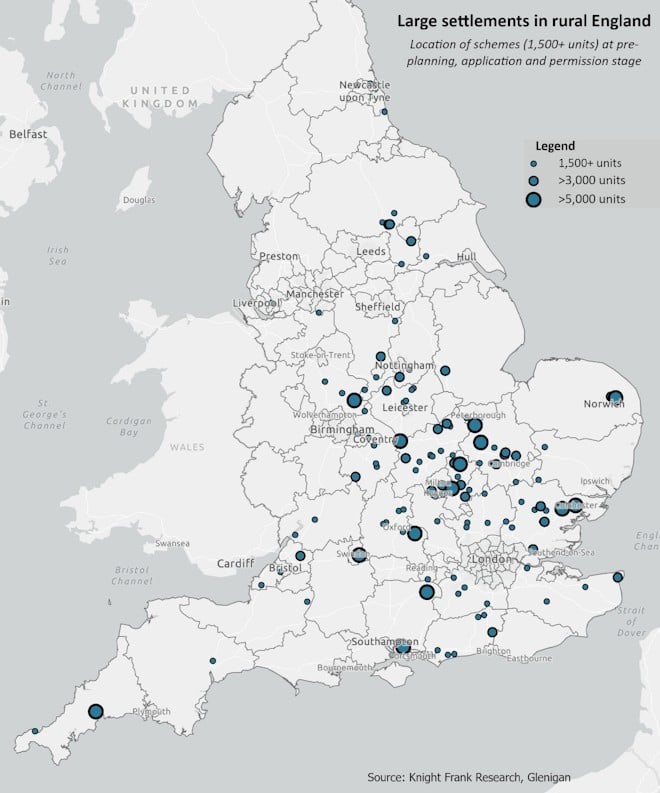

Currently, there are 83 projects in the pipeline at application or approval stage for 1,500 unit plus schemes across rural England. This includes 54 projects that have been permissioned for 162,131 homes. There is a fairly even split between garden villages and urban extensions in the mix.

To qualify for garden village status under the government’s Garden Communities programme, sites must be between 1,500 and 10,000 units.

It is striking that the majority of the developments are clustered in the centre of the country (see map), with the East of England taking in over 30%, followed by the South East at 24% and East Midlands at 17%.

While the development landscape is challenging right now, given higher finance and build costs, alongside an uncertain planning environment, large-scale developments play an important role in boosting housing delivery.

New towns will always make for great headlines and will bring opportunities for developers but there’s much more that can be done with existing pipeline sites. Ultimately, we need a diverse mix of new towns, garden villages and urban extensions spread across the country to solve the housing crisis.

Housing output levels

To get a broader picture of housing output levels, we can take a look at new data capturing energy performance certificates (EPCs) granted to new homes.

In the first nine months of the year to the end of September, the number of EPCs given to new homes in England fell 8% to just over 170,000 compared to the same period in 2022.

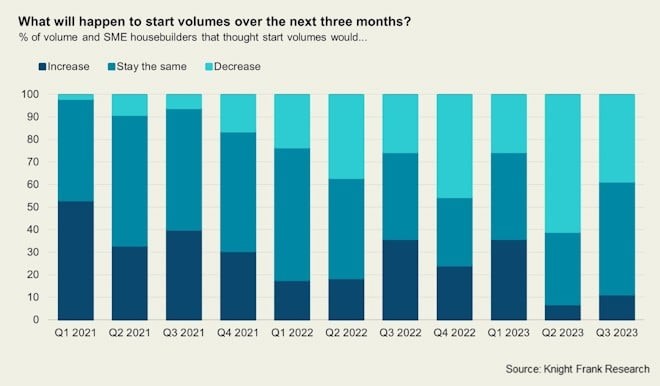

Our latest survey of over 50 SME and volume housebuilders based across England also indicates that future housing supply is under pressure. A significant chunk are expecting start volumes to fall over the next three months. In total, 39% are predicting a fall, with half expecting new starts to stay the same.

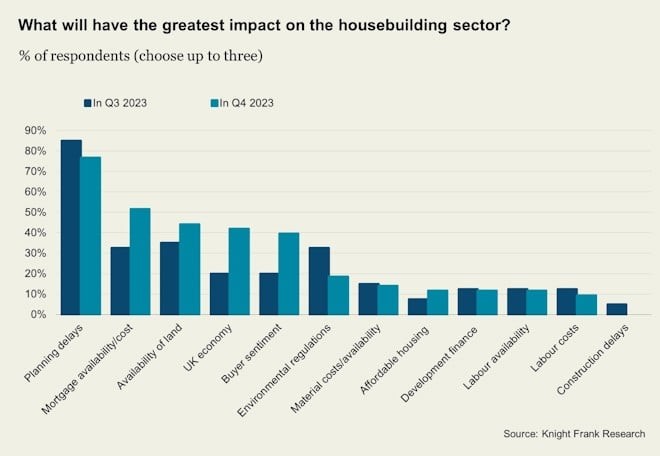

Several headwinds are limiting development. The biggest challenges for housebuilders over the next few months include planning delays (77% of respondents), followed by mortgage availability and cost (52%) and availability of land (44%), with around 40% citing both buyer sentiment and the outlook for the UK economy as key concerns.

In terms of competition for land, 40% of survey respondents said that housebuilders were the most active group in the region in England they operate in, followed by housing associations and build-to-rent developers and investors (at a joint 20% each), student housing (12%) and senior and retirement housing (7%).

Co-living takes the stage

The UK’s rental shortage is driving developers and investors in this space to diversify their offerings.

Last week, my colleague Lizzie Breckner presented our latest research on co-living in London. It is not the living sector that necessarily gets the most attention, but the pipeline is growing in the capital, albeit it remains a very small proportion of the city’s wider private rental sector at just 0.5%.

There are currently 16 completed schemes including 3,323 new homes in the capital, with a further 1,501 units under construction, according to Molior. Plans have been granted for an additional 5,616 units, taking the total market size to over 10,000 units.

Our latest UK Living Investors Survey found that 31% of respondents are presently active in the sector, a proportion that rises to 45% by 2028, signalling substantial room for expansion in this asset class.